Uddrag fra Authers:

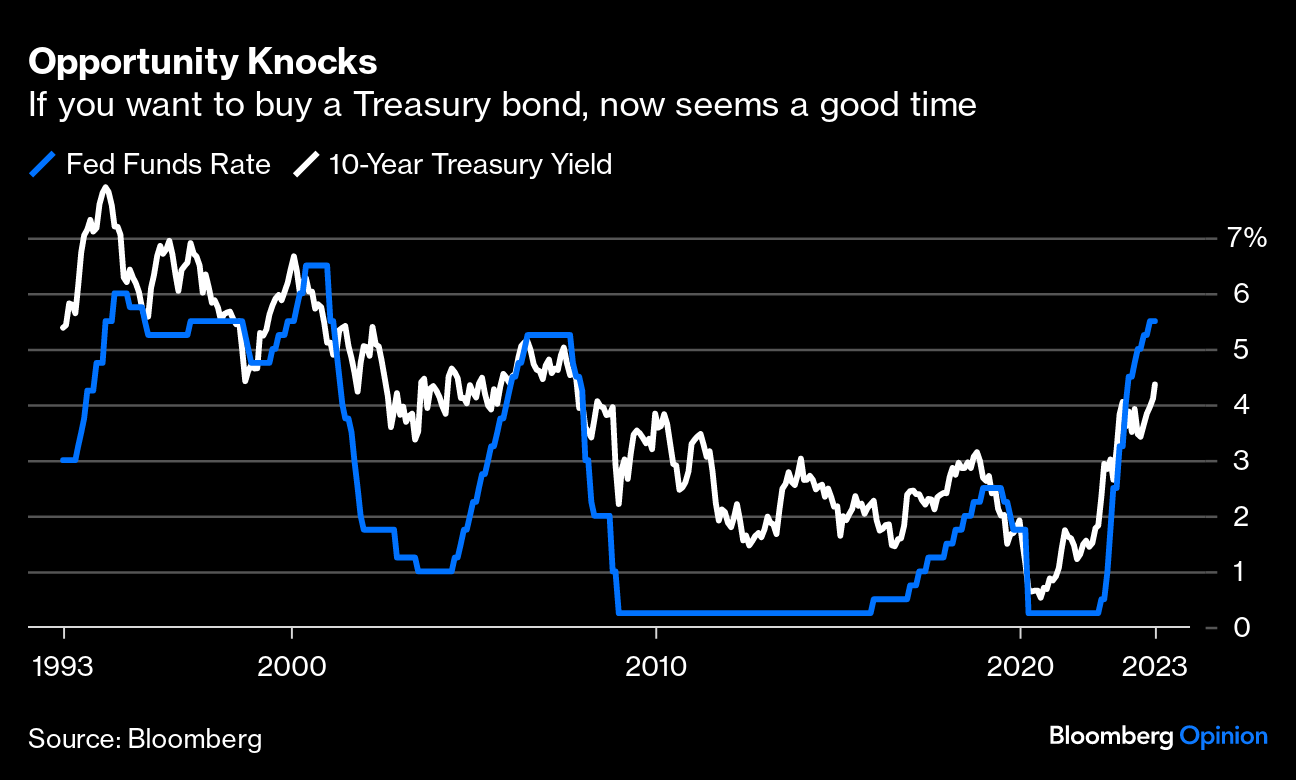

In the case of the 10-year Treasury yield, it’s moved to a fresh high not seen since 2007. On that occasion, the 10-year peaked at a slightly higher level just before the Federal Reserve under Ben Bernanke began what would prove to be a drastic series of rate cuts. Anyone buying long Treasuries when yields peaked and holding until the end of 2008 would have enjoyed a 59% gain. The rise in yields has been much faster this time, and the 10-year yield — unlike in 2007 — remains well below the fed funds rate. In other words, the weird world of an “inverted yield curve” — in which interest rates are higher over short rather than long terms — continues. Steeply inverted yield curves tend to mean that a rate cut is coming, which would again suggest that this is a good time to buy bonds:

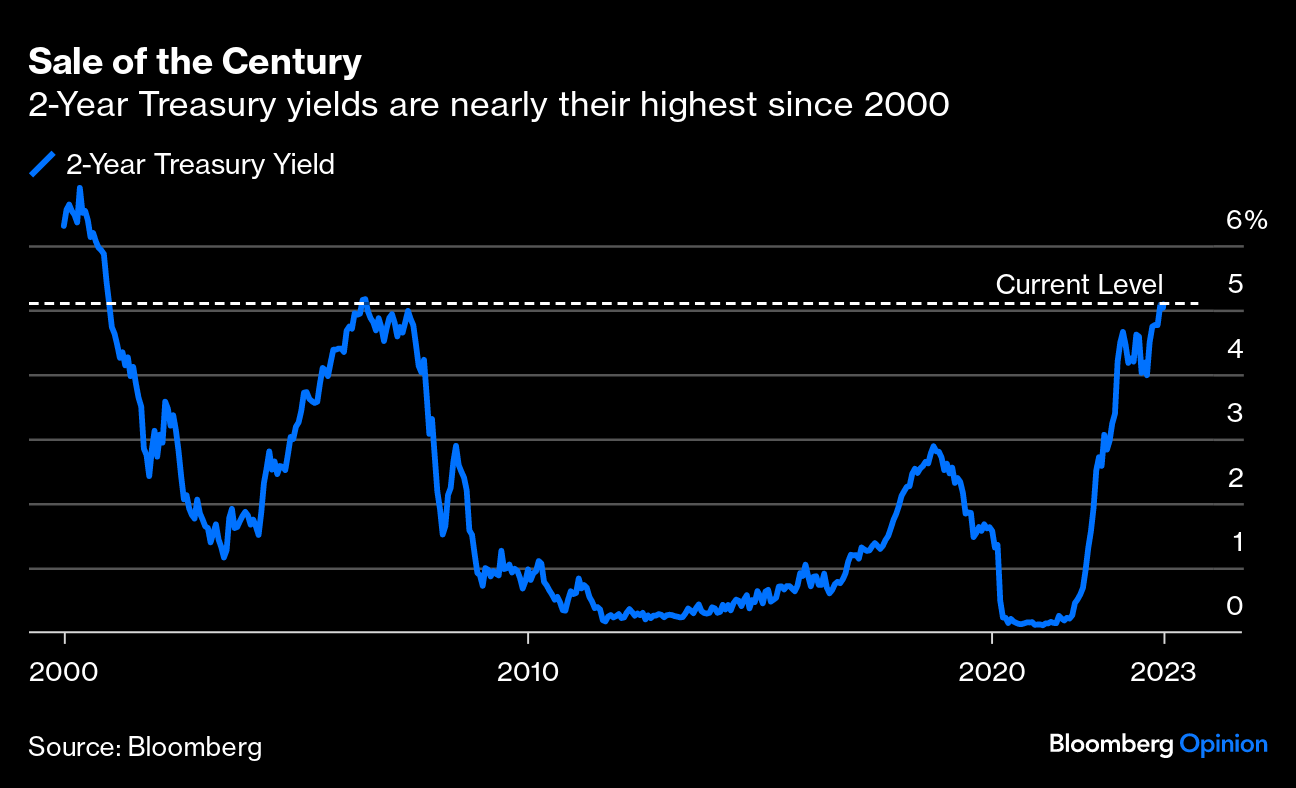

Movements in the two-year yield have been even more dramatic. Save only for a few days on the eve of the Global Financial Crisis, it’s at the highest since 2000. If you want to buy an income from short-term bonds, this is indeed the sale of the century:

This is an international phenomenon. Germany’s economy has been marred by the eurozone sovereign debt crisis that followed the GFC, and the ensuing protracted period when yields were outright negative. It still has to contend with deep pessimism. That previously unimaginable state of affairs is over. The surge in bund yields since inflation got going in earnest early last year has been if possible even more dramatic than the move in Treasuries. And while less dramatic now, the trend continues to be persistently upward:

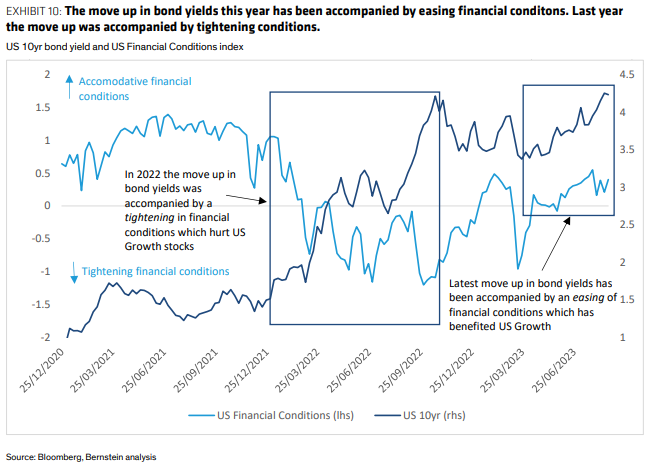

These dramatic events could be scary. For 15 years, the entire financial world has been fretting about what could happen if yields suddenly rise. Now we’re beginning to find out. And the broader markets appear oblivious. Financial conditions indexes, which use a range of conditions from different markets to measure the ease with which finance can be raised, or the strength of risk appetite, suggest that the environment is actually loose. Judging by Bloomberg’s own US conditions index, confidence is back where it was in the spring of 2022, before the Fed’s hiking campaign even started:

The corporate credit market is certainly making life easier for companies and investors. Taking the spread of the yield of investment-grade companies rated at least BAA by Moody’s over five-year Treasury bonds, we find that spreads haven’t been this tight since the summer of 2007. The credit crisis soon followed. It’s hard to believe it’s a coincidence that the last record tight for credit spreads came at exactly the same time as the last high for Treasury yields:

Whatever’s going on at present, this isn’t a direct repeat of the GFC and there are many important differences. But the experience of 2007 should be instructive. The surge in Treasury yields helped prove to credit investors that spreads weren’t adequately compensating them for their risks. That summer, money poured out of credit and back into Treasuries, sending spreads far higher. Is it unreasonable to fear something similar again?

To answer that, we need to know exactly why bond yields are rising. Different investors will have different reasons, but it’s fair to say that the rally of 2023 has been driven by very different factors than the rise of 2022. To quote a fascinating piece by Sarah McCarthy of Alliance Bernstein:

The drivers of the move higher in bond yields have been much different this year vs. last year. Bond yields this year have likely risen due to the market’s improved perception of economic growth potential. Bond yields rose last year because of inflation and expected rate hikes. Financial Conditions have actually eased this year, whereas they tightened significantly last year. The risk to Growth from here arguably is a deterioration in the market’s assessment of the economic outlook, i.e. financial conditions, rather than a move higher in bond yields alone.

That would explain the apparently irrational equanimity currently on display in the stock market, which barely sold off Tuesday. This is McCarthy’s illustration of what’s going on:

If investors think rates are high and will rightly stay high to cope with a buoyant economy, then yes, higher yields make sense. And there’s no reason for this latest spike to be as scary as its predecessor in the summer of 2007. Growth stocks can continue to prosper.

The alternative explanation is scarier. Oil prices have surged and that always means trouble. The sharp rise in crude has come as an external shock to financial markets. Layer on reasons for caution (such as the imminent possibility of yet another US government shutdown, and what looks like a potentially epochal strike in the auto industry), and maybe this isn’t the time to hold bonds.

Another explanation is that investors are trying to get in their reaction ahead of the Federal Open Market Committee meeting. The expectation is that the “dot plot” will likely show higher rates for longer. That would justify higher yields. A dot plot in which the Fed isn’t as hawkish as expected could prompt a lot of people to dive to buy bonds, however, while these generous yields last.