Uddrag fra Zerohedge:

Complete disaster.

That’s the only way one can describe today’s 30Y auction, which many expected could be challenging after a mediocre 3Y and a subpar 10Y auction earlier this year, but nobody expected… this.

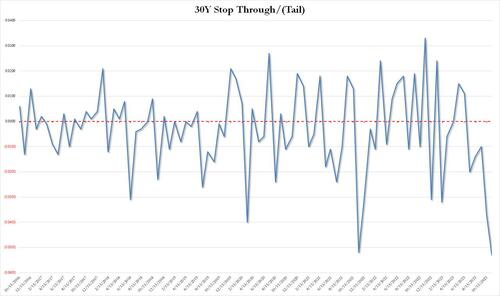

The bond priced at a high yield of 4.769%, which was below last month’s 4.837%, and just shy of the April 2010 high. But more importantly, it tailed the When Issued by a whopping 5.3bps, which was… well… terrible, because as shown in the chart below, this was the biggest tail on record (going back to 2016).

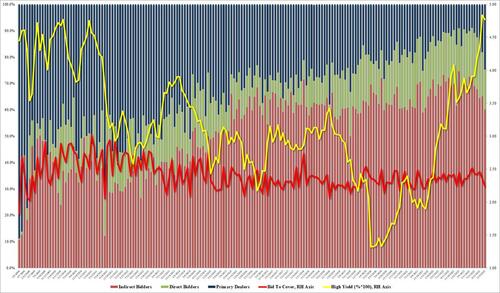

The bid to cover was just as bad: at 2.236 it was the lowest since Dec 2021.

The internals were even worse as foreign bidders (Indirects) tumbled from 65.1% to 60.1%, the lowest since Nov 2021, and with Directs taking down only 15.2%, banks (Dealers) were forced to step up and take the balance, or a whopping 24.7%, double the recent average of 12.7%, and the highest since Nov 2021.

This is a big warning flag because every time we have seen a surge in Dealer takedowns, some sort of Fed intervention – QE or otherwise – has usually followed and we doubt this time will be different.

So what happened? Well, maybe the bond market read our note from earlier this week in which we explained “How Treasury Averted A Bond Market “Earthquake” In The Last Second: What Everyone Missed In The TBAC’s Remarkable Refunding Presentation.” It may be difficult to fool the bond market for a second time.

The market reaction to the catastrophic 30Y auction was immediately, sparking a swift and painful response across markets with bonds and stocks hammered lower and the dollar spiking.

A double-whammy of a 30Y TSY auction bloodbath and Powell’s considerably more hawkish-than-expected tone prompted bonds and stocks to be clubbed like a baby seal as the dollar soared…

Did Powell finally notice that his words at the FOMC about how the market is tightening financial conditions for them prompted a dramatic easing of financial conditions…

Source: Bloomberg

Powell broke the multi-decade win-streak in S&P and Nasdaq…

Weakness in stocks hit at the cash open – after creeping higher overnight – the auction’s spike in yields sent stocks lower and then just as dip-buyers stepped in, Powell punched them in the face, taking stocks to the day’s lows…

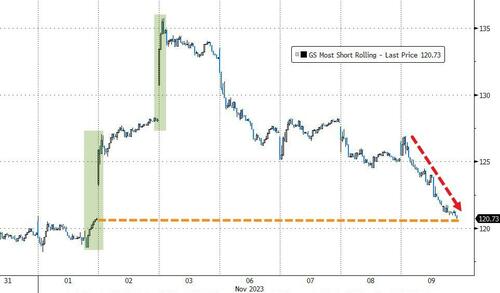

“Most Shorted” stocks were monkey-hammered lower, erasing the entire post-FOMC/Payrolls squeeze…

Source: Bloomberg

Regional Banks continue to give back the post-Bill-Gross “knife-catch” rally…

Treasury yields were higher across the whole curve with the long-end underperforming…