Uddrag fra Zerohedge:

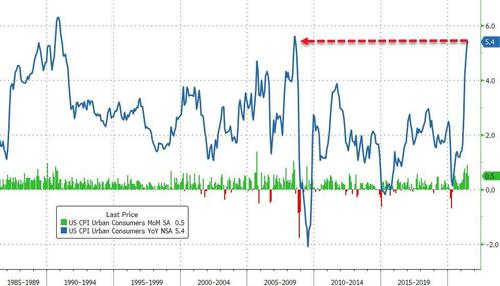

After soaring at the fastest pace since 2008, economists expected the surge in Consumer Prices to slow very modestly in July (from +5.4% YoY to +5.3% YoY). They were wrong as CPI came in slightly hot at 5.4% YoY (up 0.5% MoM).

That remains the highest since 2008…

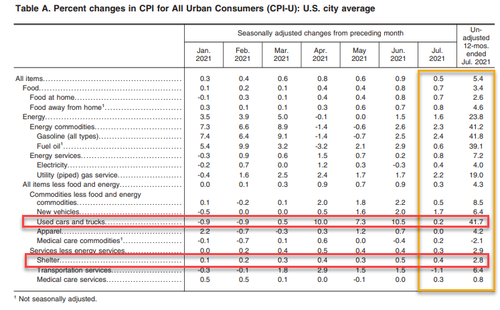

Under the hood, energy costs increased the most along with new cars.

Rent and Used Car cost appreciation slowed…

The shelter index rose 0.4 percent in July and accounted for over half of the monthly increase in the index for all items less food and energy. The index for rent rose 0.2 percent and the index for owners’ equivalent rent increased 0.3 percent. The index for lodging away from home continued to rise sharply, increasing 6.0 percent in July after rising 7.0 percent in June.

Shelter inflation jumped to 2.83% Y/Y from 2.58% in June but rent inflation dipped from 1.92% to 1.91% in July

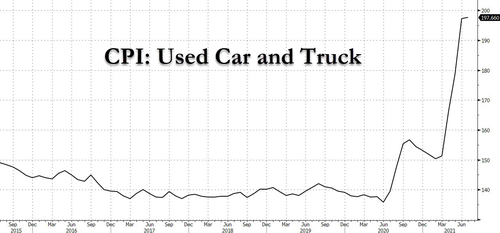

The index for new vehicles rose 1.7 percent in July and has now increased 5.4 percent over the last 3 months.

The index for used cars and trucks rose 0.2 percent in July after rising at least 7.3 percent in each of the last 3 months (and we have seen Mannheim prices rolling over fast)…

The deceleration in the index was a major factor in the smaller monthly increase in the index for all items less food and energy.

Which helped drive Core CPI of its highs, suggesting the surge may have peaked for now (the core index rose just 0.3% in July, its smallest monthly increase in 4 months)…

Source: Bloomberg

The indexes for education, for communication, for tobacco, and for alcoholic beverages all increased in July, while the indexes for household furnishings and operations and for apparel were unchanged.

Both Goods and Services inflation slowed in July…

Source: Bloomberg

Finally, we note that 10Y yields have moved at least 5bps on each of the last three CPI days (but none has seen a run up into the print like the last few days).