Uddrag fra finanshuse:

as Goldman trader Lindsay Matcham summarizes the prevailing sentiment, “anything inline or under and its off to the races for a next leg higher in equities, bonds, gold, bitcoin etc ie a continuation of the everything rally. A hot number and it’s risk off given it would be a third hot print in a row and positioning is stretched.”

That’s really the TL/DR of what to expect from the market tomorrow… with one major provision: a red-hot CPI print and the Fed will likely be unable to twist narrative expectations for a June cut in time absent something big breaking (as even Kashkari asked, why would the “data dependent Fed” be cutting if inflation is again ascendant), which in turn means that the Fed would unlikely cut in 2024 as any rate cut during the July 31 meeting (really August) would be seen as too close to the November elections and would prompt howls of outrage from Trump, republicans and a majority of the population. Furthermore, should rate cuts be taken off the table, expect a collapse in risk assets, as the market realizes that unless it itself crashes, the Fed will not move.

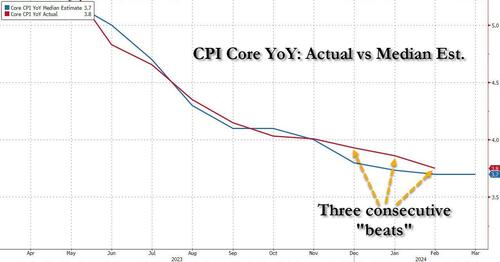

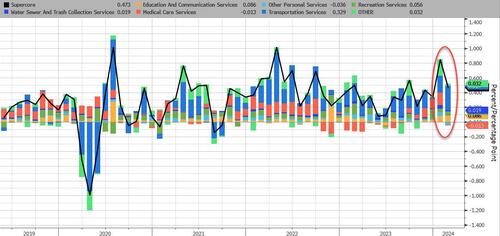

Which is why we are rather confident that after three consecutive months of core CPI coming in hotter than expectations…

… tomorrow’s number will “miss”, printing at, or cooler than, the 3.7% YoY core CPI estimate. Not because inflation is actually easing, not by a long shot as anyone who shops for, well, anything can tell you, but rather because the manipulative (and criminally leaking) Biden BLS has its marching orders as per the logic laid out above, and to avoid a market bloodbath in the months ahead of the election, now is when the BLS creative fiction team needs to start, well, coming up with creative fiction; in fact if we were betting people, we would say that the scoreboard would look something like this:

Massive pile up of TSY shorts ahead of CPI. What will cause a huge squeeze? The following:

CPI 0.3% M/M, Exp. 0.3%

CPI Core 0.2% M/M, Exp. 0.3%CPI 3.3% Y/Y, Exp. 3.4%

CPI Core 3.6% Y/Y, Exp. 3.7%— zerohedge (@zerohedge) April 9, 2024

There are two other reasons why we expect inflation to slow down.

The first has to do with a reversal of the “January spike“: recall that a big part of the data leak scandal currently rocking the Biden BLS had to do with the “explanation” (and justification) for the red-hot January inflation number. Long story, short, the BLS made it so that home inflation was front-loaded in 2024 (in this particular case, the weights for single-family detached homes was raised well above expectations) and with every passing month they will adjust the glideslope of shelter inflation to come in below estimates, thereby allowing the overall number to also come in more dovish than expected.

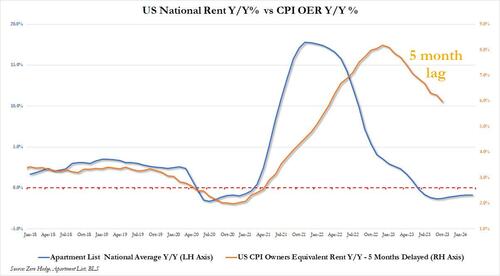

The second reason for a reversal in the hot inflation prints also has to do with housing, and specifically the catch down of Owner-Equivalent Rent to where actual rents can currently be found. This is the place where the BLS by far has the most freedom to fudge the numbers since OER rents are lagging actual market rents anywhere between 12 and 18 months. As such, the Biden statisticians can come up with any number they want and still seem credible (ignoring the fact that by the time the Fed actually does start cutting rates, actual rents will once again be rising dramatically, but we’ll cross that bridge when we come to it).

Putting it all together, we believe that when thinking of tomorrow’s headline and core CPI prints, one should ignore all logic and reasoning, all recent observations of soaring commodity prices, and merely think like a Democrat apparatchik who has gotten the “tap on the shoulder” with instructions how to make Biden as good as possible.

With that in mind, here is what the market expects tomorrow:

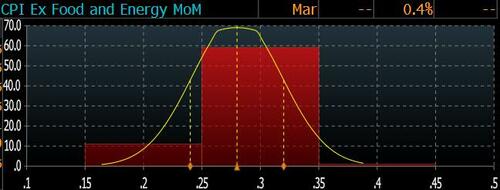

- Headline CPI is expected to rise again in March, up 0.3% MoM vs the 0.4% increase in February (which as a reminder came in as expected), while core CPI also seen rising 0.3% M/M, easing off the 0.4% February increase (which came a fraction hotter than the 0.3% est).

- It’s worth noting that there is a downward skew to the data, with just one estimate of core CPI rising at 0.4% MoM (from Regions Bank), while there are at least ten estimates of a 0.2% print. Needless to say, a 0.2% core CPI print and we are off to the races and a June rate cut.

- These monthly increases should translate into a 3.4% increase in headline CPI – up from 3.2% in February and above the recent low of 3.0% hit last June

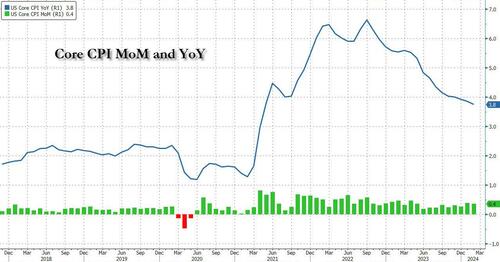

- Core CPI is expected to dip from 3.8% to 3.7%, which would make it the lowest since April 2021. Of course, in January we were also supposed to see a 3.7% print and instead we got 3.9%, but that frontloading is precisely why we expect a miss this time around.

- While in late 2023 the prevailing conventional wisdom was that Inflation was approaching the Fed’s 2% target far sooner than economists had expected – and in fact, in November, the Fed’s preferred inflation measure, the core PCE, slipped below the 2% target, sliding to 1.9% on a six-month annualized basis due to continued weakness in goods prices offset by services – it has since stalled notably proving once again that the “last mile” in the inflation fight, that from 3% to 2% will prove far more challenging than many had recently expected; in fact it’s why we are dead certain the Fed will – sooner or later – raise its inflation target to 3%. That said, the January spike in Supercore inflation which led some to wonder if the current cycle of easing inflation is over and a new cycle of rising prices has started, was mitigated somewhat by the steep drop in February Supercore. Expect more easing tomorrow in this closely-watched metric.

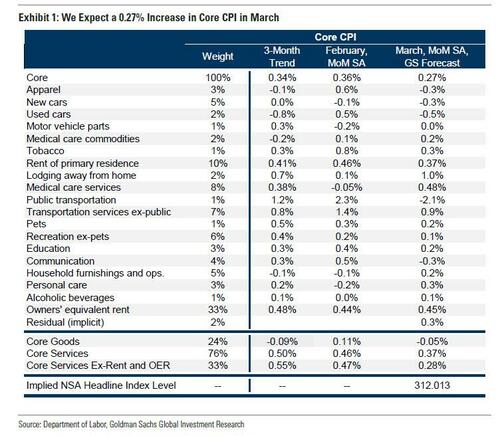

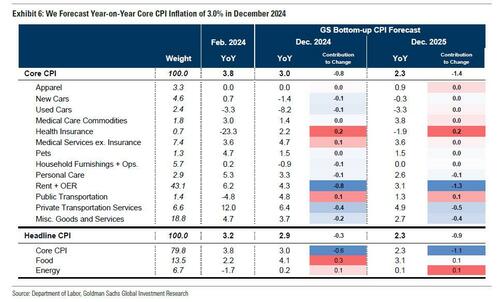

Turning to the specifics of the report, in its CPI preview note (available to pro subscribers in the usual place) Goldman’s economists are – like us – “skewed dovish”, and expect a 0.27% increase in March core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.70% (vs. 3.7% consensus). The bank also expects a 0.29% increase in March headline CPI (vs. 0.3% consensus), which corresponds to a year-over-year rate of 3.37% (vs. 3.4% consensus). In other words, all just a tad below median consensus. The forecast is also consistent with a 0.28% increase in core services excluding rent and owners’ equivalent rent in March.

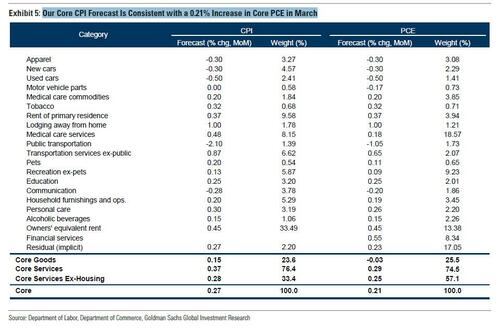

The bank’s forecast is consistent with a 0.21% increase in Core PCE in March.

Goldman highlights three key component-level trends for the March report, all of which corroborate a weaker than expected print:

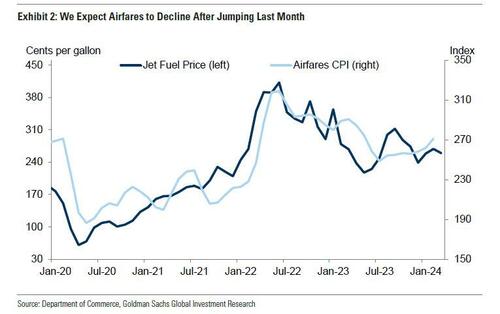

- Airfares. The bank expects airfares to pull back by 3.0%, reversing last month’s 3.6% jump. Jet fuel prices ticked down this month, and the bank has also observed a decline in our airline team’s real-time measure of airfares.

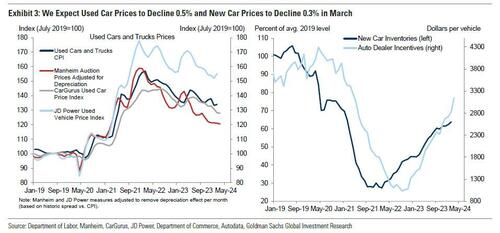

- Car prices. Goldman expects both used (-0.5%) and new (-0.3%) car prices to decline in March, reflecting lower used car auction prices and rising promotional dealer incentives. Looking ahead, expect used and new car prices to decline further, dropping by 8.2% and 1.4% respectively this year, reflecting normalizing auto production, higher inventories, and higher new vehicle incentives.

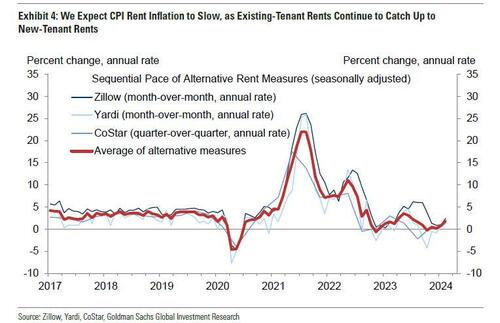

- Shelter. Goldman – also like us – expects shelter inflation to slow significantly from last month’s pace, reflecting a stepdown in rent growth to 0.37%, as the gap between rents for new and existing tenants continues to narrow. Expect owners’ equivalent rent (OER) to increase 0.45%, and going forward, the bank believes that somewhat stronger rent growth for single-family homes—which receive a much larger weight in OER—will likely lead OER to outpace rent in the CPI by around 4bps per month this year. As such, Goldman expects shelter inflation to be running at a monthly pace of around 0.30% by 2024 H2

Elsewhere in the report, Goldman expects apparel and communication prices to both decline 0.3%. The bank also assumes a 1.4% increase in car insurance, reflecting strength in online insurance price data, and a 1.0% increase in hotel lodging, reflecting positive residual seasonality.

Going forward, the bank expects monthly core CPI inflation to slow to 0.20-0.25%, and sees further disinflation in the pipeline in 2024 from rebalancing in the auto, housing rental, and labor markets, though it expects offsets from a delayed acceleration in healthcare and single-family rent growth continuing to outpace multifamily rent growth. In December 2024, the bank forecasts year-over-year core CPI inflation of 3.0% and core PCE inflation of just 2.4%.

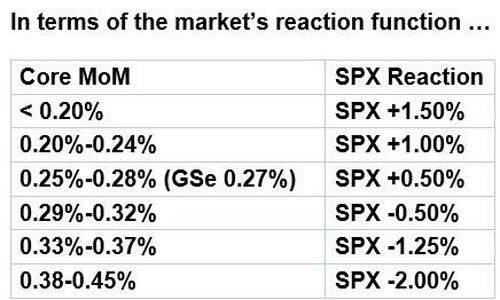

In terms of the market’s reaction function, Goldman trader Lee Coppersmith is out with a note (also available to pro subs) in which he makes the following market reaction prediction:

The straddle-implied move for tomorrow is 0.98%, up notably from last month’s expectation of a 0.95% move and notably higher from the January’s 0.70% move on CPI day; this is also the highest since November, but generally on the low side over the past two years.

A quick look at JPMorgan finds the largest US bank also in line with Street estimates: the bank’s chief economist Michael Feroli sees headline MoM CPI printing +0.3%, in line with the Street, and sees Core MoM printing +0.28%, also in line the Street’s +0.3% estimate. Similarly, on a YoY basis, Feroli sees headline inflation of 3.4% (vs. 3.2% in previous print) and he sees core inflation of 3.7% (vs. 3.8% in the previous print), both aligned with the Street.

JPM’s market intel desk is likewise ready with its own analysis (link here for pro subs), and also looks at core CPI as the key variable:

- Above 0.40%. The first tail-risk scenario, which would likely be driven by a combination of hotter shelter pricing with vehicle prices surprising to the upside. Separately, stronger energy prices could push headline CPI to nearly 4%, a psychological level that could trigger a hawkish pivot in Fed rhetoric; after the CPI print there are 6x Fed speakers the balance of the week and Fed Minutes. The ultimate outcome may be a removal of all 2024 rate cut expectations with increased implied probability of rate hikes. Look for a surge to both bond yields and to bond vol. The Equity impact would be negative, and we could see the SPX’s first -2%+ day since Feb 2023. Longer-term, this could be the catalyst for not just the 5% pullback that investors have waited for but also an official correction should earnings season disappoint and increase the sell off. Probability 10%, SPX loses 1.75% – 2.5%.

- Between 0.30% – 0.40%, inclusive. In this scenario, the print can trigger a wide range of outcomes, with a 0.3% print being digested well by the market to a 0.4% print sparking fears of another inflation surge while repricing bond yields higher as cut expectations dissipate. When thinking through this scenario I was reminded of a quote by S&P Global’s Chief Economist from the Flash PMI print on Mar 21, “Costs have increased on the back of further wage growth and rising fuel prices, pushing overall selling price inflation for goods and services up to its highest for nearly a year. The steep jump in prices from the recent low seen in January hints at unwelcome upward pressure on consumer prices in the coming months.” The biggest questions are when does this hit official prints and is the impact felt in one print or multiple? While the recent ISM-Srvcs print will assuage some of these fears is companies continue to enjoy pricing power, then short-term turmoil could lead to margin expansion, or at least stability. Probability 35%, SPX adds 25bps to loses 1%.

- Between 0.20% – 0.30%, inclusive. An in line print (0.28% – 0.3%) should bring relief to investors and likely pulls money back into the market as this removes the last major hurdle into what is likely to be a strong earnings period. As Positioning Intel mentioned, there is ample room for HFs to ramp up leverage and boost stocks ahead of buybacks returning to full strength. That said, details of the CPI print matter and anything toward the lower end of the range likely means that we are seeing a shelter disinflation accelerating to the downside which would impact forecasts for inflation for the balance of the year while also reinforcing the Fed’s dovish pivot. While the commodity price spike certainly gives pause for its ability to filter to core prices, shelter remains one of the more stubborn aspects of core prices, and the heaviest weight. Probability 37.5%; SPX adds 50bps – 1%.

- Between 0.10% – 0.20%, inclusive. Sticking with the shelter disinflation theme, this outcome likely would also include multiple downside surprises across items such as transportation, apparel, and Core Services more generally. Look for a strong move lower in bond yields, likely as part of a bull steepening. This would be supportive of Equities, specifically Cyclicals/Value, as part of an ‘Everything Rally’. While I do not think this is enough to renew calls for a May cut, this would likely pull forward expectations for a June cut, which have fallen from ~70% to ~50% over the last two weeks. Probability 15%; SPX adds 1.25% – 1.75%

- Below 0.10%. The other tail-risk scenario, where bond yields would see significant decline with the 10Y yield falling 20bps, or more, as investors potentially carry that momentum to push the 10Y yield below 4% in the succeeding days. A downward surprise of this magnitude should fully green light a June cut. Probability 2.5%; SPX adds 1.5% – 2%.

Focusing some more on how the market may interpret the numbers, here are three observations from Goldman traders

Brandon Brown (Short Macro Trading)

In the March SEP, the Committee showed a median estimate for year-end core PCE at 2.6% alongside a median estimate of three 25 bp rate cuts in 2024. We expect Powell was aligned with the median expectation of 3 cuts, and therefore think the bar for the Fed to begin cutting rates at the June meetings is very low. Core PCE printed 2.8% YoY in the most recent data set, so there is not much more progress needed to meet the Fed’s year end expectation. The market expects a CPI print around 0.28 on MoM core for tomorrow, which likely translates to around a 0.2% core PCE print at the end of the month. This will be good enough for the Fed, especially after coming off strong prints due to seasonals early in the year. An in line print would help June price closer to 75% for a 25 bp cut (currently prices just over 50%). We expect front end Fed pricing to do very little on a print in the low 0.3s, and a print above 0.35 would notably increase risk the Fed has to pass on a June cut, resulting in a fixed income selloff. A print in the low 0.2s should allow the market to price at least a full 75 bps of cuts this year, notable more than current pricing (~66bps).

Dom Wilson (Senior Macro Advisor)

This upcoming CPI probably doesn’t have quite the same intensity as the last couple of releases, but is still a key data point particularly with the market worrying more about the impact of rising rates and rising commodity prices recently. Our own forecast (0.27% on core) isn’t far from the consensus, but should be modestly reassuring. The trading challenge is that for the first time this year, implied vol (and skew) in the SPX does not look as unusually low as it has done, having held onto some of the rerating that we saw late last week. The good news from that is that because people are probably better hedged than they have been, a better number could squeeze us back up to the highs again. But protecting the downside is not quite as easy as it has been in the prior periods. I still think it’s very possible that we could outperform the implied moves, but that seemed like a much better prospect the last couple of months because those vols just looked so much too cheap for these event risks. I think call spreads are probably the way to go for our kind of forecast, but the payoffs are likely to be a bit less juicy than they have been. There’s also a bit more of a case for looking at cross-asset expressions, which haven’t really been worthwhile given how cheap optionality in the SPX itself has been. USD call vol is still close to the lows in many places and the back end of the rate market (and 2025) feels more vulnerable here to further dialing back of Fed rate cuts. I think that kind of optionality makes more sense for a broader/longer set of risks around the Fed and US growth than just this release, but it has become more interesting given that equity volatility is not right on the lows right here.

Joe Clyne (US Index Vol Trading)

Entering tomorrow’s CPI, the SPX one day straddle is going out right around 1%. The desk thinks that the risks are tilted towards the downside given the lack of long dealer gamma positioning on spot moves lower and the market stress present on down moves over the course of the last week. On last Thursday’s selloff and today’s intraday move, we saw vols spike and quick moves lower in spot. While those dips were ultimately bought, we think the dealer gamma picture has gotten even less long to the downside over the last week. On a hot number, we think there is material asymmetry lower and like the SPY May 510 490 put spread which costs $3.25 for a 6:1 payout ref 517.43.

We conclude with the view from JPM’s market intel team, which is generally in line with the above opinions from Goldman’s trading desk:

The last week had a risk-off tone as investors seemingly moved to safety ahead of CPI but also in response to heightened geopolitical risks. Addressing the former, there remain upside inflation risks given the labor market situation and strength in commodity prices with the backdrop that the rest of the world is poised to accelerate its growth further challenging the disinflation process. While these are all valid concerns, I think disinflation trend continues from here as there are signs of labor markets thawing (think percentage of new job adds that are part-time with wage growth appears to increase at a decreasing rate). While the economic reboots of Asia and Europe can support commodity prices, I think it will take some time for this create material upward pressures on US prices. Should I be wrong on this take, and we see a hotter print, the mistake may be short-lived. Why? The bull case remains intact with at/above trend GDP growth, positive earnings growth, and a paused Fed. Add to that what appears to be increasing appetite for buybacks and this bull market continues irrespective of what happens with CPI. Thought differently, are investors going to be short going into earnings where we could see another round of AI-induced upside with a broader group of companies, e.g., Walmart mentioned taking 35mm tasks out of their stores by using AI, which also led to one of their best inventory management quarters in firm history, which improved margins. While I recognize that there are a number of technical factors pointing to the potential for a pullback, there are enough near-term catalysts to prevent even a 5% pullback including (i) Google’s Cloud conference Apr 9 – 11; (ii) earnings season kicking off Apr 12; (iii) Google’s I/O on May 14; and (iv) NVDA earnings on May 24; those last two may prevent a “Sell in May and go away” narrative from emerging. This century, the SPX has averaged a +26bps return in May with 17 of 24 years producing positive returns, ~71% hit rate. June tends to be negative, and July has been the third strongest month of the year behind Nov and Apr.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her