Uddrag fra John Authers

The last time the Federal Reserve published the minutes of its latest meeting on monetary policy, in the first week of this year, it set off a dramatic shift in the market’s expectations that still continues. The minutes to its January meeting, which were published Wednesday and you can find here, were a drab affair by comparison. Stocks enjoyed a bounce, though not a particularly big one. The yield curve steepened sharply. That tells us more about the markets than it does about the content of the minutes.

This time around, the market reacted as might be expected if the minutes were “dovish” — showing the Fed to be less inclined to raise rates. That was the direct implication of the fed funds futures market which, according to Bloomberg calculations, responded by cutting the odds on a 50 basis points hike next month, rather than 25 basis points, from 63% to exactly 50%. This had more to do with what the minutes didn’t say than what they did.

There was no clear hint that hiking 50 basis points was on the table. Back in late January when the Federal Open Market Committee was discussing, the governors didn’t feel the need to get markets braced for such a thing. Given that the data published in the three weeks since then show an economy that appears to be overheating, this leaves wide open the possibility of a “shock and awe” March hike.

The minutes still show a group thoroughly alarmed by rising inflation, and distinctly inclined to err on the side of hawkishness. This section makes that clear:

Participants agreed that uncertainty regarding the path of inflation was elevated and that risks to inflation were weighted to the upside. Participants cited several such risks, including the zero-tolerance COVID-19 policy in China that had the potential to further disrupt supply chains, the possibility of geopolitical turmoil that could cause increases in global energy prices or exacerbate global supply shortages, a worsening of the pandemic, persistent real wage growth in excess of productivity growth that could trigger inflationary wage–price dynamics, or the possibility that longer-term inflation expectations could become unanchored.

If the central bankers see the risks of inflation itself tilted to the upside, they also seem more prepared to hike too much than too little. This section was pointed out by Omair Sharif of Inflation Insights LLC. Emphasis is mine:

“Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate. Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation.”

In almost as many words, we have been told that the Fed governors prepared to take the risk of hiking too much outnumber those who aren’t. It behooves all of us to take note.

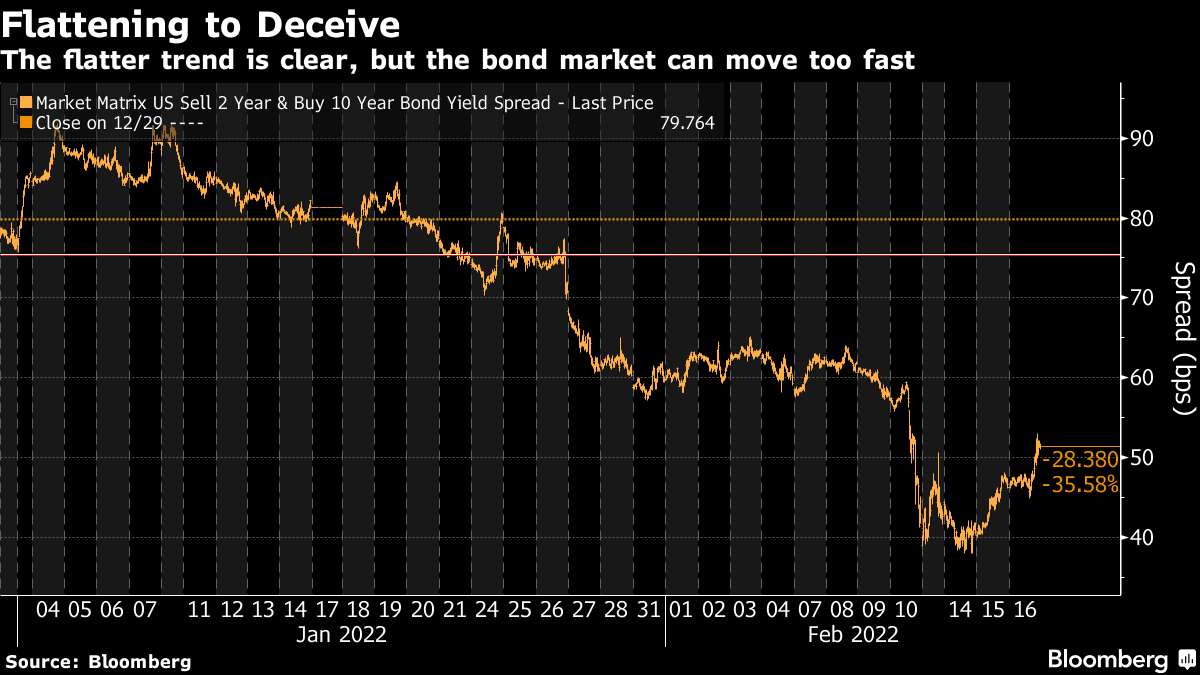

That this was treated as a dovish document therefore tells us a lot about the market’s assumptions before Wednesday. The yield curve has flattened dramatically this year, driven by a historically fast rise in two-year yields. That move was capped by an extraordinary tightening of 20 basis points in the spread between two- and 10-year yields after the release of January inflation data last week. Markets overshoot. That’s what they do. Usually, they eventually get it more or less right. Without a clear hint to brace for an increase of 50 basis points, on this occasion, the yield curve steepened again:

The direction is unchanged. As for how far and how fast the Fed will hike, they don’t know yet, while it’s also unclear how negative market reaction will be. We just have to wait and see. Those with the facilities to trade minute by minute should have ample opportunity to make money. Anyone tempted to try trading from home will have just as many opportunities to lose. And everyone should navigate on the assumption that the longer-term destination will be a regime of higher inflation and higher rates.