Uddrag fra Seeking Alpha:

- The difference between the Federal Funds rate and CPI is the largest ever.

- The Fed will have to hike well above the currently expected 2.8% terminal rate.

- Thus, the next recession is inevitable.

The Fed has just committed the biggest policy error ever

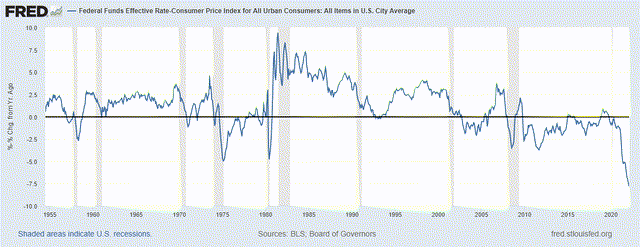

The data on Effective Federal Funds rate starts from 1954 on FRED. Since 1954, the Effective Federal Funds rate has been on average 1% higher than the annual inflation rate CPI. In June of 1981, the Federal Funds rate was almost 10% higher than CPI inflation rate. There were several episodes when the Federal Funds rate was below the CPI inflation (during the recessions of 1958, 1975, 1980, after the 2000 dotcom bubble, and during and after the great financial crisis of 2008). In each of these cases, the difference never went below -5%. Currently, the Federal Funds rate is around 7.8% below the CPI inflation – this is the lowest point in history! Here is the chart:

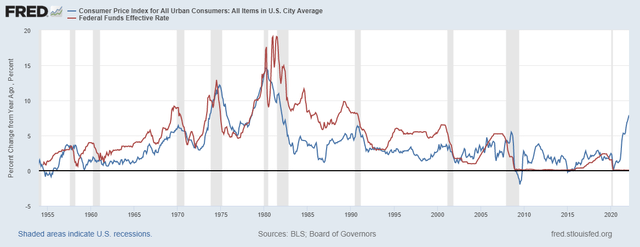

The chart below shows the historical co-movement between the Federal Funds rate and the CPI inflation. Obviously, the correlation is positive and high – the Federal Funds (red line) rate closely tracks the CPI inflation (blue line), and the red line is usually above the blue line. Here is the chart:

The difference between the Federal Funds rate and the CPI inflation can be used as a measure of the real interest rate, but also it can indicate the Fed’s miscalculation of inflation, and thus, point to the possible Fed’s policy error. Here is the brief analysis of each episode on negative real interest rate.

The cases of 1958, 1974, 1981

The previous episodes when the Federal Funds rate was below the CPI inflation were during the recessions of 1958, 1974, 1981 when the Fed correctly predicted a falling inflation and lowered the Federal Funds rate below the CPI inflation to create a temporary negative real interest rate to kick-start and boost the post-recession recoveries.

Prior to the recessions of 1974 and 1981, the Fed hiked the Federal Funds rate far above the CPI inflation to lower the inflation expectations, which in-fact caused the recessions, and thus, subsequently the Fed lowered the Federal Funds rate below inflation rate. However, it could be argued that a temporary negative interest rate in 1974 contributed to an even larger spike in inflation leading to the 1981 recession. Similarly, the Fed interest rate cuts below the CPI in 1981, possibly contributed to an even larger inflation spike and recession in 1982. Thus, both of these cases are possible Fed errors, which led to an even higher inflation, and a recession.