Fra Refinitiv:

THIS WEEK IN EARNINGS

AGGREGATE ESTIMATES AND REVISIONS

22Q2 Y/Y earnings are expected to be 5.6%. Excluding the energy sector, the Y/Y earnings estimate is -3.4%.

Of the 35 companies in the S&P 500 that have reported earnings to date for 22Q2, 80.0% have reported earnings

above analyst estimates. This compares to a long-term average of 66.1% and prior four quarter average of 80.6%.

22Q2 Y/Y revenue is expected to be 10.8%. Excluding the energy sector, the growth estimate is 6.6%.

68.6% of companies have reported 22Q2 revenue above analyst expectations. This compares to a long-term

average of 61.8% and an average over the past four quarters of 78.5%.

For 22Q2, there have been 78 negative EPS preannouncements issued by S&P 500 corporations compared to 45

positive EPS preannouncements. By dividing 78 by 45 the N/P ratio is 1.7 for the S&P 500 Index.

The forward four-quarter (22Q3– 23Q2) P/E ratio for the S&P 500 is 15.8.

During the week of Jul. 18, 72 S&P 500 companies are expected to report quarterly earnings.

There has been a decrease in the share-weighted earnings for the S&P 500 since the start of the quarter (to $465.0B

from $465.6B). Eight of the eleven sectors have experienced downward revisions to estimates.

Since May 1, the consumer discretionary (-13.2%) and communication services (-4.1%) sectors have recorded the

highest percentage decreases in earnings, while the energy (32.0%) sector has recorded the highest percentage

increase in earnings. Overall, share-weighted earnings for the S&P 500 have decreased by 0.1% since the start of the

quarter.

Since May 1, the consumer discretionary (-4.7B) and health care (-3.0B) sectors have recorded the highest dollar-level

decreases in earnings, while the energy (13.3B) sector has recorded the highest dollar-level increase in earnings.

Overall, expected share-weighted earnings for the S&P 500 have decreased by 0.6B since the start of the quarter.

Q2 2022: EARNINGS SCORECARD

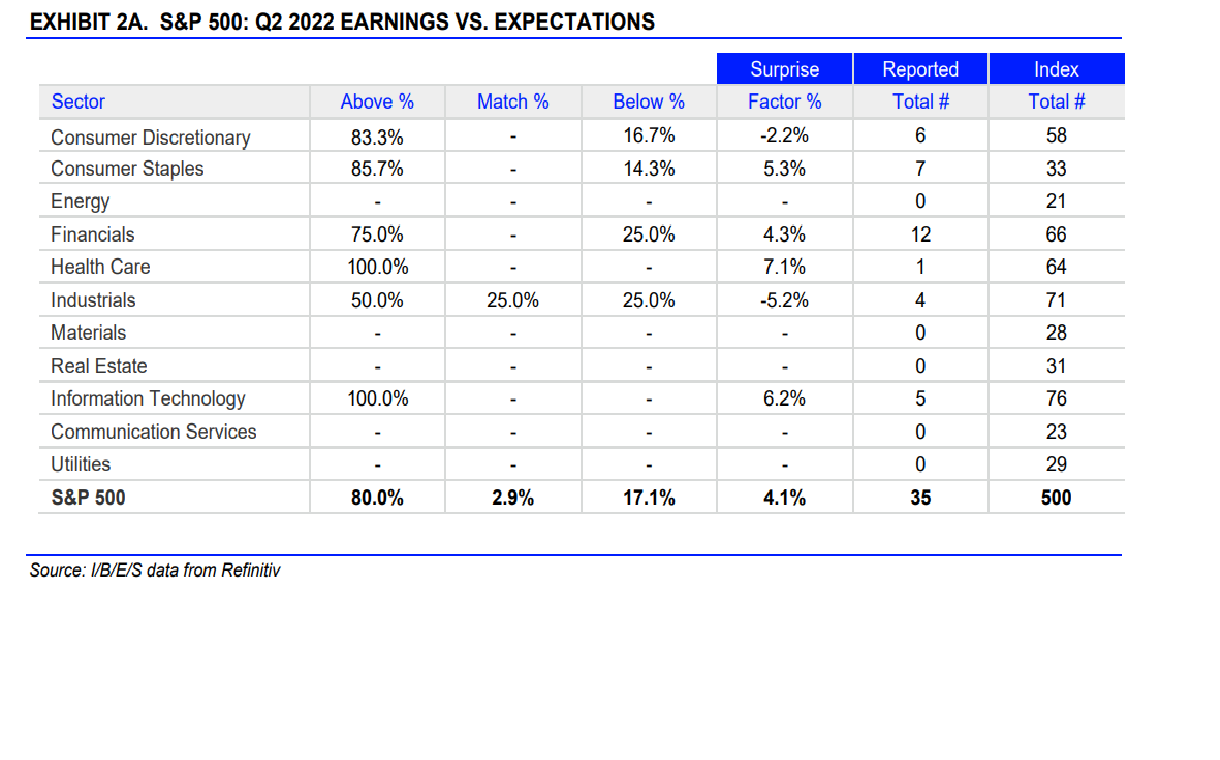

Through July 15, 35 companies in the S&P 500 Index have reported earnings for Q2 2022. Of these companies,

80.0% reported earnings above analyst expectations and 17.1% reported earnings below analyst expectations. In a

typical quarter (since 1994), 66% of companies beat estimates and 20% miss estimates. Over the past four quarters,

81% of companies beat the estimates and 16% missed estimates.

In aggregate, companies are reporting earnings that are 4.1% above estimates, which compares to a long-term (since

1994) average surprise factor of 4.1% and the average surprise factor over the prior four quarters of 9.5%.