Nordea hæfter sig ved, at den hårde asiatiske kurs mod Covid – “nul-tolerance” – kan få en langvarig virkning, nemlig ved at skabe forsyningsproblemer og ved at skrue priserne i vejret. Der har ikke kun været havnelukninger i Kina, men også begrænsninger af forsyningskæden i Sydkorea, Taiwan og Japan. Det fører også til højere priser og kan skubbe inflationen i vejret. I sidste ende kan det skabe problemer for julehandelen! Virksomhederne må sende deres ordrer nu.

Freight rates started exploding in China

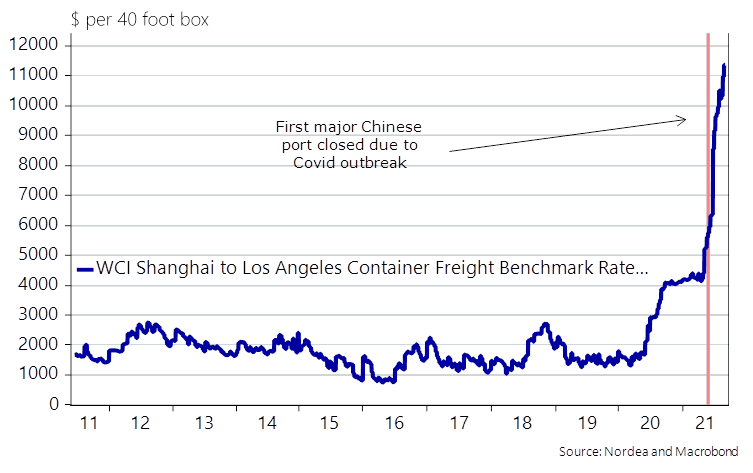

Delta remains a bigger issue in Asia than in the West as the “zero tolerance” policy has reignited bottlenecks and led to a bigger part of the Chinese supply chain being restricted than in 2020. We have seen tons of interesting or even bizarre explanations and excuses for the exploding freight rates in recent weeks, but we find that the real reason is very simple.

If a substantial part of the supply chain (China, Korea, Taiwan and partly Japan) wants to pursue a zero covid policy, then we will end up with continuous large-scaled hiccups due to an outbreak in ports, airports, production facilities or the likes.

The outset of the mega-move in freight rates namely coincided exactly with the date when the Dalian port was closed due to an outbreak, which has since been accelerated by closures of ports/terminals in Dalian and most recently Ningbo-Zhoushan (the third busiest port worldwide).

This is just one out of seven good reasons to expect that the Covid-19 crisis has been a trigger for an inflationary regime-shift (Global: 7 reasons why Covid-19 could lead to an inflationary regime shift) as we wrote about during the week. We see very little real-world momentum towards another Covid-strategy in Asia, which means that this phenomenon is here to stay for now. You better buy your Christmas presents asap.

Chart 4. The freight rates started exploding when Chinese ports were closed due to Covid outbreaks

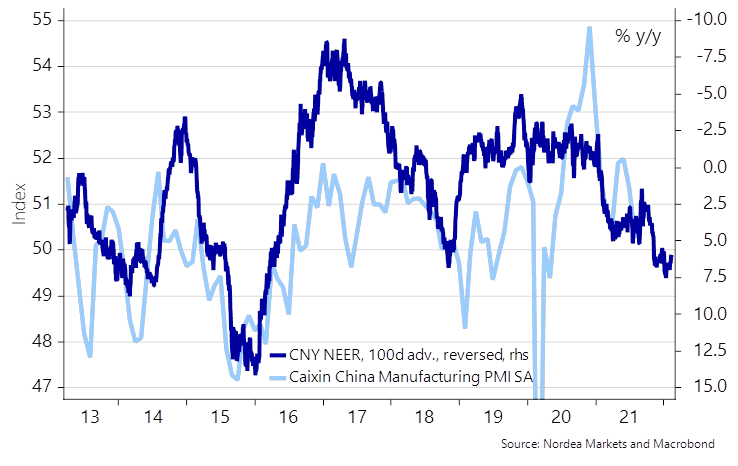

The global freight bonanza may stem from China, but China is also clearly slowing by now. A (too) strong Renminbi is one of several culprits, but the credit impulse is probably the biggest antagonizer of growth. It is in other words not unlikely that we get a so-called surprise cut from China in coming weeks or months. The reserve requirement ratio was cut in July, but it is probably not enough to refuel the credit momentum in China and maybe almost as importantly, it hasn’t been enough to turn the tide on the Renminbi yet.

By now it is as big an issue for China to have a strong currency versus Europe, if not bigger, than versus the USD, why China needs a policy in place that ensures that the current Yuan momentum is reversed in broad terms.

Several further reserve requirement ratio cuts usually do the trick, but it may be even more effective to deliver a surprise cut to one of the (gazillion of) policy rates with a direct link to the real economy such as the one-year loan prime rate. The RRR cut will fuel the supply side appetite, but a cut to one of the lending rates may be needed to fuel the demand side. All-in-all, it is starting to look attractive to be long USD/CNY in our view, especially if we get a cocktail of Fed tapering and PBoC easing at the same time.