Det kan lyde kynisk at tale om de gevinster, investorerne kan få, når Ukraine-krigen er overstået. Men kendsgerningen er, at markederne generelt stiger efter nogle måneder. Merrill har set på udviklingen siden Cuba-krisen i 1962. I gennemsnit er markederne steget med 8,8 pct. et år efter krigenes eller krisernes ophør – svingende fra minus 30 til plus 30 pct. Vedrørende Ukraine-krigen er situationen mere kompleks, da de økonomiske sanktioner spiller en særlig rolle, og da økonomierne i forvejen var belastet af en stigende inflation. Merrill vurderer dog, at den amerikanske vækst i sig selv vil spille en større rolle for de amerikanske aktier end krigen og dens følger, og desuden vil de fundamentale økonomiske forhold på langt sigt altid overgå virkningen af krige og kriser – hvor frygtelige krige end kan være.

Data Check: Some Key Metrics Amid a Sea of Uncertainty

Investors find themselves in a sea of uncertainty, with market expectations unmoored by the

unfolding crisis in the heart of Europe, surging oil prices and mounting inflationary pressures on

multiple fronts. Compounding matters has been the amplified 24/7 “breaking news” cycle that

always accompanies historic pivot points like the Ukraine-Russia crisis.

Against this backdrop, we compiled a few metrics that speak to the current investment landscape,

while suggesting potential investment opportunities. The list isn’t even remotely complete but does

attempt to numerically frame some of the salient signposts of our tumultuous times.

Numbers that matter:

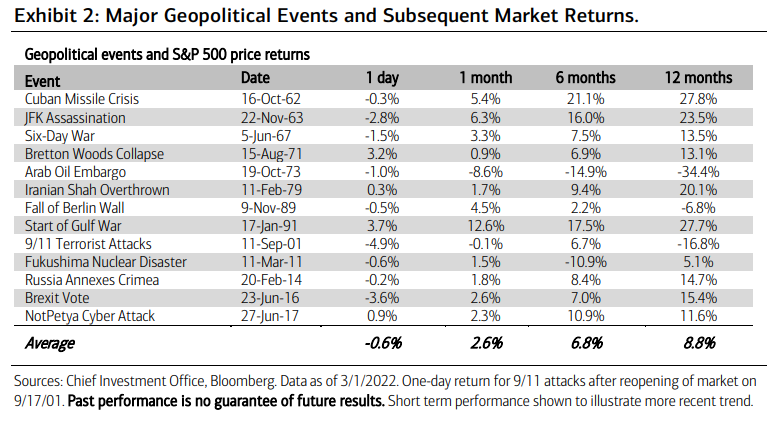

8.8%—the average return of the S&P 500 following a major geopolitical shock since the

Cuban Missile Crisis. As the accompanying table highlights (Exhibit 2), geopolitical shocks to

Equities are typically short-lived, with market gains one, six and twelve months out from the initial

shock.

There are exceptions to this rule—the rhythm of history isn’t linear. But that said, at the end

of the day, we believe the future path of U.S. Equities will be driven in large part by U.S. nominal

gross domestic product (GDP) growth, inflation expectations, the cost of capital and earnings

expectations. Over the long term, market fundamentals will outplay geopolitical dynamics—however

unappetizing the latter happen to be today.