Uddrag fra Zerohedge:

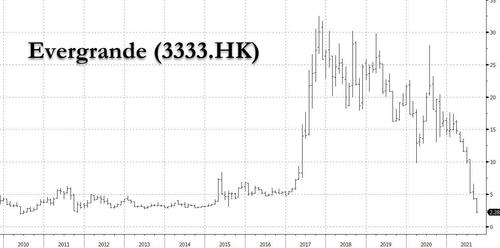

In retrospect, China, Japan, South Korea and Taiwan picked a great day to take a holiday, which as we noted last night hammered Hong Kong stocks more than 3%, slamming the Hong Kong property sector and sending Evergrande – which is expected to default within hours to a bank loan due Monday while crucial interest payment deadline on its offshore bonds looms on Thursday – to its lowest market cap ever (it closed down 10.2% just off the worst levels of the day) before the rout spread to European bourses and US equity futures as Evergrande’s escalating liquidity – and now solvency – crisis spread beyond the sector.

At 24,099 points, Hong Kong’s broader Hang Seng index has closed at its lowest level since October 2020.

“That affects the banks as well — if you have lower property prices what happens to their mortgages?” Tse said. “It has a chain effect.”

And with Hong Kong becoming the temporary epicenter for the Evergrande meltdown (before it shifts back to China), contagion which had long been absent, finally spilled over across the globe, hitting not only stocks but also FX and commodities, with angst over this week’s FOMC meeting where some still think the central bank will announce tapering (spoiler alert: it won’t), only deepened on Monday, sending U.S. futures falling more than 1.3% as low as 4,356.25 touching the lowest level since Aug. 19 and far below the 50DMA which has proven to be a remarkable support zone, while European equities were 2% lower and hitting a two-month low. Treasuries gained along with the dollar before Wednesday’s Fed meeting, where policy makers are expected to start laying the groundwork for paring stimulus. Cryptos crumbled, with Bitcoin plunging to $44,000.

The early drop which sent the VIX to 26, its highest reading since May 12, was especially ominous because, as Mohamed El-Erian said, “after three straight weeks of losses, today’s trading session will be a notable test for the “buy-the-dip”/”there is no alternative”/FOMO narrative that has impressively powered stocks through prior headwinds.” Meanwhile, while we wait to see the dip buyers, the benchmark S&P 500 is on track to snap a seven-month gaining streak.

Economically sensitive industrials Boeing Co and Caterpillar Inc slipped 1.7% and 1.9%, respectively. Banking stocks including Morgan Stanley, JPMorgan Chase & Co and Bank of America Corp fell between 1.8% and 2.7% in premarket trading, tracking U.S. Treasury yields. A slate of U.S.-listed Chinese stocks including Weibo Corp, Bilibili Inc, Vipshop Holdings Ltd and Pinduoduo Inc shed between 3.4% and 5.4% amid a widening regulatory crackdown in China. Needless to say, it is a busy morning in the premarket on Monday, and here are some of the biggest movers today:

- Freeport McMoRan (FCX US), Cleveland-Cliffs (CLF US), Alcoa (AA US) and U.S. Steel (X US) down 3%-4% premarket, following the path of global peers as iron-ore and metals prices sink

- Cryptocurrency-exposed stocks sink premarket and in Europe after Bitcoin slipped as it hit a key line of resistance

- Tesla (TSLA US) shares down 2% amid a broad equity selloff. Also hurt by a report that the U.S.’s top crash investigator urged the company to address safety concerns before expanding its cars’ self-driving features

- Chinese stocks listed in the U.S. slump in Monday premarket trading as growing investor angst about China’s real estate crackdown rippled through markets on Monday

- SmileDirect (SDC US) up 16% premarket amid continued touts for the retail-trader favorite, while Meta Materials slips.

- Among other so-called meme stocks: IronNet -7.5%, Offerpad -6.7%, Vinco Ventures -2.7%, AMC -5.5%

- Teradata (TDC US) shares attractive ahead of a likely inflection for its “underappreciated” cloud business, Morgan Stanley writes in note upgrading to overweight

- Wynn Resorts (WYNN US) and Las Vegas Sands (LVS US) slide 2% premarket after their share price targets were lowered at Morgan Stanley, which pushes back its projection of Macau market recovery to mid-2022 from 4Q21 given coronavirus-related concerns in China

- Verastem Oncology (VSTM US) soars 33% premarket after it announced Sunday that a study data in low-grade serous ovarian cancer showed encouraging response rates and progression-free survival

It wasn’t just Evergrande: Wall Street’s main indexes have been hurt this month by fears of potentially higher corporate tax rates denting earnings and have shrugged off signs inflation might have peaked. As such, while eagerly waiting to see what Beijing’s response will be to the Evergrande contagion, all eyes will also be on the Fed’s policy meeting on Wednesday, where the central bank is expected to lay the groundwork for a tapering, although the consensus is for an actual announcement to be delayed until the November or December meetings.

“Anything pointing to a November tapering decision may support the U.S. dollar further and perhaps extend the latest setback in equities,” said Charalambos Pissouros, head of research at JFD Group. “Market participants may also be eager to find out whether this could also result in earlier rate hikes.”

Aside from Evergrande and the prospect of reduced Fed stimulus, financial markets also face risks from uncertainty over the outlook for President Joe Biden’s $4 trillion economic agenda as well as the need to raise or suspend the U.S. debt ceiling. Investors were already fretting over a slowing global recovery from the pandemic and inflation stoked by commodity prices. On Sunday, Janet Yellen said the U.S. government wrote a WSJ oped in which she said the US will run out of money to pay its bills sometime in October without action on the debt ceiling, warning of “economic catastrophe” unless lawmakers take the necessary steps.

“The edges of the bullish narrative cover are being pulled and the darker underlying reality is coming to the fore,” said Sebastien Galy, a senior macro strategist at Nordea Investment Funds SA. “It is taking the market more time to price in these shocks than I had expected, and the market is far more realistic as the buy-on-dip mentality fades with the fear of inflation.”

European markets were also pounded following the rout in Asian equities earlier. The Stoxx Europe 600 index dropped as much as 2%, on track for the biggest decline since July. Raw materials led the broad-based retreat as iron ore extended a slump below $100 a ton and base metals declined after China stepped up restrictions on industrial activity. Germany’s DAX underperformed as a rebalancing takes effect. The FTSE 100 fares marginally better, declining ~1.6%. Losses spanned all Stoxx 600 sectors with miners, autos and bank the hardest hit. Here are some of the biggest European movers today:

- Lufthansa shares rise as much as 5.1% after the airline announced plans to raise EU2.14b to pay back part of a government bailout received during the pandemic.

- Bawag shares gain as much as 5%, touching a record high, after increasing its targets and raising its dividend payout ratio for FY22.

- AstraZeneca shares increase as much as 3.3%, the most since April 30, after the pharmaceutical group released positive results from trials of its Enhertu breast cancer drug.

- European mining stocks hit the lowest level since February, hit by falling iron ore and base metal prices along with downgrades for heavyweight sector names.

- Prudential shares tumble as much as 8.3% after announcing a share placing which Panmure Gordon said came on the worst day possible, coinciding with a selloff in Asian peers.

- AP Moller-Maersk shares decline as much as 4.4% after Berenberg writes that the risk of container rates peaking and triggering an outsized share price decline “is paramount.”

- Holcim and HeidelbergCement shares slide after they were downgraded at JPMorgan on ESG-related concerns for the building-materials sector and soaring energy costs in Europe.

Earlier in the session, Asian stocks were mauled led by a selloff in Hong Kong amid concerns over a Beijing squeeze on real estate companies and contagion from China Evergrande’s debt crisis. The MSCI Asia Pacific Index slipped as much as 1.3%, with China Evergrande Group and other real estate stocks leading the decliners. Hong Kong shares were the hardest hit, sending the Hang Seng tumbling as much as 4.2% amid the biggest selloff in property stocks in more than a year as traders tracked the risk of contagion from the debt crisis at developer China Evergrande.

Markets in China, Japan, Taiwan and South Korea were closed for holidays. Deepening concerns over Evergrande’s debt woes, along with China’s ongoing corporate crackdowns, have rattled markets. Traders also mentioned that President Xi Jinping’s drive to create “common prosperity” may spill over into the property market.

“We are seeing fears of contagion effect from China Evergrande playing out,” said Jun Rong Yeap, a market strategist at IG Asia. “With China closed today, the limited avenue is bringing the risk-off movement to be focused on the H.K. market, which may aggravate the selloff.” The MSCI Asia Pacific Index’s decline extended its 1.6% loss last week. The gauge is up just 0.7% for the year, compared with an 18% climb in the S&P 500 Index.

Shares in Ping An, China’s biggest insurer, fell as much as 8.4 per cent on Monday, after closing down 5 per cent on Friday as it was forced to disclose that it held no exposure to Evergrande debt or equity. Ping An has Rmb63.1bn ($9.8bn) of exposure to the country’s real estate stocks across its Rmb3.8tn of insurance funds.

Metal prices also fell on Monday as concerns grew about the impact on commodity demand of a pullback in the Chinese property market. The property sector accounts for about 20% of the country’s copper consumption and 10 per cent of its nickel demand, according to analysts at Liberum. Copper prices fell by 3% to $9,074 a tonne, while nickel fell by 2% in morning trading on the London Metal Exchange.

Meanwhile, emerging-market stocks headed for their biggest drop in a month, while Russia’s ruble and South Africa’s rand led developing-nation currency declines.

In rates, Treasuries hold gains in early U.S. session following a bout of flight-to-quality that lifted futures during Asia session (with cash market closed for Japan holiday). The 10-year yield dropped 3.4bps to ~1.3277%, with yields richer by 3bp-4bp in long-end of the curve as bunds and gilts lagging slightly; 2s10s flatter by 2.8bp, 5s30s by 1.2bp after breaching 102bp for first time in a year. This week’s events include 20-year auction Tuesday and FOMC policy announcement Wednesday. Bund, Treasury and gilt curves bull flatten. Bund and gilts richen 3-3.5bps across the back end, outperforming USTs by a half basis point or so. Peripheral spreads and swap spreads widen out with the belly of the Italian curve lagging peers.

In FX, the dollar surged with commodity currencies such as the Australian dollar and Norwegian krone plunging as a rout in iron ore and risks from China Evergrande Group’s debt crisis hurt sentiment. Haven FX is well bid with JPY and CHF at the top of the G-10 scoreboard. AUD and NOK are the worst performers with the broad commodity complex trading poorly. RUB and TRY are among the weakest in EM FX.

In commodities, crude futures are in the red as WTI drops 1.75%, snapping below $71 while Brent drops over $1 to trade near $74.30. Ferrous metals were under sharp pressure in Asian hours; base metals are deep in the red with LME copper down as much as 2.8%, LME nickel drops as much as 3.1%. Iron ore prices reached a record this year but slumped 20 per cent last week — their worst weekly performance since the 2008 financial crisis — after markets digested the impact of government curbs on steel production. On Monday, iron ore futures in Singapore fell as much as 11.5 per cent to below $100 a tonne for the first time in more than a year.

“There are fears . . . that the crisis could spill over to other companies in the sector and might directly affect the building and completion of houses,” analysts at Commerzbank said. “The construction sector is one of the biggest consumers of base metals such as copper and aluminium, as well as of steel.”

Spot gold rises off Asia’s lows, trading little changed near $1,755/oz. Crypto cratered with bitcoin trading around $44k.

Luckily, there is little on the calendar today – besides the sheer chaos gripping markets – with just the September NAHB housing market index on deck in the US; We als ohave the Federal election in Canada.