Den kinesiske industriproduktion klarede sig godt i oktober med en stigning på 3,5 pct., og det indikerer en god udvikling i fjerde kvartal. Men der er nedgang i byggesektoren på grund af regeringens indgreb mod sektoren. Det medvirker til en lavere økonomisk vækst fremover. ABN Amro venter en vækst i 2022 på 5,3 pct. mod ca. 8 pct. i år.

China – October data point to stabilisation

China’s activity data for October came in stronger than expected. Growth of industrial production accelerated to 3.5% yoy (September: 3.1%, consensus: 3.0%), helped by an easing of energy shortages that had formed a key drag on production over the past month.

Power supply rose by 11.1% yoy, more than offsetting the ongoing contraction in property-related sectors. Retail sales accelerated to 4.9% yoy (September: 4.4%, consensus: 3.7%), extending a pick-up from a summer dip (August: 2.5% yoy) when services consumption was hard hit by zero-tolerance covid-19 policy.

Fixed investment slowed further to 6.1% yoy ytd (Jan-Sept: 7.3%, consensus: 6.2%), as the government’s tight policy versus real estate still forming a drag on property-related investment.

Meanwhile, the official unemployment rate in urban areas was stable at 4.9%, remaining below pre-pandemic levels (2019 average: 5.2%).

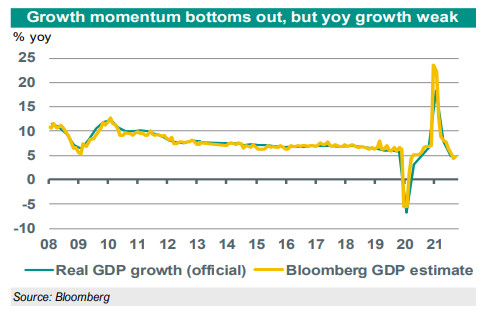

All in all, the October data are in line with our view that quarterly growth will show a pick up in Q4, following a very weak Q3 (+0.2% qoq). That was also confirmed by Bloomberg’s monthly GDP estimate, that improved marginally in October to 4.7% yoy (September: 4.4%), the first such improvement since January 2021.

Ongoing export strength and a piecemeal easing of monetary and fiscal policy should also help to stabilise China’s growth. That said, ongoing drags from the real estate sector will continue to form a key headwind.

Going forward, although we expect some normalisation of quarterly growth rates in 2022 compared to this year (with hardly any growth in Q1 and Q3 due to pandemic drags), we expect annual growth to fall from the above trend pace of around 8% in 2021 (driven by the base effect of the first covid-19 shock in Q1-2020) to 5.3% in 2022.