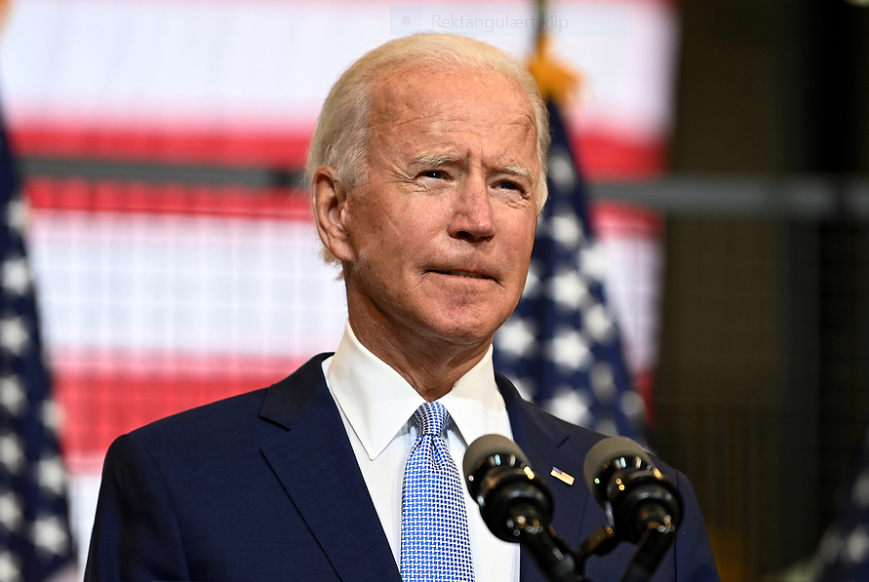

Den amerikanske centralbank har ifølge Scotiabank allerede mistet kampen mod inflationen, og det kan betyde, at præsident Bidens enorme investeringsprogram, Build Back Better, falder til jorden, så Biden bliver hårdt svækket i sidste del af sin præsidentperiode – en lame duck. Centralbanken har ignoreret tegnene på kraftige prisudviklinger og sagt, at det kun er midlertidigt. Banken har også ignoreret, at Omicron var langt mildere end frygtet. Store lønstigninger og en kraftig inflation er ganske enkelt en pind i ligkisten til Bidens investeringsplan, og han vil ikke have mulighed for at gribe ind mod eventuelle senere kriser, skriver Scotiabank.

The Fed May Have Already Lost the Inflation Fight and Crippled the Biden Administration

- Bidens Build Back Better is dead, the US probably faces a lame duck presidency into future uncertainties

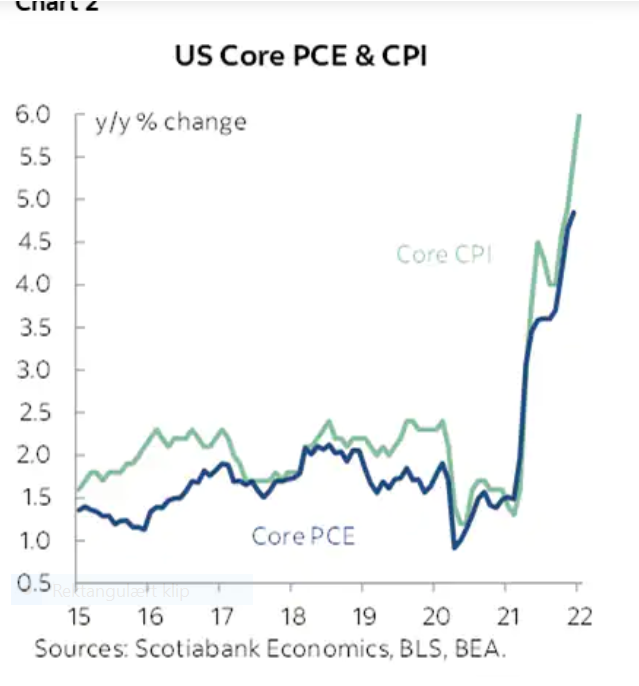

US inflation came in well above expectations last month and at 7.5% y/y hit its highest rate since February 1982. At 6% y/y, core inflation is running hotter than at any time since August 1982.

Forty-year highs in inflation accompanied by remarkably high breadth and no signs of pressures letting up at the margin should deeply worry the FOMC. The centralbank is so far behind the inflation fight with the US at or beyond maximum employment alongside rising wage pressures that this is going to be very difficult to address with monetary policy tools absent abrupt and harsh policy movements.

Persistent supply chain pressures combined with hot demand (ie: it’s both!) in a booming US economy that is entering excess aggregate demand risk unmooring wage and inflation expectations. The odds of a 50 point hike in March and roll-off commencing as soon as Q2 have gone up again. The cost to the Fed’s misreading of inflationary pressures is that the Biden administration could well be a lame duck presidency over the duration of his term which could reduce policy flexibility down the road should the economic outlook require it.

Markets are now pricing a cumulative six hikes by the Fed this year if they go at a quarter-point drip pace. Our forecast is still 7 hikes.

Why did inflation shoot higher than just about anyone expected and particularly higher than my estimate?

One theory is that price gains were hot because behaviour has fully adapted to the pandemic. Another theory is that omicron was generally milder in terms of average severity of outcomes and so it didn’t dampen high contact prices like delta and prior waves did. A third theory is that there is high damage to supply chains from omicron, yet nonfarm did not support that interpretation from a labour market standpoint.

This is how central bankers should be looking at the pressures rather than talking all the time about year-over-year rates and how they are distorted when we don’t really have much comfort around that argument anyway (chart 2).

The same central bankers who told us not to focus upon year-over-year rates throughout the pandemic to date are now telling us to focus upon how they’ll ebb going forward. I’d rather they be more circumspect toward the pressures at the margin and not so wedded to shorter-term developments by year-end or versus how price pressures could evolve over the full cycle. There is very much a live debate around that outlook which should merit not sounding overly strident that inflationary pressures will magically disappear going forward.

THE DRIVERS

A breakdown of the CPI basket is shown in charts 3–6. Chart 3 shows the unweighted y/y changes in CPI inflation by component; 84% of the CPI basket is over 2% y/y which indicates very high breadth. This is clearly not just a relative price shock versus generalized inflation. Chart 4 does the same thing but weights the individual components in terms of their shares in the CPI basket. If you’d like to avoid inflation then don’t own a house, don’t drive a vehicle, don’t go anywhere and don’t eat.

It didn’t take long after the release for Senate Manchin to chirp that the Fed has to address inflation “head on.” Strong payrolls and hot inflation are the final nail in the Build Back Better coffin. The US already has political gridlock from within the ruling Democrats who in theory hold onto the Executive and legislative assemblies. Come November, the incumbent’s historical disadvantage during mid-term elections is likely to cement gridlock over the remainder of President Biden’s term through 2024.

While that may be welcome in the short-term by way of not adding further fiscal impulses to an already hot inflation picture, it could hamper the ability of the US administration to respond to future shocks especially as conditions migrate away from the relatively early growth impulses.