Uddrag fra John Authers:

Financial markets have little sense of direction as everyone waits to see which way Vladimir Putin moves his troops currently massed on the border with Ukraine. Stock and bond markets oscillated throughout the day in response to snippets of news, and the NASDAQ Composite index managed to close unchanged for the day.

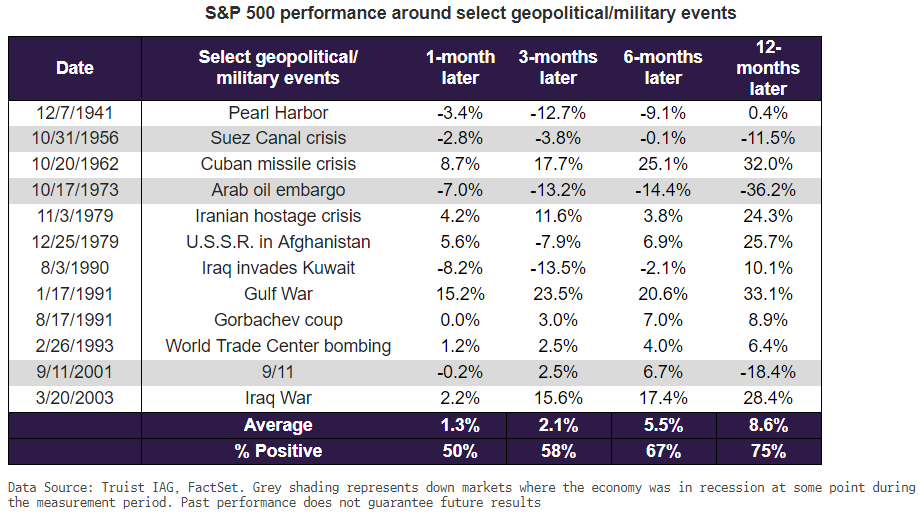

There cannot be any exact historical parallels for what is about to transpire, but the following table put together by Keith Lerner at Truist is useful. It shows how stock markets moved following the biggest geopolitical surprises from Pearl Harbor onward:

There is a need for caution here. The coup against Mikhail Gorbachev prompted a selloff quickly named Red Monday, but the coup was over by the end of the week and all the market’s losses had been made good. This was an epic political surprise, but it was also resolved with remarkable swiftness. Saddam Hussein’s invasion of Kuwait drove equities into a brief bear market, but the stunningly swift resolution of the war that followed enabled a full recovery inside 12 months.

The odds are that the situation in Ukraine will also be resolved in a way that most of us can live with, because few people have any interest in the nightmare scenario of outright war and heavy sanctions. What this exercise does show is that it would be risky to exit stocks altogether. Stocks do go up most of the time, and are more likely to go up if they’ve just had a selloff. It doesn’t, however, suggest that it’s a good idea to go all-in on stocks while many very damaging scenarios remain possible.