Uddrag fra Authers:

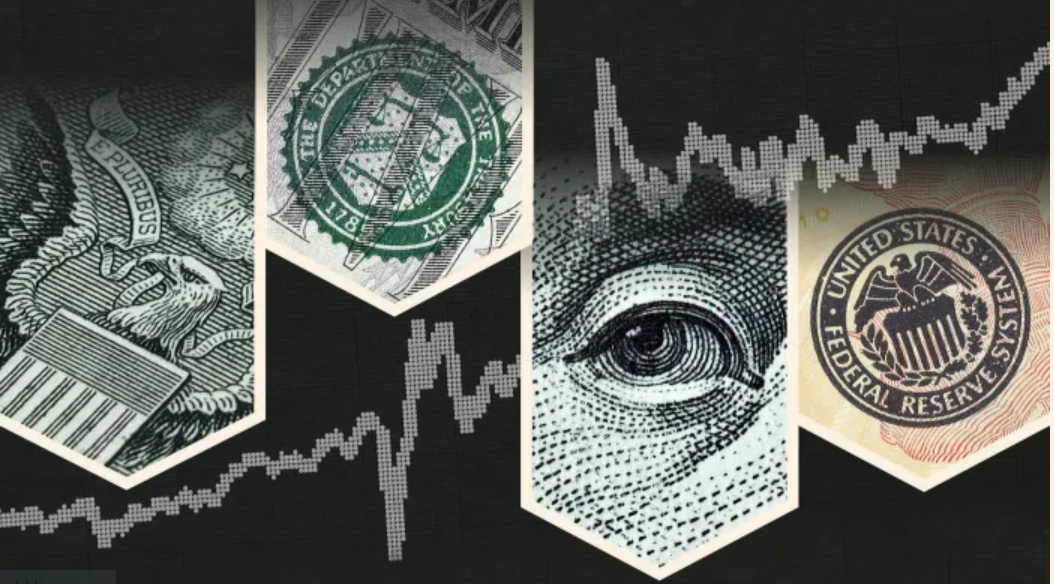

When comparing when debt needs to be renewed for small and large caps in the US and Europe, the following chart from Societe Generale’s quantitative strategist Andrew Lapthorne shows that the US-based large caps of the S&P 500 seem to have locked in great deals. Everyone else faces a credit “wall” or “cliff”:

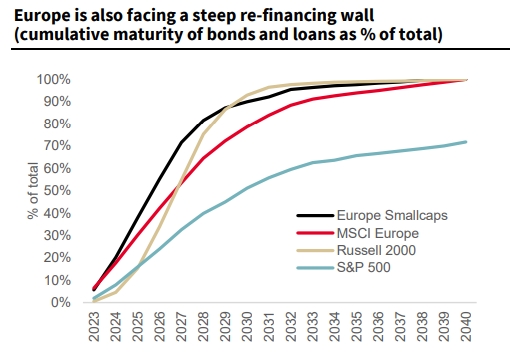

Small-caps’ share prices suggest credit is getting too tight, and the yields on their bonds are beginning to do the same. The spreads payable for taking on the extra risk of high-yield or “junk” bonds has remained very tight so far this year, fully repairing the damage from the March bank failures. Spreads are still not extreme by any measure; but they’re rising, and the trend seems to be clearly upward as the 200-day moving average has now been breached:

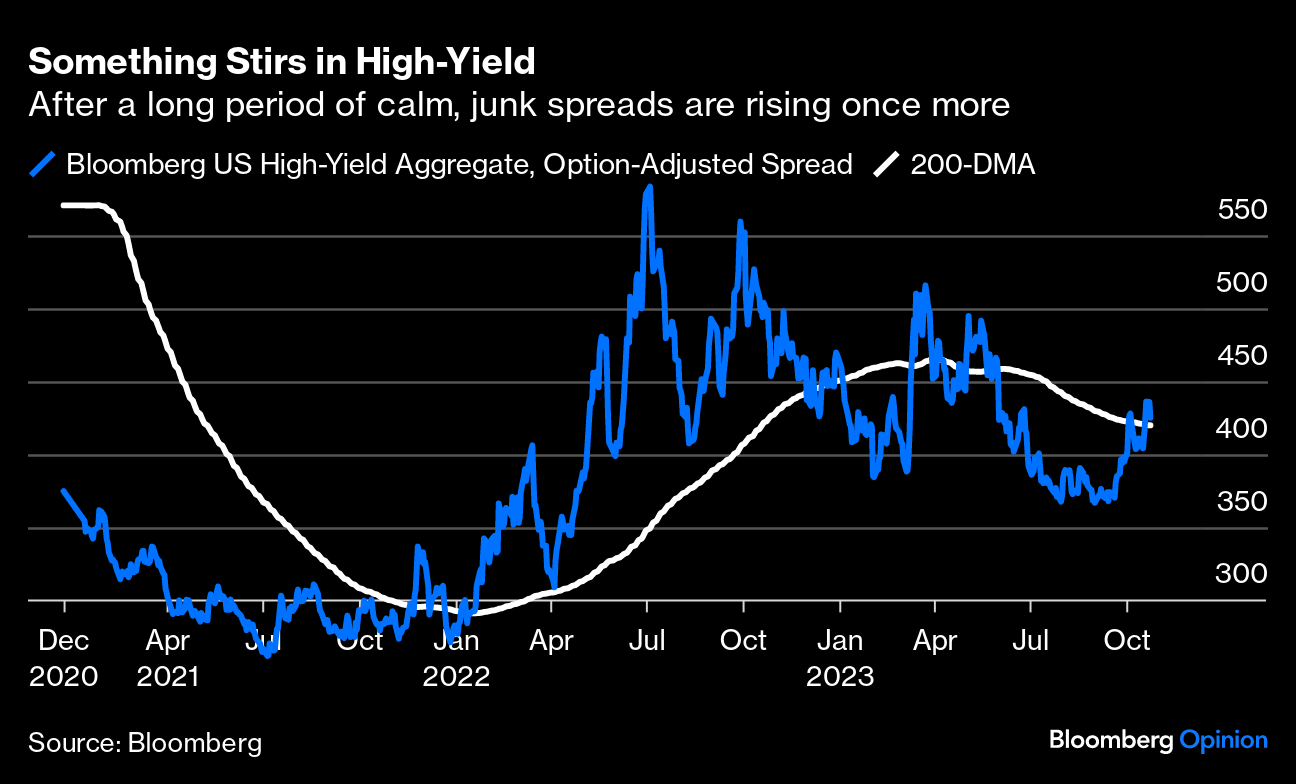

Small companies also face issues dealing with their bank managers, as well as with Mr. Market. The Federal Reserve’s survey of senior lending officers, which has been conducted quarterly since 1990, suggests that the proportion of banks tightening rather than loosening standards for commercial loans has now hit almost 50%. It’s only been exceeded during the worst moments of the pandemic, and the Global Financial Crisis:

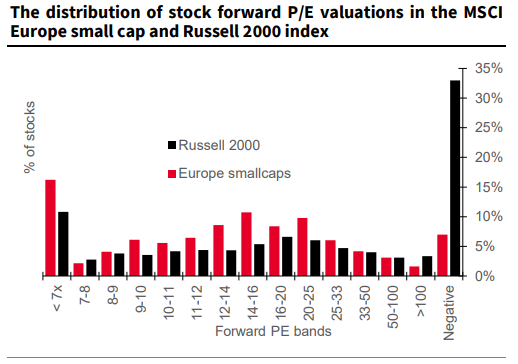

A lot of smaller companies have another very serious problem when it comes to paying their debts: They don’t have any profits. This chart from Lapthorne shows that the proportion of “zombie” loss-making smaller companies is far higher in the US than Europe. This hasn’t mattered while rates have been low. Once higher rates are payable, it will — and might even contribute to a tip in the balance from the US to Europe:

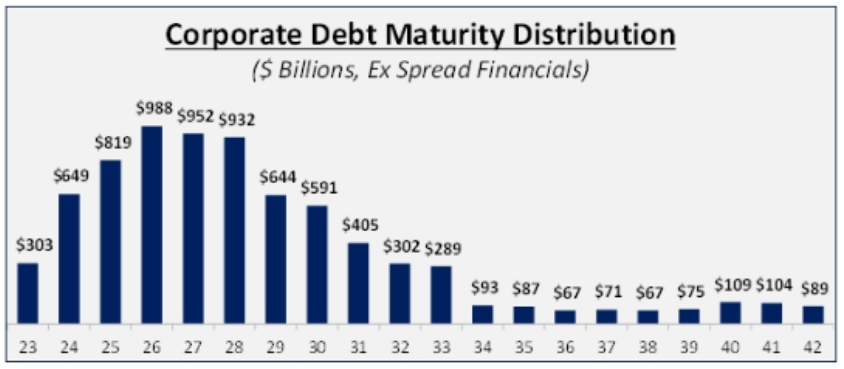

Meanwhile, even the bigger companies of the S&P 500 are beginning to feel some pressure. Treasurers did a good job of locking in low rates when they were available in 2021, but they generally weren’t able to finance themselves for that long. Amounts due to be repaid increase noticeably next year, and then jump to levels that could be really problematic in 2025 and 2026, as illustrated in this chart of the S&P 500 (excluding financials) from Chris Senyek, chief investment strategist of Wolfe Research:

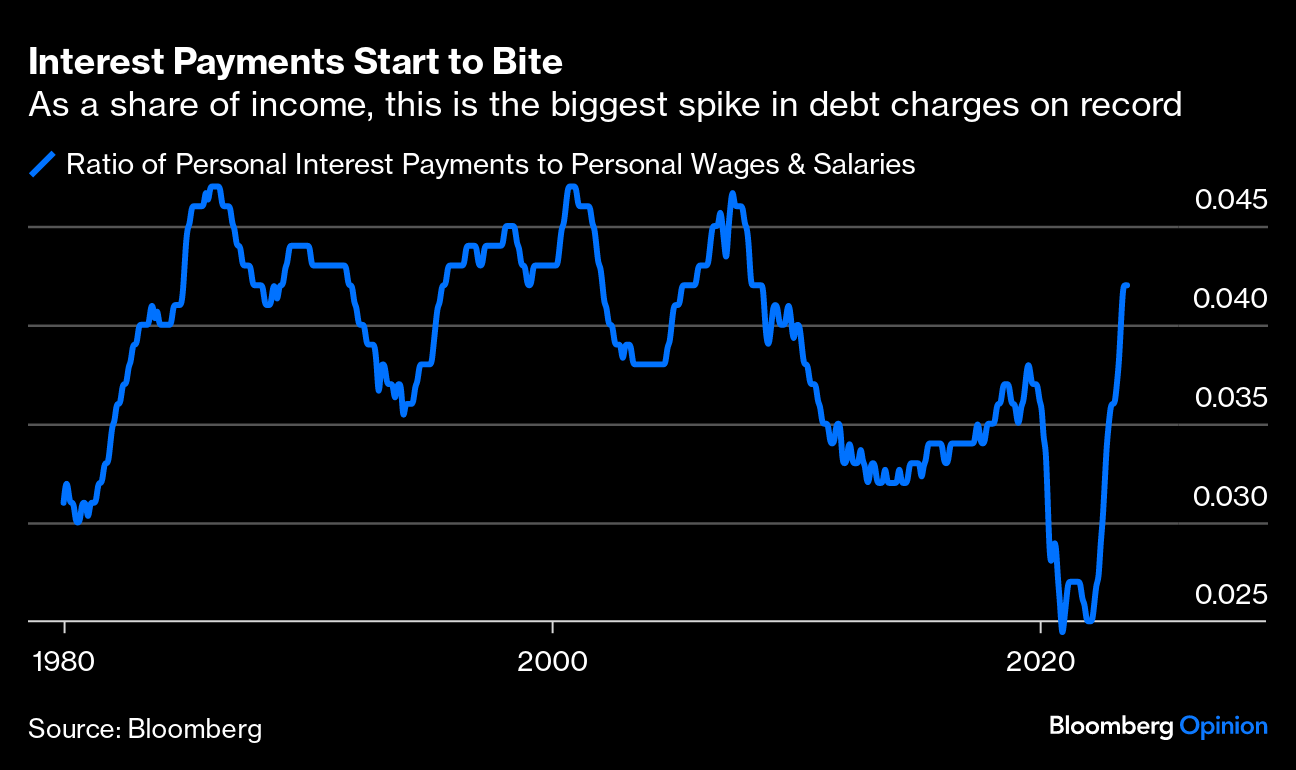

For a final sign of trouble in the offing, look to the consumer. Mahmood Noorani, the CEO of Quant Insight of London, shows that total interest payments by US consumers have surged of late as a share of wages and salaries. Again, this could easily contribute to a credit crunch:

Monetary policy generally works with an 18-month lag, Noorani points out — and it’s now been that long since the Fed started to hike. If credit is at last turning, it’s doing so on cue.