Uddrag fra Authers:

The day has finally arrived. Federal Reserve policymakers are convened in Washington to discuss their future monetary tightening path — after a campaign that is already the most aggressive in decades. In the face of a banking crisis on both sides of the Atlantic, an inflation print that remains elevated and global recession risks that have increased in probability, what will Jerome Powell and his colleagues do?

Many in Wall Street say Wednesday’s meeting is among the most crucial in recent memory, because any decision will likely have negative ramifications. Hike 50 basis points and markets would panic; hike 25 and add further pressure to an already stressed banking system; or hit pause and signal to the world that the Fed lacks faith in the financial infrastructure and its own crisis management.

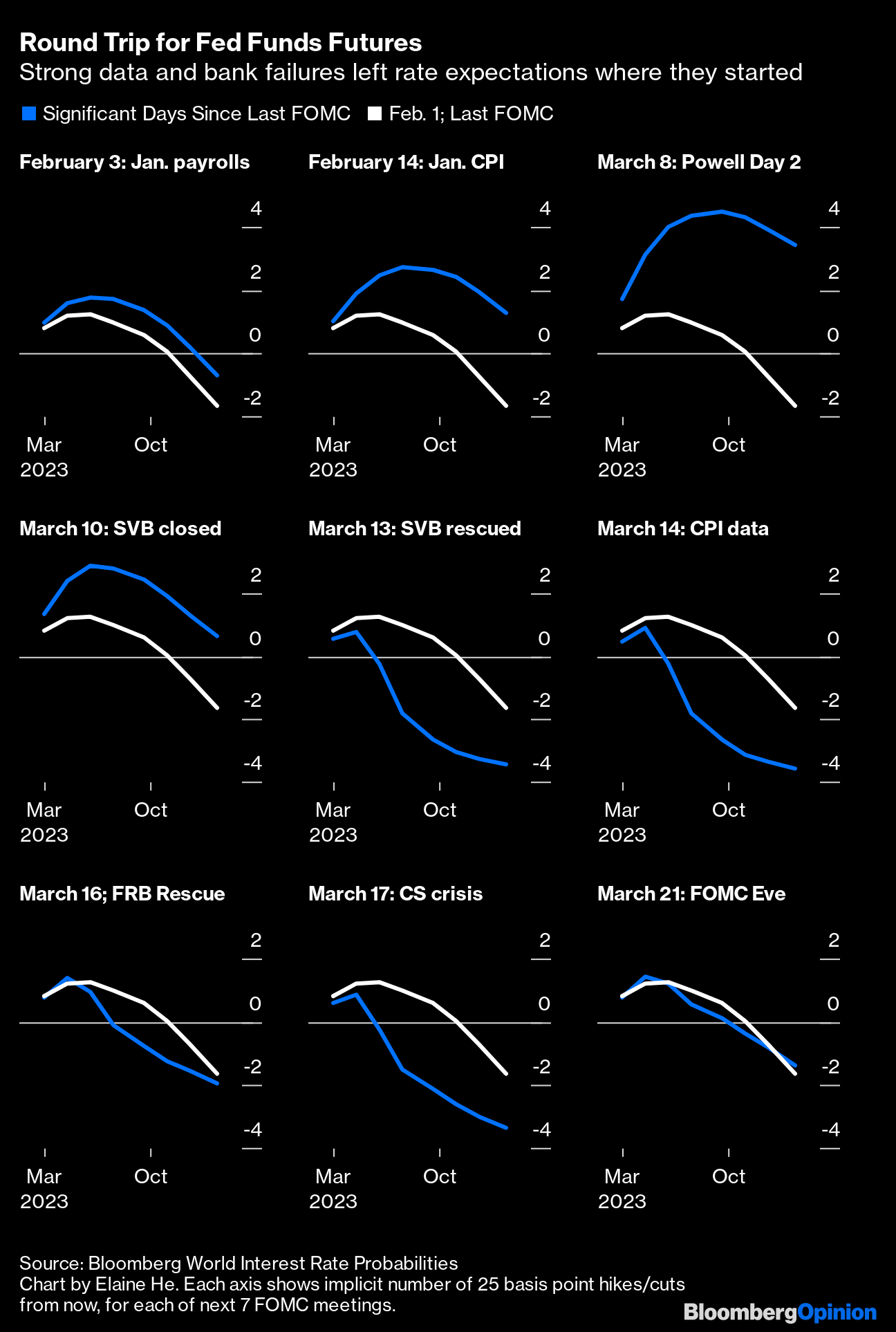

The turbulence in Fed expectations since the Federal Open Market Committee last met on Feb. 1 has been nothing short of stunning, as Points of Return chronicled in this Big Take piece that detailed how bets had flipped from the start of this month. The Bloomberg World Interest Rate Probabilities function (WIRP on the terminal), which derives implicit predicted fed funds rates after each meeting from futures prices, shows the expected path is now almost exactly back to where we were at the start of February — but only after a round trip around the sun.

In the following graphic, take a look at the white line, which represents how many cuts or hikes of 25 basis points were implied by fed fund futures at the end of trading Feb. 1. This is in effect the benchmark. The blue lines in each chart, meanwhile, show the market’s expected number of hikes and cuts at the end of significant days since then. The shifts have been remarkable, but the short-term prediction is fairly clear. For now, swaps are pricing in an 80% chance of a quarter-point rate hike, to a range of 4.75% to 5%, the highest since 2007 on the eve of the Global Financial Crisis. This is a departure from every other Fed meeting over the past year, in which traders have fully priced at least one such move, but it would still count as a major surprise if the fed funds rate were left unchanged:

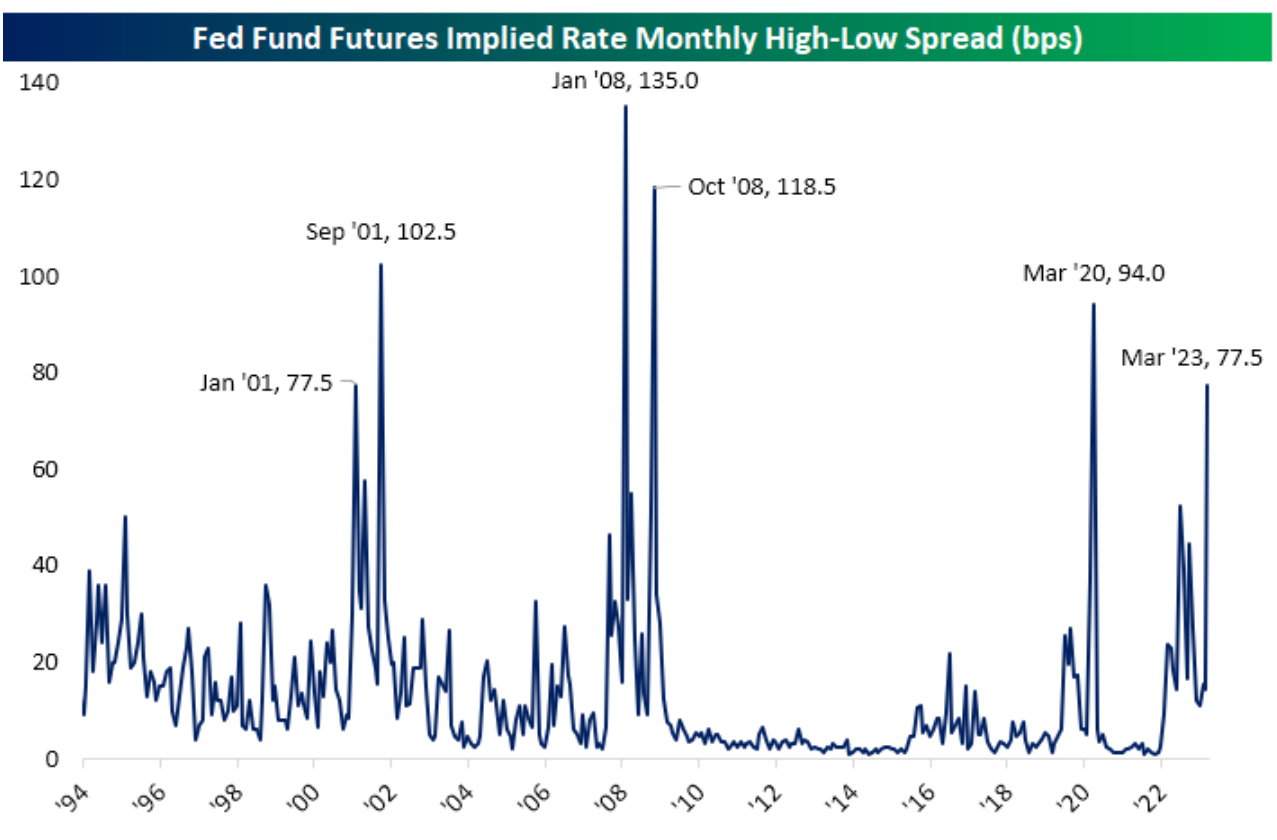

The fluctuation of fed funds futures has been so extreme that, since their inception in 1994, the only other months to see such volatility were: January 2001 (when the Fed started to hike); September 2001, month of the 9/11 terrorist attacks; January and October in the crisis year of 2008; and March 2020, when Covid-19 arrived.

This is according to an analysis by Bespoke Investment Group. In contrast to the Fed’s current tightening regime, all those months saw the central bank cutting rather than hiking in response to clear crisis conditions. Over the last month, the gap between the highest and lowest fed funds rates that have been predicted stands at 77.5 basis points:

To Chris Senyek of Wolfe Research, who believes the Fed should hike 25 basis points, there is simply no good option available for Powell:

The Fed is looking to both tighten and loosen financial conditions at the same time. In our view, this is very likely to add to inflation’s persistence and prolong the upcoming recession… Further, Fed Chair Powell’s press conference tone is always a huge wild card (that often conflicts with the statement, QT guidance, and “the dots”)!

Whatever the outcome, the most important thing to George Cipolloni is the messaging. The portfolio manager at Penn Mutual Asset Management also thinks the Fed will (and should) hike by a quarter-percentage point, then pause:

It almost seems silly to discuss the minutia whether it’s 25 or 50… Inflation is still a problem. Until inflation starts to come down, they’re trapped, and what the Fed doesn’t want to do is cut or not raise and then have another bad inflation reading come up because nobody would trust them anymore.