Uddrag fra Goldman/Zerohedge:

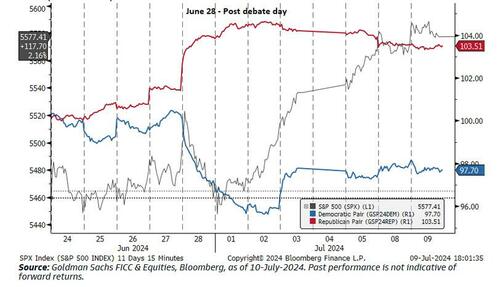

We have some bad news for Democrats: according to a new note published by Goldman’s trading desk “on June 28th, the day following the debate, the market priced in a Trump victory and a Republican sweep.”

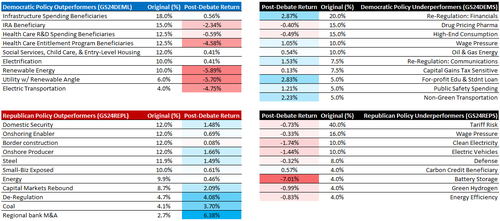

As Goldman thematic trader Louis Miller writes, the bank’s Republican Policy Outperformers vs Underperformers pair (GSP24REP) was up +4.51 std dev and the Democratic Policy Outperformers vs Underperformers pair (GSP24DEM) was down -3.78 std dev (vs YTD).

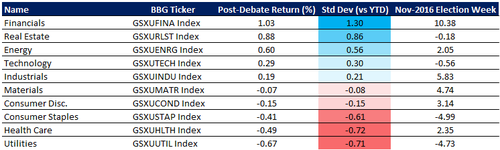

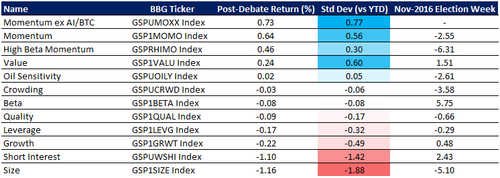

The Goldman trader highlights similarities between the market’s reaction post the debate as well as 2016’s election week: both the Size factor and the Staples/Utilities sectors underperformed on June 28th as well as during the election week in 2016, while the Value factor and Financials outperformed during the same time periods.

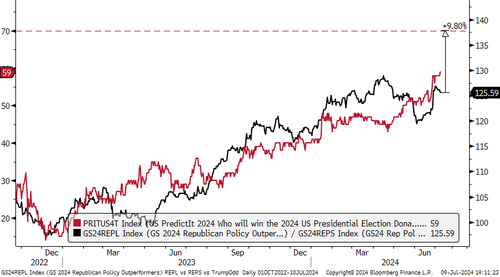

Pointing to the chart below, Miller also notes that performance of the Republican and Democratic basket pairs in the last ten days shows how reactive the market was to the first presidential debate, “and investors are positioning themselves for a Trump victory and Republican sweep.”

Below we excerpt some of the key observations from the Goldman note, starting with Miler’s take that if Trump’s PredictIt odds continue to go up and reach 70%, the Goldman desk expects ~9.8% upside in the Republican pair (GSP24REP)

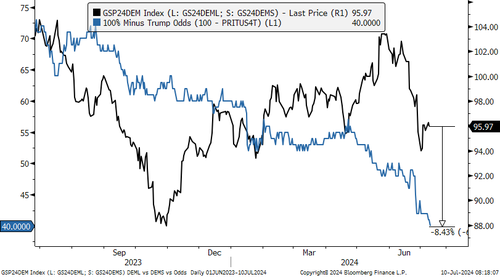

On the other hand, with uncertainty around the Democratic nominee, Goldman likes to compare the Democratic pair to Trump’s PredictIt odds of not winning the Presidential elections. This implies ~8.43% down move in the GSP24DEM pair.

Volatility of the election pairs (GSP24DEM and GSP24REP) were both lower than SPX vol prior to the debate, but that has quickly shifted.

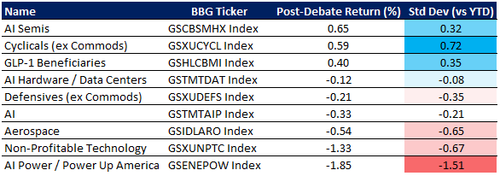

It is worth noting within the industries that may benefit or face challenges if policies are implemented, the most sensitive and reactive pockets of the markets are those exposed to traditional energy vs renewables and those exposed to de-regulation.

This observation is in line with Goldman’s diversified sector baskets on post-debate day as well as during the election weeks in 2016: Financials/Energy outperformed while Staples/Utilities underperformed

From a factor perspective, Momentum ex AI/BTC is correlated to Republican outperformers this year, but was not in 2016, whereas the Value & Size factors are in-line with 2016.

A very common question Goldman has received is whether or not its secular themes are sensitive to the elections: the response is that “they are not. None of our baskets have moved more than 1 std dev during the day following the debate except for our Power Up America. The latter has a small exposure to renewables and underperformed after the debate due to that exposure.”

Finally, here are Goldman’s favorite trade implementations:

- Republican Policy Outperformers (Long)

GS24REPL 2 month 105% call costs 1.34% (buying a 17.55v). It has a 25d at inception

- Companies at risk to Tariffs (Short)

GS24TRFS 3 month 82% 92% put spread costs 1.29% (buying a 29.3v to sell a 35.4v). It has 12d at inception and offers a potential 7.75 : 1 payout.

- Democratic Policy Outperformers (Short)

GS24DEML 3 month 81% 91% put spread costs 1.35% (buying a 30.82v to sell a 35.3v). It has 13d at inception and offers a potential 7.41 : 1 payout.

- Republican Policy Outperformers and Tariff Policy

BUY 20Dec24 .GS24REPL>105% & EURUSD<97.5% @ 8.5% (52%/21% EQ/FX indivs)

BUY 20Dec24 .GS24REPL>110% & USDCNH>101.5% @ 7.5% (34%/22% EQ/FX indivs)

- Republican Policy Outperformers and Expansionary Fiscal Impulse

BUY 20Dec24 .GS24REPL>112.5% & 10ySOFR>ATMF CMS+0.5% @ 8% (27%/25% EQ/IR indivs)

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her