Fra destatis.de

Production in industry

June 2023 (in real terms, provisional):

-1.5% on the previous month (seasonally and calendar adjusted)

-1.7% on the same month a year earlier (calendar adjusted)

May 2023 (in real terms, revised):

-0.1% on the previous month (seasonally and calendar adjusted)

+0.0% on the same month a year earlier (calendar adjusted)

WIESBADEN – Production in industry in real terms (price adjusted) was down 1.5% in June 2023 month on month after seasonal and calendar adjustment, according to provisional data provided by the Federal Statistical Office (Destatis). After revision of the provisional data, production in May 2023 was almost unchanged (-0.1%) compared with the previous month (provisional figure: -0.2%). The three-month on three-month comparison showed that production was 1.3% lower in the period from April to June than in the previous three months.

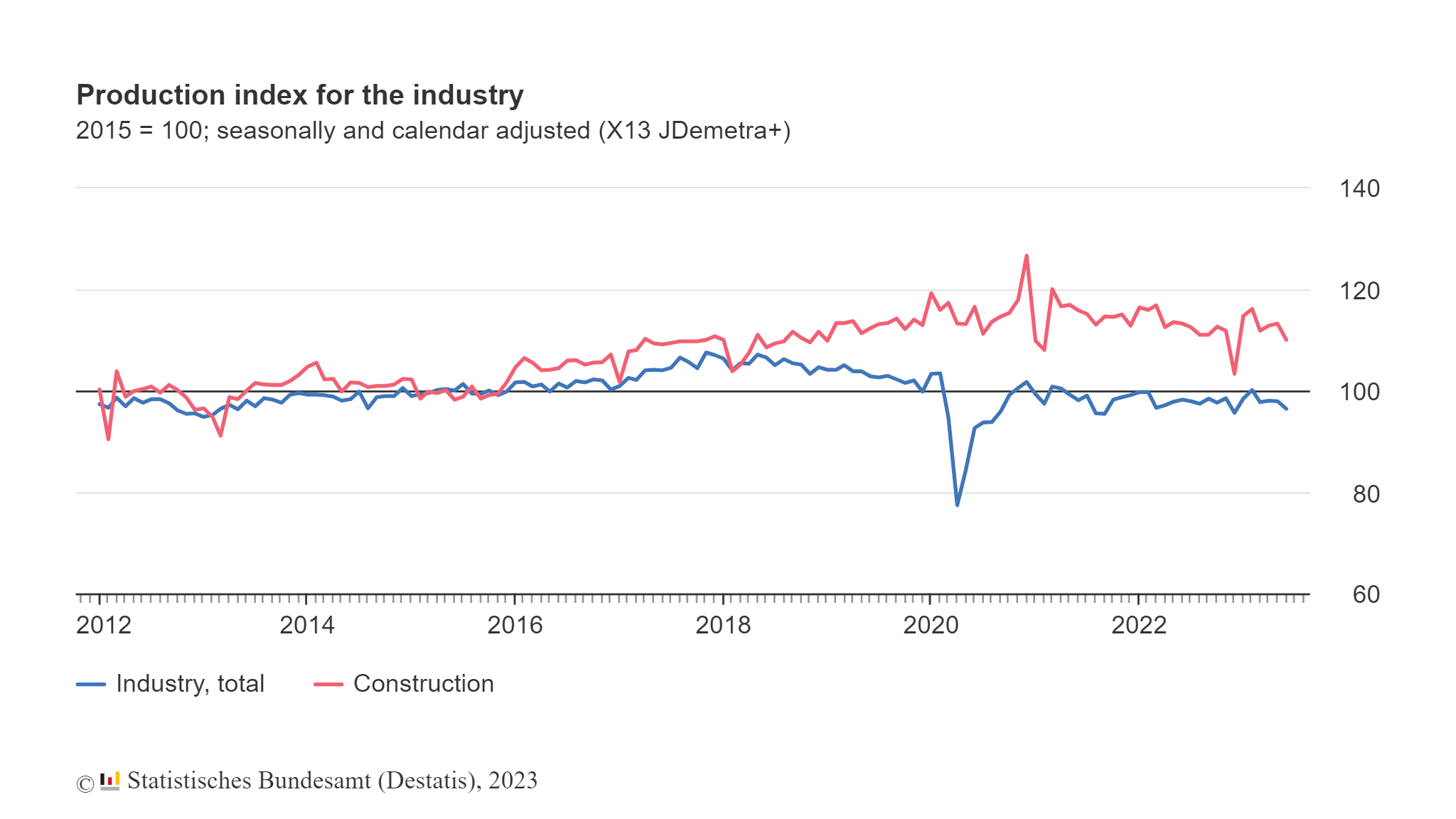

Production index for the industry

Within industry, the development of production varied greatly between the individual economic sectors: The automotive industry had a particularly negative impact on overall performance in June 2023 (-3.5% month on month after seasonal and calendar adjustment), following production growth of 5.8% in the previous month. The construction industry (-2.8%) also weighed on overall performance. By contrast, the strong growth in production in the pharmaceutical industry (+7.9%) had a positive impact on overall performance, following the decline of 13.3% in this sector in May 2023.

In June 2023, production in industry excluding energy and construction was down 1.3% from May 2023 after seasonal and calendar adjustment. The production of capital goods decreased by 3.9%. The production of consumer goods increased by 1.8% and that of intermediate goods by 0.4%. Outside industry, energy production was up 0.6% in June 2023.

Compared with June 2022, production in industry was down 1.7% in June 2023 after adjustment for calendar effects. Production in industry excluding energy and construction decreased by 0.3% over the same period.

Production up in energy-intensive industrial branches

Production in energy-intensive industrial branches increased by 1.1% in June 2023 from May 2023, after elimination of seasonal and calendar effects. Compared with June 2022, production in energy-intensive industrial branches was down 12.2% in June 2023. An analysis on the Production index for energy-intensive industrial branches (only in German) is available on the “Industry, manufacturing” page of the Federal Statistical Office’s website.

Methodological notes:

The differing comparative periods must be taken into account in all press releases on short-term indicators. Short-term economic monitoring focuses on comparisons of seasonally and calendar adjusted figures with those of the previous month or quarter. These reflect short-term economic trends. Year-on-year comparisons of calendar adjusted results enable long-term comparisons of levels and are not influenced by seasonal fluctuations and calendar effects. The results of month-on-month, quarter-on-quarter and year-on-year comparisons may differ considerably because of the Covid-19 crisis and the war in Ukraine.

The rates of change are based on the production index for industry. The average figure for 2015 is used as the basis of the index and set to 100 index points (2015 = 100). The X13 JDemetra+ method was used for calendar and seasonal adjustment.

The five branches referred to here as “energy-intensive” have particularly high energy demands in relation to their gross value added. In the reference year of 2020, they collectively accounted for 76% of total industrial energy consumption. Their proportion of industrial gross value added stood at 21%. In 2020, just under one million people (935,000) were employed in the more than 7,000 industrial establishments of these branches in Germany.