Uddrag fra Goldman/Zerohedge:

Exactly one week after Goldman’s top TMT/tech sector specialist,Peter Callahan, warned that he was getting a surge of inbounds with the common theme that “this is getting crazy…right?”. the crazy has spilled over in the form of some selling of the top momentum names, and even though Calahan’s trading desk collagues noted that the “And Many Of Our Clients Have Prepared For A Momentum Crash”, Callahan admit that after last week’s “wobble”, he himself is also turning tactically “nervous.”

He explains why in his Sunday note, which we have excerpted here:

Wobble

Bit of a wobble last week (Tues + Fri were two of the larger days of NDX underperformance in the last 6+ months) – couple thoughts on the backdrop from here below as we try to frame the current backdrop & Friday’s reversal lower. Count me as tactically ‘nervous’ ( but, structurally, still (very) Bullish).

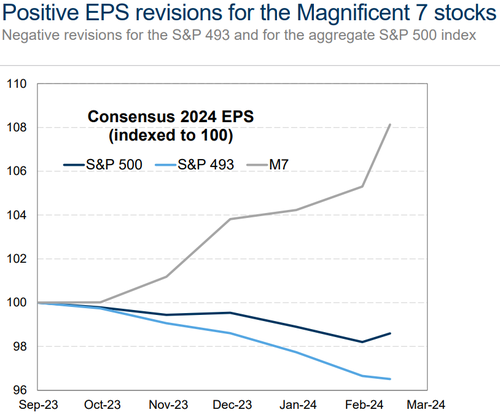

1) Earnings: truth of the matter is, as of late, Tech earnings have largely landed somewhere between solid (AVGO & CRWD both beat, but GIR’s forward ests barely budged on either) and disappointing (MRVL, GTLB, CIEN, SNOW & MDB all guided below expectations), which has likely contributed to the choppier price action as of late (.. and the leak lower in Software, which is really starting to stand out against the backdrop of lower Rates). One thing to call out on earnings – a trend we’ve been writing about the last few months, is the transition from layoffs -> hiring , which we are starting to see with an uptick in “hiring” trends across the Software industry – MDB, GTLB & CRWD all called this out last week.

To be clear, if we zoom out, Tech earnings = very strong with Info Tech & Comm Srvcs sectors modeled to grow ‘mid-teens’ y/y in CY24 vs. SPX ~HSDs y/y, just a rougher patch the last two weeks.

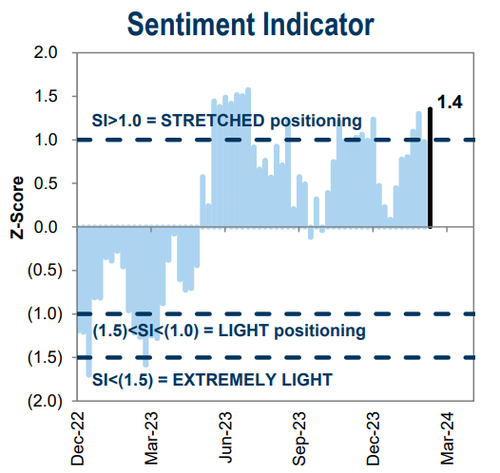

2) Techincals: we have noted a fair bit of complacency in the Tech / A.I. tape lately (think relatively few questions on up 2-3% daily moves vs. a bevy of questions during the reversal on Friday, which saw NVDA reverse ~10% lower intra-day) .. which speaks to the pockets of excitement that are evident across various sentiment measuring sticks (think: GIR sentiment indicator in ‘stretched’ zone – below, AAII bull bear spread at YTD highs, CNN index in greed territory, cryptos at all-time highs, et al). With the SOX entering Friday with a 14-day RSI of 74, it is perhaps not overly surprising to see some reversion [e.g. more sellers on ‘down’ moves than on ‘up’ moves].

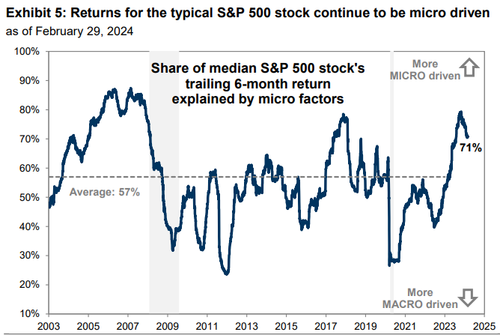

3) Micro -> Macro: one dynamic that we’ve been focused on is the expiration of micro catalysts (earnings & conference seasons wrapping up) and a transition to macro catalysts (CPI & PPI this week, FOMC the week after, before earnings start back up in mid-April). One reason I take note of the micro news vacuum (save ORCL / ADBE earnings + NVDA / AVGO events the next few weeks) is because over the past 6 months, the share of returns driven by micro factors has remains high at 71% (chart below), a contrast to the backdrop in 2022, in which returns were primarily macro-driven amid aggressive Fed hiking and recession fears.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her