Merrill har analyseret, om der er en forbindelse mellem en høj indtjenings-margin og en efterfølgende nedtur eller recession. Det er der. Derfor må investorer betragte en meget høj indtjening som en varsling af en kommende nedtur. Det kan f.eks. være et varsel om øget risikovillighed i virksomhederne. Historisk er en recession kommet omkring to et halvt år efter et topniveu i marginen, men siden 80’erne er der ofte gået fire år. Det nuværende niveau for indtjeningsmarginen er det højeste siden 60’erne, og det er tegn på, at der kommer en nedtur inden for en kort årrække, måske i 2023-24, men hvis de øgede lønninger som følge af coronakrisen, og hvis inflationen fører til højere renter, kan nedturen komme langt tidligere. Så Merrills råd til investorerne er: Følge nøje med i virksomhedernes indtjening. De udgør også et risikosignal.

How Durable Are Record-High Margins?

The nonfinancial corporate (NFC) profit cycle features prominently in macroeconomic

frameworks tailored for tactical investment strategy decisions. Given its clean tie to the

economy, the broad profit cycle provides significant clues related to business cycle timing.

Peak profit margins often signal an economic downturn well in advance of other leading

indicators, an important factor for equity investors. And higher profits allow for

productivity-enhancing investments that can lengthen the cycle. The profit cycle can also

provide valuable information about corporate credit risk and spreads.

Broadly speaking,

staying tuned into the profit cycle helps give investors a better chance to navigate tactical

over- or underweights to risk assets. Below we lay out some of the key features of this

profits cycle with a focus on margins.

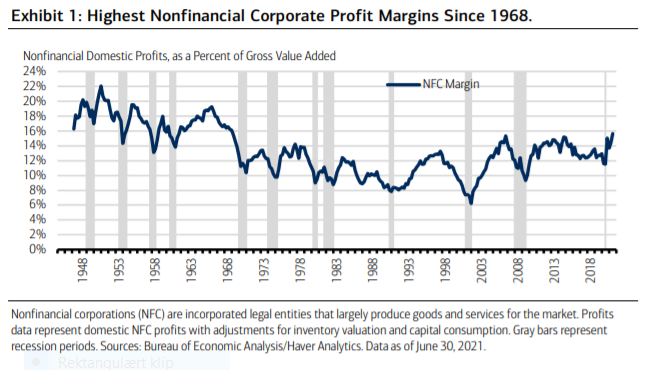

Recently released data for Q2 reflect a typical early-cycle profits boom when topline growth picks up at the same time companies are lean. Domestic nonfinancial corporate profits ran at a 50% annual rate for the quarter and are currently 27% above pre-pandemic levels, a 17.3% annual rate, according to Bureau of Economic Analysis.

The level of profits far exceeds even pre-pandemic estimates of earnings for this year and

next, an important reason why equity performance has been so strong. Corporate profit

margins are the highest in decades by several metrics. But a number of factors including

rising labor costs, fading fiscal and monetary stimulus, and higher corporate taxes is a risk

and an eventual peak in margins has important implications for investors.

For one, the peak in profit margins (to the extent it can be identified in real time)

tends to give an advanced warning of a recession and therefore can provide a

multiyear runway to begin paring back risk-assets.

This pattern features prominently in

Exhibit 1, where the blue line (profit margins) often peaks in advance of the gray bars

(recessions). In the post-war period, on average, margins peak about two-and-a-half years

before a recession starts. Since Paul Volker, former Fed Chair, broke the back of inflation

in the early 1980s that lead time has extended to over four years, on average.

In the current environment, investors should also consider the fact that margins are

historically very high and expected to trend even higher. The multidecade trend shown

in Exhibit 1 is for higher highs in profit margins and higher lows, perhaps as a result of

technology implementation and productivity.

The combination of internet penetration

starting in the early 2000s and the increased use of automation and robotics likely has

benefited operating leverage. Lower interest rates have also played a role, as net interest

costs as a percentage of gross value added for nonfinancial corporates are well below the

long-term average.

Overall this gives pause to investors who think a record high means

mean reversion is inevitable. To be brief, companies have a cushion to deal with either a

collapse in demand or rising costs, and, if margins peak, the relative level should also be

considered.

In many economic cycles, the peak in overall profits coincides with the peak in

margins. This occurred in both the 1990s expansion leading into the tech bubble burst and

the 2000s expansion that ended in the Great Financial Crisis. Without earnings growth,

equity markets are left with multiple expansion, and valuations are already not cheap. The

fact that nonfinancial margins are reaching a multidecade high, while labor costs pressures

are building, and top-line growth set to slow is consistent with the idea that overall profits

growth is to slow as well, in our opinion. If an identifiable peak in margins emerges, investors

should consider the chance that peak earnings are not far away.

Another argument for margins peaking sooner-rather-than later is the fading of

fiscal stimulus. In the recent GDP and profits data release, the Bureau of Economic

Analysis (BEA) noted the effect of fiscal transfers on corporate profits, including the

Payroll Protection Plan (PPP). This boost is likely to fade, and there is also growing risk

that after-tax margins take a hit from potentially higher corporate taxes.

An important takeaway for long-term investors that avoids trying to top-pick margins, a

difficult task in real time, is to recognize that it appears as though business cycle risk

could go up significantly in 2023–2024, in our opinion, as margins will likely have peaked

and the Fed will likely be raising rates. A faster labor market recovery could pull that risk

forward.