By Ven Ram, Bloomberg markets live commentator and analyst

There is inflation in our midst, and it seems insidious. It’s the type that adds up quickly, works its way through the economy and finds it way straight and ominously into your wallet.

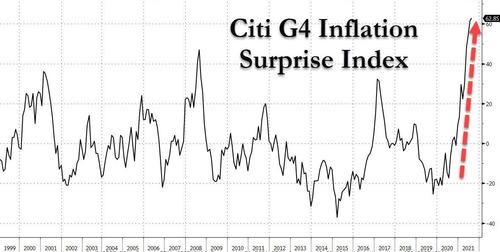

Price of goods and services in some of the biggest G-10 economies are rising at a pace not seen in years, challenging even a very liberal definition of what constitutes “transitory”.

Central banks led by the Fed and the European Central Bank have decided that they would rather let consumers grapple with higher prices for now than slow an economic recovery. Norges Bank, on the other hand, has already raised its benchmark for the first time in the current cycle even though underlying inflation is low, for fear of letting asset-price imbalances build. The Bank of England, for its part, fired its first shot across the bow after retail-price inflation surged in the neighborhood of 5% in August.

Clearly, the reaction function of central banks to rising prices is different; it may also be that with rates as low as they have ever been, policy makers want to create a buffer for yet another rainy day by pitching up their benchmarks at the first available opportunity.

While it’s reassuring that inflation is alive and kicking, it seems to be driven by bottlenecks in getting a good or service through the last mile of its journey to make sure it reaches the hands of the consumer. That’s definitely the case in the U.K. where supermarket shelves are sparsely stocked and queues outside gasoline stations are serpentine.

In other words, this is the kind of inflation that isn’t quite the demand-led variety that central banks would love to see. With the median age of populations in many developed economies rising, the propensity to consume is dwindling. That means demand-pull inflation may prove yet elusive, but whatever the quality of inflation, it’s best not to look a gift horse in the mouth.