Der er mangel på alt – fra chips til støvsugere. Men der er ikke mangel på penge. Likviditeten hos de amerikanske forbrugere og virksomheder har ikke været så stor siden 50’erne, skriver Merrill. Et vanvittigt beløb på 5.300 milliarder dollar i cool cash! Det skyldes høj indtjening samt udskudt forbrug, og pengene skal ud og arbejde, og derfor tror Merrill, at det vil stimulere det amerikanske aktiemarked trods nok så megen modvind, og det vil også føre til højere kurser og et højere afkast.

One Thing Not in Short Supply: Cash

Chips, cans, cars, cleaners—you name it, and it is in short supply, throttling near-term

economic growth and earnings prospects not only in the U.S. but around the world.

However, not lacking is cash and hence our conviction that U.S. Equities remain in an

uptrend, notwithstanding some mounting headwinds.

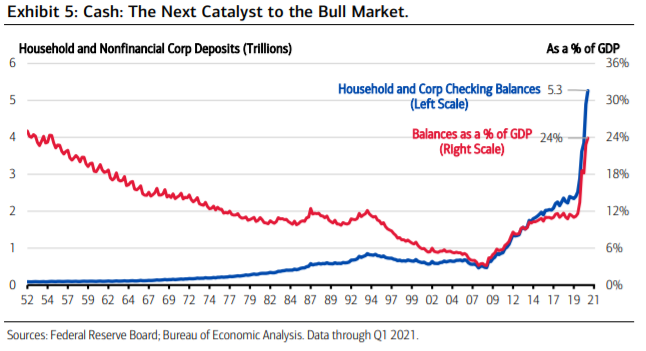

Capital is the oxygen of the economy and capital markets, and, as Exhibit 5 highlights, the

amount of liquidity presently held by U.S. corporations and American households—on an

absolute or relative basis—has never been higher, totaling a staggering $5.3 trillion as of

Q1 of this year.

According to the latest Flow of Funds data, corporate checking accounts

totaled $1.9 trillion6 at the end of Q1 of 2021, while households were sitting on $3.35

trillion. The combined figure equates to 24% of U.S. GDP, a level not seen since the 1950s.

Multiple reasons explain the surfeit of cash, ranging from stronger-than-expected profits

growth, deferred capital expenditures (CapEx) spending as the coronavirus Delta variant

has spread, generous government transfers to U.S. households, ultra-low interest rates,

and rising wages, among the primary reasons.

What does all of this mean for the markets? First, we believe concerns of “fiscal cliff” are

overdone—i.e., when both Congress and the Fed step back from priming the

fiscal/monetary pump, U.S. households and corporations will have the financial

wherewithal to keep the economy humming at a solid clip.

The upshot: more upside earnings surprises.

Second, hoards of corporate cash entails rising CapEx spending into

2022 (bullish for the U.S. Technology sector) and increasing levels of share buybacks and

dividend growth.

And third, in terms of portfolio construction, rising levels of consumer

spending and CapEx into 2022 support our barbell approach to owning cyclicals (Energy,

Materials, Industrials and Financials), as well as secular growth leaders like Technology and

Healthcare.

The bottom line: The common refrain is that “cash is trash.” That’s not untrue in a lowyielding world.

However, think of present cash levels as a future catalyst to higher U.S.

Equity prices/returns.