Nordea, der har fulgt diskussionen om en nedskæring af de amerikanske obligationsopkøb (tapering) intenst, skriver, at det nu er “en done deal”, at der kommer en tapering, og beslutningen kan blive annonceret på centralbankens virtuelle Jackson Hole-møde i Wyoming i denne uge. Det eneste udestående er, hvor aggressiv nedskæringer bliver, og det vil især afhænge af udviklingen af Delta-varianten og corona-vaccinationerne, mener Nordea.

Week ahead: Tapering in Wyoming!

The Fed tapering is now a done deal this year unless the Delta variant messes up the outlook. The big question is now how aggressive a tapering process we should expect and how we should trade it? We like the USD and curve flatteners for now.

Tapering is now openly the base case of the Federal Reserve for this year unless something goes wrong. The meeting minutes revealed a fairly big hawkish turn from a majority of the FOMC members.

“Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year”. Stocks are not happy, but the USD is, while the fixed income response has been fairly muted.

It shouldn’t come as a big surprise that a lot of FOMC members openly favour tapering this year, as they have been on parade with that message in the press over the past three to four weeks.

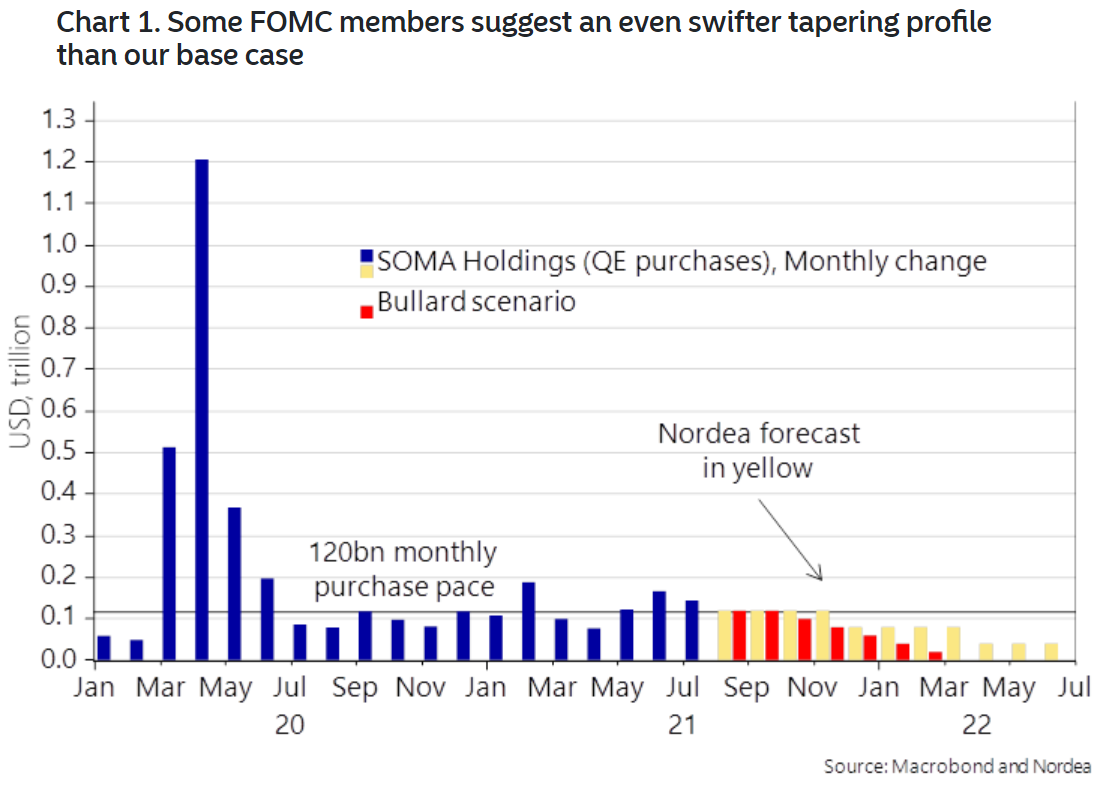

The big question is how aggressive the Fed intends to be – some members suggest a substantially more hawkish tapering profile than our forecast already now – including Bullard (hawk) who suggested ending the asset purchases by 22 March. Just three or four months ago, we had the most aggressive Fed forecast in the world. That is no longer the case as the Fed and other analysts have caught up with our view.

Usually we would argue that a tapering process should lead to 1) a stronger USD, 2) a flatter yield curve, 3) an expensive USD in the xCcy basis and 4) underperformance of small caps. The USD curve already started flattening markedly on the heels of the message delivered in June when Powell started hinting that tapering was actually debated within the Fed.

In 2013/2014 when the Fed tapered QE3, the spread between 30yr bond yields and 5yr bond yields started flattening materially as tapering was actually implemented. This was also the case when the ECB tapered in 2019. It seems as if the market has sniffed out that a tapering process risks flattening the curve, which is why parts of the “taper flattening” has been frontloaded over the summer. To be very precise we expect 5s30s flattening, but 2s5s steepening into a tapering scenario.

EUR/USD has made several unsuccessful attempts to break below 1.17, while it seems as if the FOMC meeting minutes finally proved to be the needed catalyst for a sustained move below such levels, and we have increased our conviction on a further move lower in the cross. We target levels around 1.10 over our forecast horizon and expect the bulk of the move to happen sooner rather than later in conjunction with the launch of the tapering process.

We always like when there is no “policy resistance” to our FX view and that currently seems to be the case for EUR/USD. Would the Fed be annoyed with a lower EUR/USD reading? Not really, as they would then be able to partly export the current overshooting (supply side) inflation.

Would the ECB be annoyed with a lower EUR/USD reading? Not at all, since a lower reading would be helpful in bringing EUR inflation to 2% or above as wished for. This leaves a decent scope for a move lower in EUR/USD, also as positioning is not yet USD heavy (Majors forecast update: We increase our conviction in a stronger USD).