Uddrag fra Bloomberg- kommentar:

Money growth in Europe continues to decelerate, suggesting that the recent amplification of the ECB’s hawkishness will be dialed back down sooner than the market currently projects.

M3 money for Europe showed a deceleration to 1.4% year-on-year in May from 1.9% the previous month, according to data released earlier. More consequential for economic activity is lower forms of money, especially M1. The latter is mainly made up of demand deposits – i.e. deposits created when new loans are made, and deposits that are ready to be deployed into the real economy.

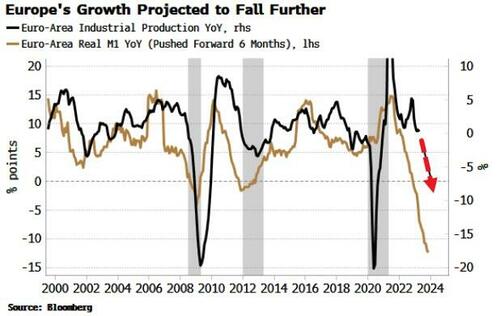

Real M1 growth continues its steep decline. Soft data in Europe such as PMIs had been surprising to the upside previously but are now catching down to hard data such as money growth. As the chart below shows, the fall in real M1 growth points to a continuation of weakening growth in Europe.

Higher forms of money tend to be counter-cyclical. For instance M2 minus M1 is rising sharply as savings deposits are rising. Savings accounts offer a higher rate of interest, which is attracting deposits. But money being locked up for saving purposes cannot boost economic activity.

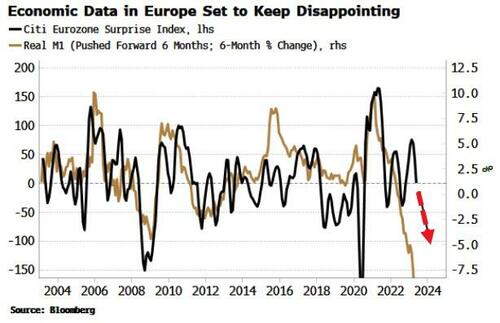

Curiously, economists in the aggregate don’t seem to follow M1 as a leading indicator. If they did, then we shouldn’t see the leading relationship between real M1 growth and economic surprises in the chart below.

As the chart shows, we should expect economic data from Europe in the coming months to increasingly disappoint.

This leaves the ECB’s recent amping up of its hawkish rhetoric vulnerable to being eased back again as the data deteriorates, and inflation continues to fall in the coming months at a decent clip (as projected by fixing swaps).

Like the Fed, the ECB is using “talk” to bend the rates curve to its will, i.e. “higher for longer”.

Thus far the Euribor curve has been listening, with the December 2023 vs December 2024 steepening.

But weaker-than-expected growth could soon convince the market cuts are coming sooner than the ECB is currently intimating, re-flattening the curve.