Uddrag fra Zerohedge

Headline and Core CPI printed ‘as expected’ (which is likely disappointing for the whisper numbers and remember the last CPI printed ‘cooler than expected’). Goods inflation continues to slow but Services inflation continues to soar (highest in over 40 years). Shelter costs continue to soar.

* * *

Expectations for this morning’s headline CPI ranges from +6.3% to +6.8% YoY, with consensus seeing a 0.1% decline MoM – something the world and his pet rabbit has bid stocks up into anticipating this as the signal for an about face by The Fed on their higher for longer narrative as it ‘proves’ inflation has peaked.

The headline print came in right as expected with a 0.1% decline MoM (leaving the YoY print at +6.5% as expected)…

Source: Bloomberg

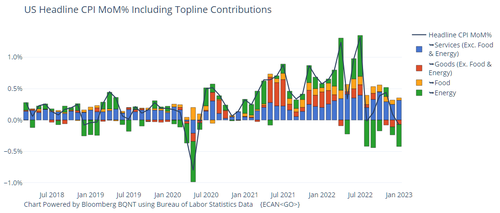

While Goods inflation tumbled to its lowest since Feb 2021, Services inflation soared to its highest since Sept 1982…

Source: Bloomberg

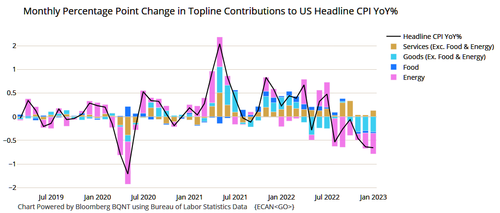

Energy was the biggest driver of the decline in the YoY print along wioth Goods costs (while Services continues to rise)…

Services and Food costs rose on a MoM basis…

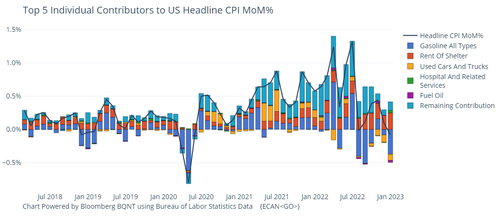

With shelter still rising on a MoM basis…

Core CPI rose 0.3% MoM as expected, leaving the YoY rise at +5.7% – lowest since Dec 2021…

Source: Bloomberg

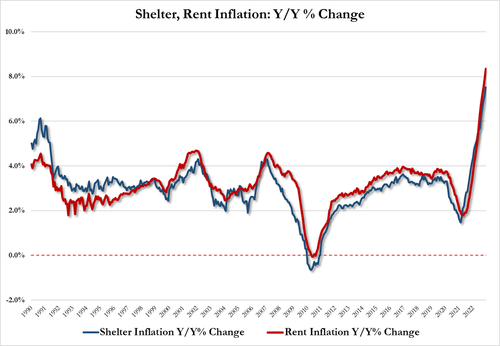

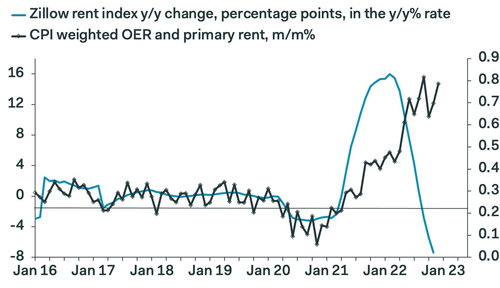

Shelter was biggest contributor to Core CPI 0.3% gain: the increase in the shelter index in December at 0.8% is biggest since 1990s.

- Dec rent inflation 8.35%, Y/Y up from 7.91% in Nov

- Dec shelter inflation 7.51% up from 7.12% in Nov

It is also about 12 months behind market reality, as Pantheon Macro notes:

“biggest contribution to the core was rents they account for the entire increase in the core owners equivalent rents up 0.79% biggest increase in the three months but it won’t last, given the steep drop in rents for new tenants recorded by Zillow and others“

Real average weekly earnings continue to decline – this is the 21st month in a row that Americans’

Source: Bloomberg

Finally, it appears CPI is tracking the decline in M2 velocity (with a lag) rather well…

Source: Bloomberg