Uddrag fra Authers:

Evergrande Evermore |

There’s a grand old journalism school cliche that the real news is happening wherever everyone was looking a year ago. In the markets, with a much shorter attention span even than journalists, we can maybe cut that down to two weeks. The U.S. stock market had an unpleasant Thursday session to end the month, but still brought the S&P 500 no lower than its trough on Monday last week, the day when the difficulties of the stricken property developer China Evergrande Group first prompted a wave of fear in U.S. markets. As the intervening days have brought ample fresh excuses to sell, for those who wanted to sell, that implies that people are far more confident about the Evergrande situation now. It is hard to see why.

Some of this can be down to the psychological concept of “anchoring.” Two weeks ago, the question was whether Evergrande would turn into a Chinese Lehman crisis. The odds look good that it won’t. Once this had been duly internalized, it became much easier to ignore disquieting evidence that Evergrande will do significant damage to a Chinese economy that already appeared to be slowing.

In terms of new “news,” we now know that Evergrande is starting to pay money it owes to people who hold its debt through wealth management plans, or WMPs, which are China’s most popular retail investment vehicles. However, it has still only paid the first 10% of what was due last month. In itself, this implies a 90% haircut is still a possibility, which would be a horrific outcome.

We also now know that the government has been prepared to buy a stake in Shengjing Bank Co., a regional lender, from Evergrande. This was a classic move to limit the risk of financial contagion a la Lehman, and helps to confirm that China isn’t going to let Evergrande turn into a generational crisis if it can help it. As Beijing does have the tools to stop that happening, this is good news for the rest of the world.

However, the priorities that the Chinese government is showing should alarm more or less everyone. WMP-holders need to be paid something because there are a lot of them, and an Evergrande default would hurt them grievously. There have already been angry demonstrations over the issue. So domestic political stability and the survival of the Communist leadership remain paramount, as they have been for decades.

Meanwhile, buying the Shengjing stake not only helped Evergrande and all its creditors. It also helped out a long list of ultra-wealthy stakeholders in Shengjing, many of them politically connected and good friends with Hui Ka Yan, Evergrande’s billionaire founder. It looks like crony capitalism.

Finally, there is the issue of foreign creditors. At the time of writing, there has still been no payment to holders of a dollar-denominated bond who were due to be paid Wednesday.

At this point, it looks like the priorities are:

- Avoid a systemic Lehman-style crisis;

- Avert popular unrest over WMPs;

- Make sure all the well-connected cronies are OK;

- Maintain good relations with overseas investors and creditors.

Number 4. at this point seems to come a long way behind the first three. This may well be a defensible set of priorities for the officials trying to manage the crisis in China, but it’s not great news for international investors. It would imply a much slower flow of investment money into China in future, and likely would portend more damage for dollar-denominated Chinese assets.

To be clear, this is a developing situation. Chinese priorities may yet prove to be different from the list above, and foreign creditors may be much happier. But the key point is that it’s hard to frame all this as particularly good news since Evergrande first struck fear into Western investors at the beginning of last week.

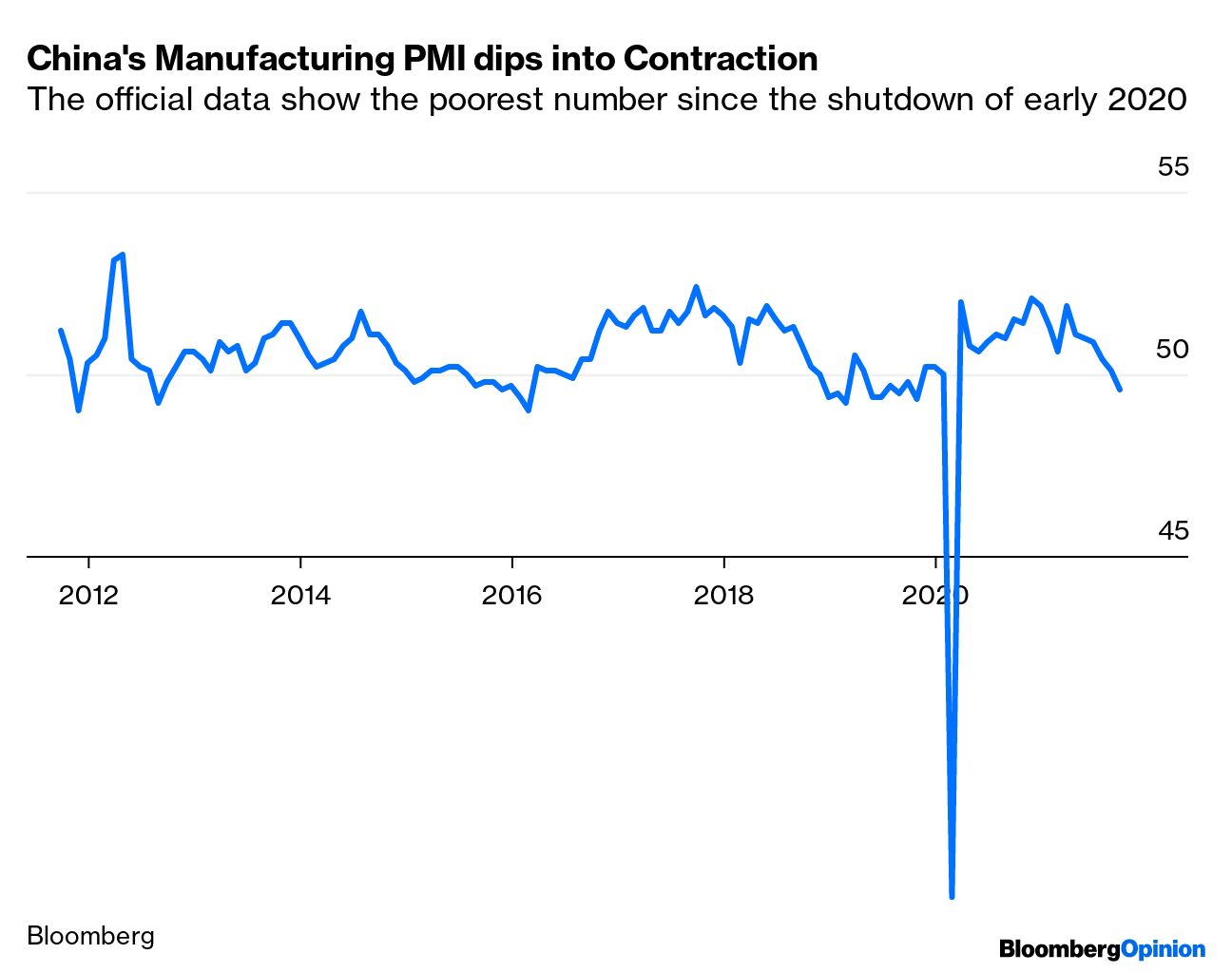

Further, Evergrande feeds into mounting evidence of a slowing Chinese economy, which has contributed to the risk-off moves and shift into the dollar of the last few days. Unlike much of the rest of the world, China doesn’t have a lot of data to come in the next week. Its ISM surveys for September are already out, and they show an ongoing slowdown. The Caixin and the official numbers moved in different directions, as Chinese data continue to be problematic (to be euphemistic). Bloomberg Intelligence’s advice is to prefer the official number as a guide to the strength of industry. That is a shame, because the official number shows manufacturing dipping into contraction:

The effect of China’s power shortages is already visible. The administration has made a priority of fixing that problem, but it remains to be seen whether it can. It’s hard to imagine that Evergrande, or the general attempt to clamp down on leverage in real estate which has been going on for a while now, will yet have had much effect on the numbers.

We’re about to get the standard beginning-of-the-month deluge of data, which will reveal whether other countries’ manufacturing sectors are also slowing. In the U.S., Friday will also bring consumer sentiment and inflation expectations from the University of Michigan, and the latest readout of the PCE deflator, the Fed’s favorite inflation gauge. It’s likely that we will continue not to talk that much about China and Evergrande. But the news will continue to be in the place that everyone was talking about two weeks ago.