Uddrag fra Authers:

It’s Hard To Be Lagarde… |

Thursday brings the spotlight to Europe, and what could be a historically consequential meeting on monetary policy by the European Central Bank. It’s going to raise rates. But there is now some question over how much — 25 or 50 basis points? And the constraints have never looked tighter.

We all know that the world as a whole suffered from a pandemic, and is now suffering inflation in its aftermath. But the ECB has to deal with three pressures that don’t affect the Federal Reserve.

Italy

and the Risk of Fragmentation

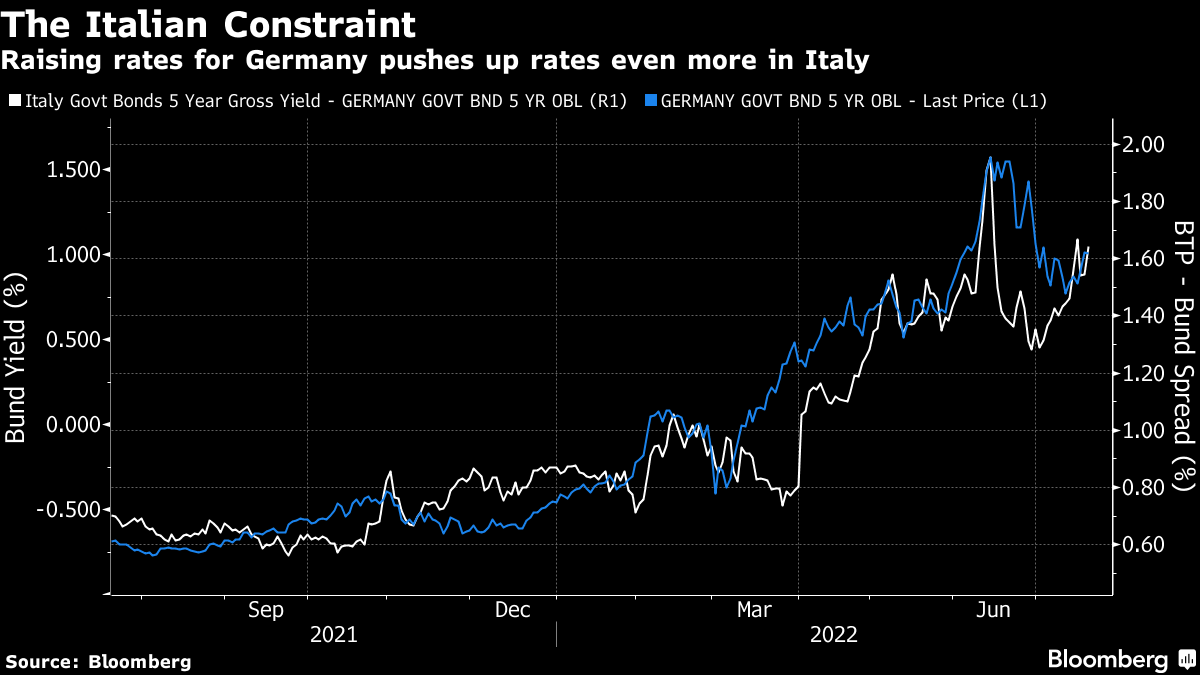

As of Wednesday, it appears that the resignation of Mario Draghi as Italy’s prime minister is at last a done deal. That amps up uncertainty, which in turn tends to amplify the spread between the yields on Italian and German bonds. This is a key measure of political risk, or specifically of the risk that the eurozone begins to fragment. The more aggressively the ECB chooses to hike, the greater the concerns over the Italian economy, so Italian yields rise by even more, taking the spread even higher. Italian political drama on the eve of a rate decision is thus as unwelcome a development as bank President Christine Lagarde and her colleagues could possibly imagine.

Whatever the ECB chooses to do, it’s going to have to produce good and convincing details on how it can stop this spread widening further. If there was any doubt over this, Italy’s latest political crisis has removed it.

Europe’s Banking System

Unlike the Fed, whose decisions on credit are generally refracted through markets, the ECB must contend primarily with the banking system. That’s a problem because Europe’s banks have been far weaker than those of the US ever since the Global Financial Crisis. And the latest edition of the ECB’s quarterly survey of senior lending officers at eurozone banks show that both the supply and the demand for credit are falling rapidly.

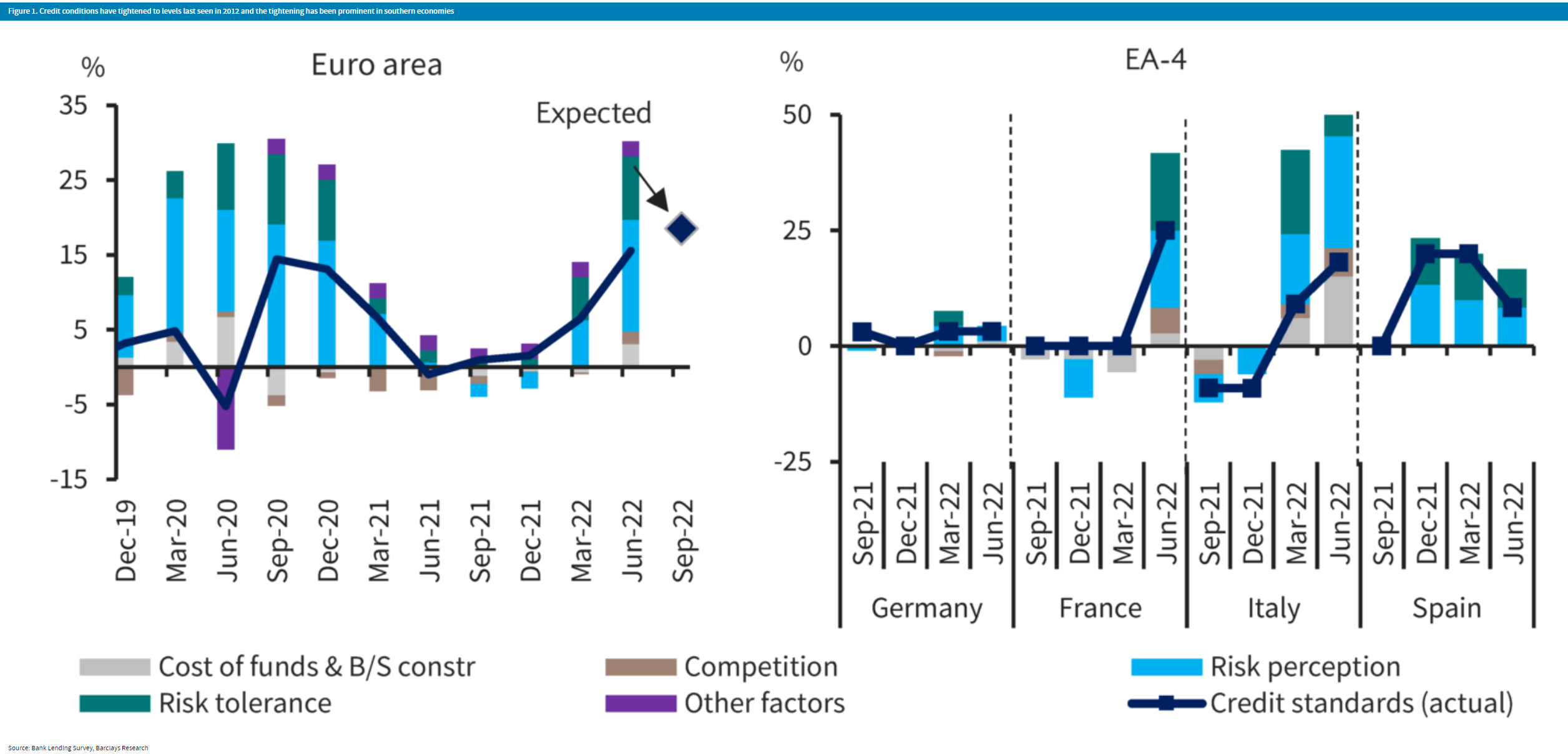

Most awkwardly for the ECB, the health of the banks tends to accentuate the fragmentation risks within the eurozone. This is the assessment by economists at Barclays Plc:

Credit conditions have continued tightening, and incrementally so in peripheral economies. The tightening in credit standards — now at their tightest level since 2012 — has been driven by increased risk-aversion, due to elevated uncertainty, and lower risk-tolerance as economic conditions are on a worsening trajectory. Across countries, credit standards have deteriorated in Italy, France, and Spain, while remaining unchanged in Germany. The results of the BLS provide further confirmation..: We expect a reversal of the decade-long monetary policy easiness to have an asymmetric impact across countries, especially acute in countries where the sovereign-debt nexus is strong (eg, Italy and Spain).

This chart from Barclays shows the pattern clearly. A rise means that credit standards have tightened (meaning the credit is harder to come by), and the chart also shows the different reasons given by banks for why they thought credit was tightening:

On top of all this, the ECB wants to start withdrawing its support for the banking system through the “TLTRO” (targeted longer-term refinancing operations) loans, with which it has been easing pressure on banks. The terms are generous and this makes sense — but again, Barclays warns that it could have greater impact in peripheral economies. In short, the banking system could multiply any monetary tightening to take it to a dangerous level.

Energy

Europe is not just waiting for the ECB to announce new interest rates; Thursday should also give some formal indication of how much energy Russia is prepared to provide, as maintenance work on the crucial Baltic Nord Stream pipeline is due to be completed. This is what has happened to the forward price of natural gas in Germany over the last two years:

The latest words as of Wednesday were not encouraging. Vladimir Putin, Russia’s president, said the pipeline was reopening, but with conditions. As Bloomberg reported:

Putin made clear that if a pipeline part that was caught up in sanctions isn’t returned to Russia, then the link will only work at 20% of capacity as soon as next week — as that’s when another part that’s now in Russia needs to go for maintenance. After frantic diplomatic efforts by Germany, the turbine is on its way home from Canada.

The stakes are high. According to the International Monetary Fund, cutting off Russian energy could on its own cause the German economy to shrink by almost 5%. In a genuine cliffhanger, we must await dawn in central Europe on Thursday — roughly when this newsletter should be reaching you — to see how much gas is actually getting through. Late Wednesday, the head of Germany’s grid said that Russia had arranged for the pipeline to work at 30% capacity. Within a few hours of the pipeline moment of truth, the ECB will need to say what it’s doing about monetary policy.

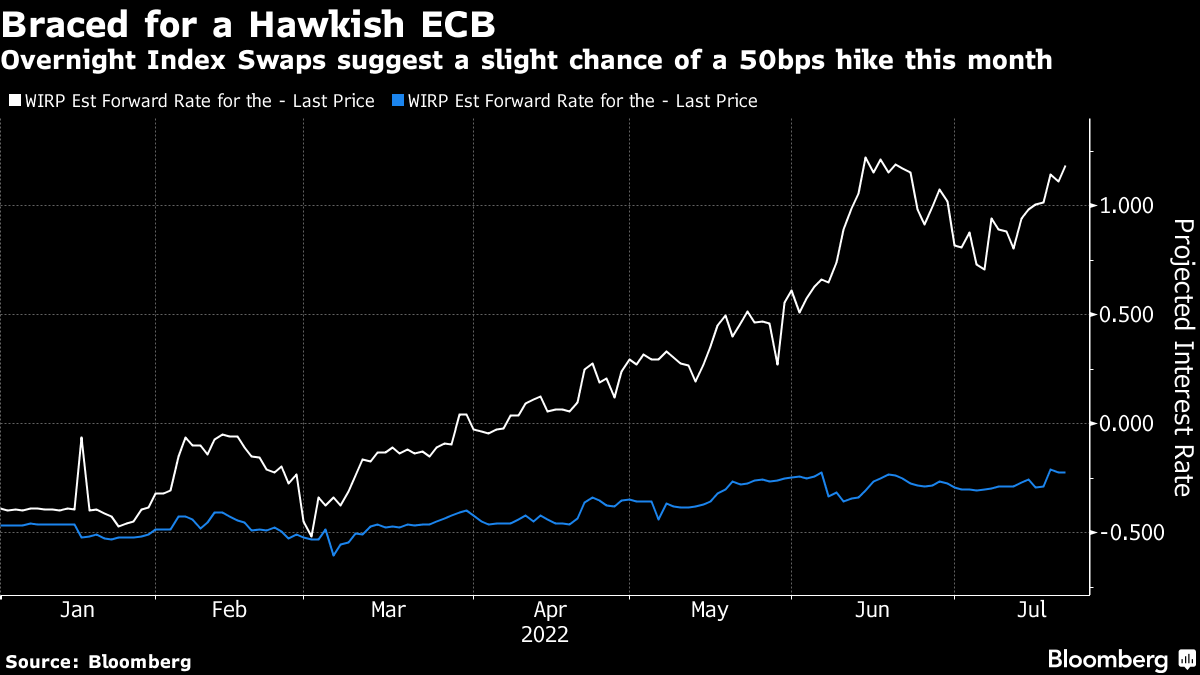

Despite all of these constraints, the market, as measured by Bloomberg’s World Interest Rate Probabilities function, does see a very slight chance of a 50-basis-points hike in July, which would bring the ECB’s target rate up the heady heights of 0%. Meanwhile, the last week or so has seen a hardening in the belief that the rate will have risen beyond 1% by year’s end:

If the ECB really does go full hawk and hike by 50 basis points, we can expect the euro to surge well above parity with the dollar. If it doesn’t, and fails to offer a convincing plan to stop eurozone fragmentation, a dollar could be worth more than a euro for a while. It must be very hard to be Christine Lagarde.