Uddrag fra Zerohedge:

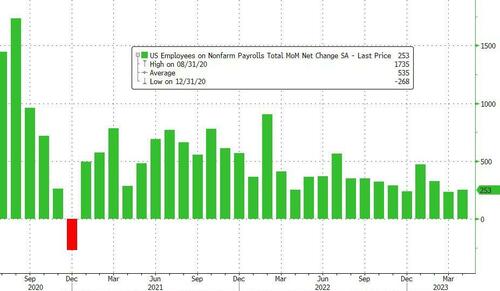

… as April payrolls reportedly rose by 253K, a big jump from the the March number…

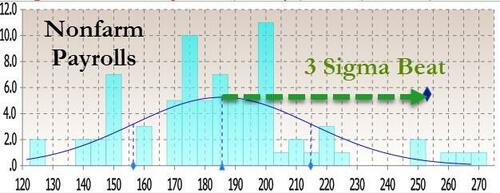

… and what is a 3-sigma beat of expectations of 185K.

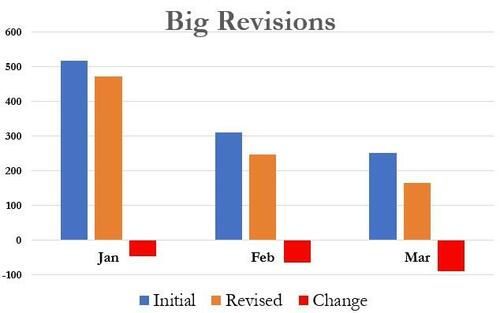

And speaking of previous prints, the March number was unexpectedly revised sharply lower, from a consensus-beating 236K (exp. was 230K) to a huge miss at 165K, a number which surely would have impacted the Fed’s thinking and potentially put a premature end to the rate hikes. But wait there’s more, because February was also revised lower by 78K, from +326,000 to +248,000, which would also have missed the whisper estimate. With these revisions, employment in February and March combined is 149,000 lower than previously reported. And then there was a downward revision in January too… Combined, this is how the downward revision looked:

And just like that, we get confirmation that every BLS number is only gamed to beat the current month consensus estimate so that Biden’s admin can take props for handling the labor market “:better than expected.”

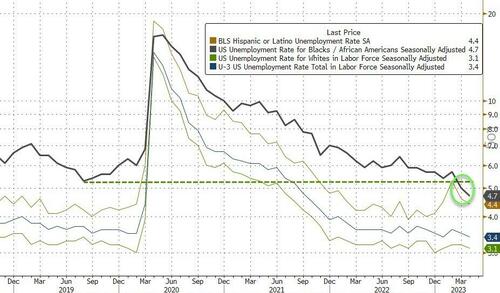

Turning to the unemployment rate, which we expect will also be revised dramatically higher just after the 2024 presidential election, it unexpectedly dropped from 3.5% to 3.4%, (an in fact 3.39% unrounded) stronger than consensus expectations for an increase to 3.6%. Among the major worker groups, here are the the unemployment rates for adult men (3.3%), adult women (3.1%), teenagers (9.2%), Whites (3.1%), Blacks (4.7%), Asians (2.8%), and Hispanics (4.4%). Of note, the unemployment rate for blacks dropped to a record low.

There were no surprises for the participation rate which at 62.6%, came right on top of expectations.

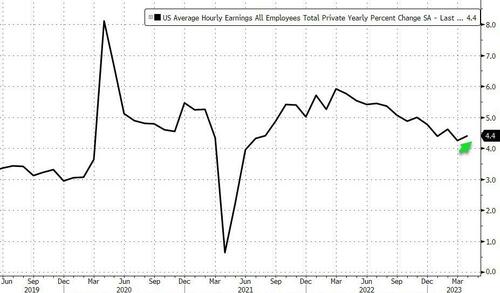

There was more: with most third party metrics showing a continued drop in wages, the BLS once again decided to portray the data in the best possible light for Biden, with average hourly earnings rising to 4.4% from 4.2%, (revised to 4.3%) and above the estimate of 4.2%…

… which translated into a remarkable 0.5% increase for the month of April alone.