Uddrag Goldman Sachs/Zerohedge

Under the cover of hawkish comments from Fed Governor Wallace, Hatzius and his team have surmised that the first rate cut is unlikely to come as early as our previous forecast of the May meeting.

We have dropped the May cut from our forecast but continue to expect cuts in June, July, September, and December, for a total of 4 in 2024 (vs. 5 previously).

We have added an additional cut to the end of our forecast and now expect 4 more quarterly cuts in 2025 (vs. 3 previously).

This implies no change to our 3.25-3.5% forecast of the terminal rate.

So what they take with this hawkish hand (shifting from May to June for the first cut, and lowering overall cuts in 2024), they give with this dovish hand (raising expectations for more rate cuts in 2025), to keep the future dream alive with low terminal rate talking points.

The market was already there (in fact more hawkish with just a 58% chance of a cut in June now priced in)…

Source: Bloomberg

As Hatzius explained last night, in a speech this evening, Governor Waller said that he is “going to need to see at least another couple more months of inflation data before I can judge whether January was a speed bump or a pothole” and that “delaying rate cuts by a few months” is unlikely to hurt the economy.

Because there are only two rounds of inflation data and a little over two months until the May FOMC meeting, his comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely.

Comments from other Fed officials this week and the minutes to the FOMC’s January meeting have also suggested that the first cut is likely to be delayed until June.

President Harker argued that the “greatest economic risk” to the achievement of the FOMC’s goals “comes from acting to lower the rate too early,” and Governor Bowman emphasized that the time for rate cuts was “certainly not now.”

President Kashkari noted that he wanted to “get a little bit further away before we start lowering rates,” and President Bostic said that he expected that the FOMC would “start returning our policy stance to a more neutral stance in the summer time.”

The minutes to the January FOMC meeting noted that “most” FOMC participants saw risks to the achievement of the Fed’s goals as tilted toward premature easing, while only “a couple” of participants emphasized the risk of overtightening.

The preference to wait somewhat longer appears to reflect two changes in Fed thinking.

First, as strong activity data have piled up, Fed officials have become less concerned about the risk of keeping the funds rate too high for too long, which they had previously emphasized, and appear to have shifted toward our view that the largest risks from past rate hikes are behind us and cuts are therefore not urgently needed.

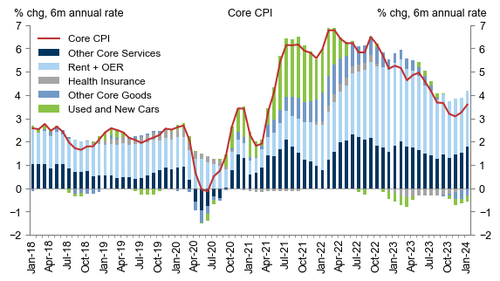

Second, in contrast to the earlier emphasis on the six-month annualized rate of core PCE inflation and Chair Powell’s indication that cuts should come “well before” inflation reaches 2%, Fed officials now appear to be taking a more cautious approach of wanting more definitive evidence that inflation will approach 2% before cutting, in part because some worry that the stronger performance of the economy could inhibit further progress in reducing inflation.

Of course, Hatzius remains firmly in the camp that rate-cuts will not be necessary due to any slowdown or recession, no, no!

They will merely be a technicality to manage ‘real rates’ as disinflation continues down its merry path to 2% and ‘restrictive’ policy needs to be adjusted/normalized.

Hatzius et al. were note alone in their thoughts on recent FedSpeak (most notably Waller’s), though the traders were more vociferous and decisive.

Goldman’s Josh Schiffrin (Head of Macro Trading Strategy) correctly pre-empted the comments last night, stating that “I think Waller’s speech is probably the event of the week for US markets.

“Given the strength of the data and recent hot inflation readings each word will be carefully parsed to see if he has modified his view on the potential for easing policy which he first articulated in late November. I think given it’s only one hot inflation print, and inflation coming down was the basis for him to contemplate easing, I think he will indicate something to the effect that: The print was unwelcome, he still believes we are on a general downtrend on inflation but that he is watching future data very closely.

I expect data dependency to be a key theme as regards the outlook for monetary policy. It will also be interesting to see whether he connects recent and ongoing strength in the economy to a potentially higher neutral rate of interest.”

He appears to have been correct, as Goldman’s Mike Cahill (Senior FX Strategist) pointed out that Waller is notable because he relies much more on realized inflation, rather than activity, to determine the path for appropriate policy. He is left with 3 key questions:

1) to what extent did the stronger January print give him pause. You could argue that it’s a one-off, or that annual price resets are still “real” and need to be taken into account. I think Waller will use this opportunity to reaffirm that March is off the table, but cuts beyond that are a live possibility given the progress;

2) to what extent has the stronger activity data changed his view. If you go back now and read his seminal November speech, it doesn’t read as dovishly knowing that the economy grew around 3% for the quarter. You could read his willingness at the time to herald a couple weak surveys as a sign that he is looking for a reason to cut. But, the continued resilience of the US economy has more than a few on the FOMC reconsidering how restrictive they are. If Waller joins that chorus, it will be a key marker because he should be among the more dovish on the FOMC given his focus on realized inflation;

3) does he stick to his “earlier and more gradual” prescription for cuts? If so, then I think we need to continue to price closer to the December dots as a baseline for the Fed this year.

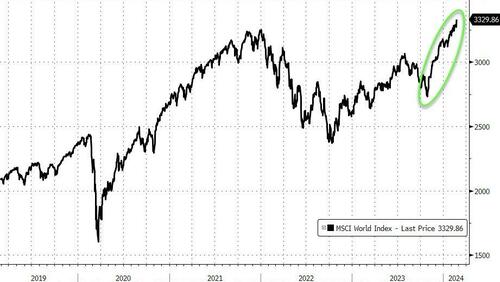

Finally, to be blunt, we wonder is this all just a charade to keep the game going til November. As a reminder, for now, rate-cuts don’t seem to matter (but then again nothing else matters but NVDA)…

At this point, just how realistic is any cut at all, when all global markets are at all time high (US, Europe, Japan except China)…

…inflation has reversed higher…

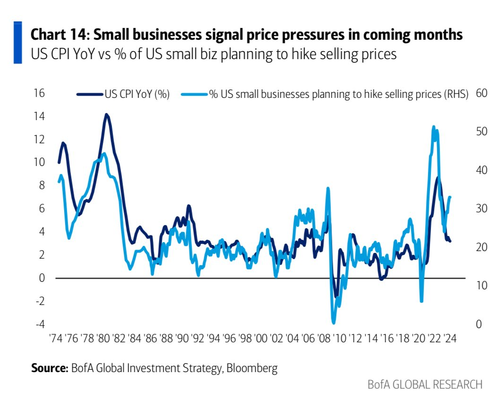

…AND small business are starting to hike prices again…

What is the over/under on when Hatzius is forced to retrace further to 3 cuts in 2024 (oh, but 5 cuts in 2025?) – before or after a renaissance in banking stability issues in mid-March?

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her