Uddrag fra Goldman/ Zerohedge/

Waiting for the correction

Goldman’s flow guru, Scott Rubner, has been calling the market very well over the past months. He is starting to change his bullish thoughts:

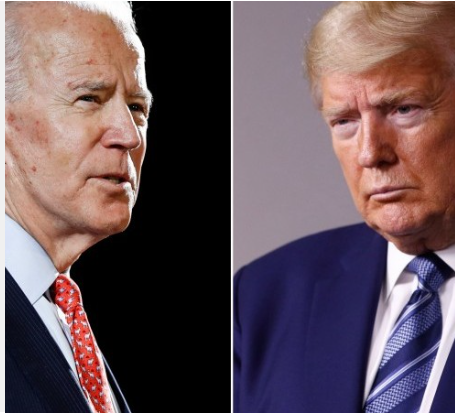

The remaining bears have capitulated, and sentiment is overwhelmingly bullish. After 34 new all-time highs, he is turning tactically bearish as the pain trade has shifted from upside to downside. Buyers are exhausted after the best trading days of the year. Fund flows typically peak by July 17th. Future trades will focus on earnings and election hedging.

They forgot the pre elections outflows

Outflows until November, and then inflows. Are we doing the inverse this time around?

Source: GS

August

August is the main outflows month…

Source: GS

Far from euphoria

JPM market intelligence team reminds us why this could grind even higher:

1. Change in positioning is only slightly positive on a 1wk basis while the 4wk remains negative (similar to where things stood 3 months ago).

2. HF Short Flows have NOT shown persistent covering: despite the rally, 20d ETF short flows are fairly neutral. Most often the 20d short flows have shifted to strong covering near market peaks.

3. ETF Flows not extreme in recent months: 20d ETF flows (across investor types, not just HFs) have dipped back towards 0 and could rebound.

4. HF Net Flows: as we noted 2 weeks ago, 4wk net flows had dipped <-1z and often they turn back to positive with the market holding up, rather than a sell-off emerging immediately. HF net leverage is around the 70th %-tile since 2017 with room for Eq. L/S nets to rebound towards YTD highs.

Mind the gap

The gap between SPX and Fed reserves is huge.

Source: Refinitiv

Low…

SPX 1 week implieds close to post Covid lows…despite CPI, Powell and earnings starting.

Source: BofA

Cheap?

Implied vols are low, but since we aren’t realizing much at all…things aren’t as cheap as they “look”.

Source: Refinitiv

Puking puts

Put call ratio continues imploding…

Source: TRadingview

Choking on theta

Dealers are running massive long gamma here, acting as a huge vol dampener. They have size deltas to sell if markets move up, and size deltas to buy in case we move lower. This is theta agony and everybody that has run big long gamma in dull summer trading knows the “Chinese water torture” feeling…usually a good time to buy vol/hedges, although “most” have already promised not to buy options again.