Uddrag fra Zerohedge:

The big question is, what can we do about this extreme outlier risk as NVDA has now become a ‘macro’ factor.

Following a monster 2023 (+346%) and a huge rally YTD (+40%) NVDA is now the 3rd highest market cap name in the US.

Given its prominent rise, NVDA has become a large driver and contributor of market returns, so as Goldman trader Guillaume Soria explains in a note this morning, a sell-off in the name would not only hurt portfolios that hold the name, but would also ripple through the market across the momentum factor and consensus trades.

Macro Implications for Momentum:

Over the last 5 years, on the 6 instances where Mega Cap Tech had a 5-day drawdown greater than 10% (median ~12%), the SPX followed suit and was down ~9%. The underperformance of the index was driven by the weight of Mega Cap in the index (currently standing at 27%) and the beta to the market. While momentum has typically been resilient to Mega Cap Tech sell off, this event is different because:

- NVDA’s 2.6 loading to the momentum factor and the convergence of long momentum and AI Beneficiaries, which were some of the top winners in 2023, could lead to a subsequent move across the space.

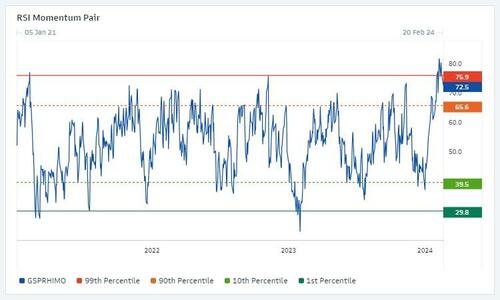

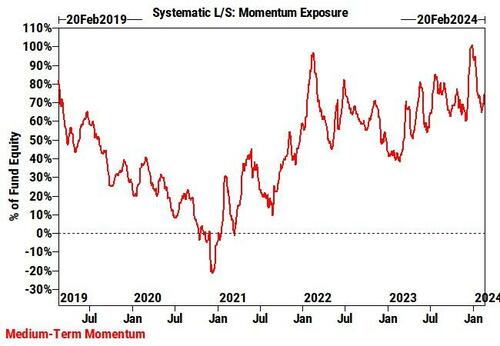

- Momentum Positioning & technical indicators are stretched with gross leverage at 99th percentile on a 5yr lookback, systematic Momentum exposure at 90th percentile, and US Momentum RSI breaching 80 last week and remaining in overbought territory.

Momentum remains overbought…

Source: Goldman Sachs

Systematic Exposure to Momentum is very elevated…

90th percentile

Source: Goldman Sachs

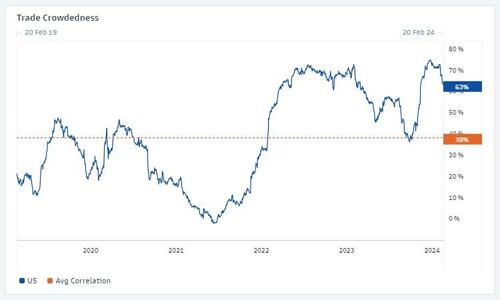

Crowding Risk is high…

Correlation between Megacap, Hedge Fund Crowding, Momentum and Size trades is almost 2x the historical average correlation…

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her