Uddrag fra Andreas Steno:

The UBS deal with Credit Suisse was obviously better than a bankruptcy, but it is relatively evident that we are talking about a forced marriage. AT1 investors will be wiped out in the deal and even if this is only a $175bn market, it is likely going to lead to substantial spill-overs to the European banking sector. AT1s are obviously “below” equity from a hierarchical perspective, but at least some equity in UBS would probably have been expected by the investors. AT1s have sold off at record pace in Asia in this morning and the bleeding will continue during the day.

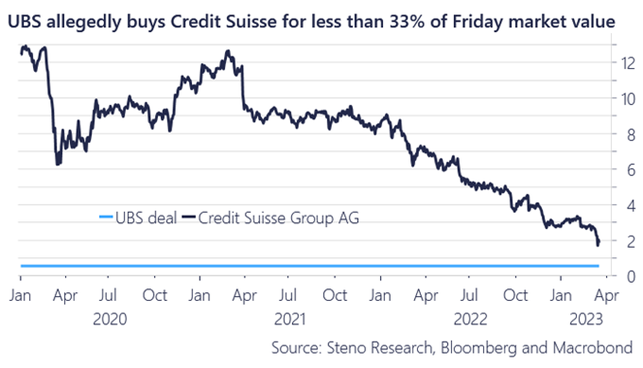

We also need to remember that the deal is at around 30% of the market value of Credit Suisse from Friday even with public intervention and liquidity packages included. There was no true bid for Credit Suisse and UBS has effectively been handed the keys for free. This is NOT a bullish signal for European banking stocks, rather the exact opposite.

Chart 2. A brokered deal WAY below Fridays close price

The ECB and European authorities are still stuck at phase one in the crisis playbook. “There is nothing to see here, but we are monitoring the situation”. Reuters reported yesterday that two major banks in Europe worry about contagion and have asked the ECB to step in.

The story was written by Stefania Spezzati and Elisa Martinuzzi. Look at the names and make your own conclusions on where those two “major banks” are from. I know what I think.