Uddrag fra Goldman/ Zerohedge

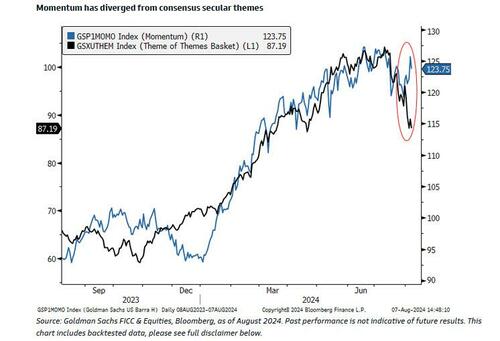

Goldman thematic trader Louis Miller said that given the drawdown and uncertainty around AI, and uncertainty on 1. geopolitics, 2. US election, 3. US economy and 4. market microstructure, the bank “can say with confidence that today is different than yesterday and/or the recent past, and the momentum factor doesn’t really show that yet.” As such, the thematic desk recommended to sell this factor in this more discerning risk backdrop, especially as the moves in momentum have been muted in comparison to the index selloff and historical drawdowns of the factor

Since then we have seen a rollercoaster of daily market swings, the biggest drop since Sept 2022 followed by the biggest jump since Nov 2022, as positioning – which heading into this week was extremely short vol – painfully tries to reset, while Wall Street strategists scrambling to add some value and estimating everything from how long until the carry trade is unwound to whether we have hit the bottom.

But while traders debate these critical issues, the sense we are getting from Goldman’s trading desk, where the bank’s own capital is at risk, is that the vampire squid has already made up its mind and is now bracing for the worst case outcome, and is contemplating what the best crash position – or rather “hedge” as it is known in polite society – is ahead of the coming meltdown.

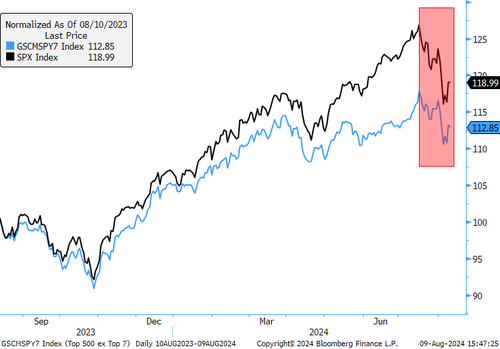

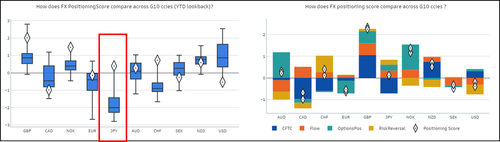

As Goldman’s Matthieu Martal writes in a note published by the bank’s trading desk late on Friday titled “Time to switch SPX hedges to GSCMSPY7” , the “JPY carry trade helped fund long US Tech and this week’s unwind heavily penalized S&P 500 as a result.” Similar risk appetite resets, according to Martal, have historically seen 9%-10% drawdowns in the next 3 months, or in other words, “hedging beta continues to makes sense… how to best hedge is the question.”

Said otherwise, there is no question what comes next. The only question is how to get hurt the least.

Discussing its downbeat outlook, the Goldman desk sees signs of

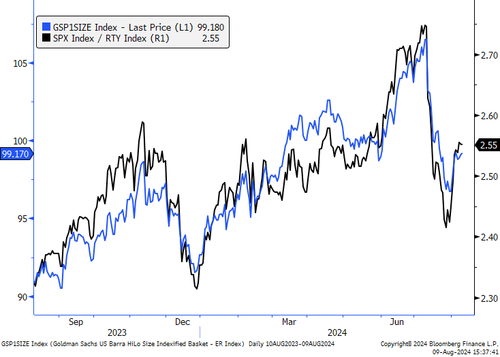

- the size factor turning (GSP1SIZE)

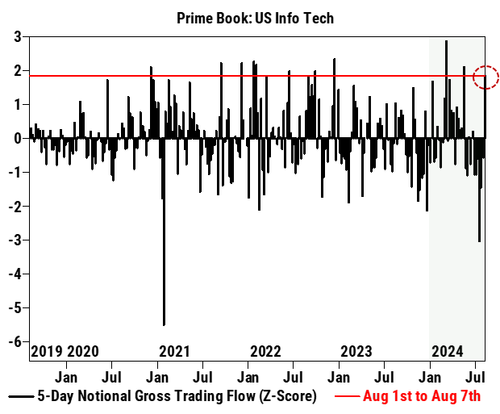

- HF lifting US tech

- JPY unwind is almost complete

- CTA dynamics shifting, and

- AI concerns increasingly well understood

… all pointing at Goldman’s “Top 500 ex top7 enhanced index” basket GSCMSPY7 being a more efficient hedge than SPX from here.

And here is the bank’s trade Idea:

- If looking for a hedge to recent longs, we like the 2 month GSCMSPY7 85 95% put spread for 1%, or a potential 10:1 payout (max loss premium paid). This offers a vol discount to SPY via this trade, and we think on the next leg down it offers more attractive convexity. Conversely, if you want to buy the dip in megacap tech, you can sell the 3 month 90% put to buy the 110 120% call spread for costless on GSTMTMEG Index (max loss unlimited).

Below we excerpt from the note, starting with a chart of the S&P vs the S&P500 ex top 7 stocks:

Next, we find that the size factor had its most sizeable 3 week move since Covid. This means that being short large cap has been blessed with exceptional returns, but the trade may have already panned out. Meanwhile, small cap outperformance feels at odds with recession concerns and locking in some of those by reducing large cap shorts thanks to GSCMSPY7 makes sense here in Goldman’s view.

As we first discussed yesterday, while US tech stocks got aggressively de-risked by the hedge fund community since mid-July, in the strongest stream of outflows since the Jan 2021 Meme stock squeeze, this dynamic looks exhausted now. Meanwhile, as JPM now calculates, the JPY carry led unwind is 60-75% done, and HFs have started to buy the dip in US info tech.

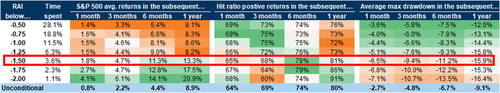

That being said, Martal ominously warns that “further equity drawdowns are to be expected” which is also the basis for the desk’s bearish view. He notes that the GS risk appetite is at -1.5, which historically gives you a strong buy signal… but also signals heightened risk of a large drawdown in the coming months. And while US equities were up on a 3m rolling basis 68% of the time, the average drawdown during these episodes was 9.4% (data since 1991).

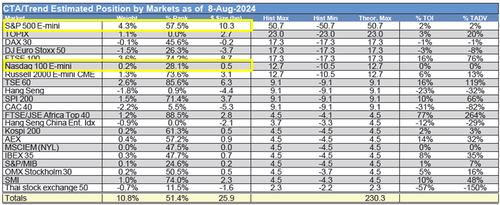

The Nasdaq already had a 14% drawdown, which triggered massive CTA supply, with $109bn of global equity sold over the last month. As extensively discussed here, systematic selling has been keeping a lid on equities, and they projected to keep offloading equities, with $45bn for sale next week on a flat tape.

From here, Nasdaq systematic length should switch net short -$2BN, not far from historical lows at -$10bn with asymmetry being more positive going forward. However, S&P systematic positioning remains in the 57th 12-month percentile, or sasid otherwise, machines will keep on selling the 493 but supply will fade for the top 7.

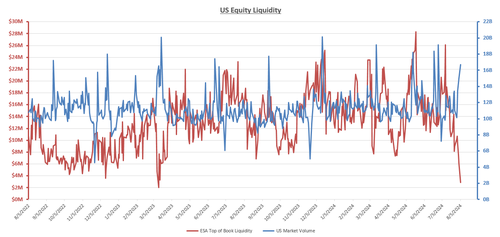

This is especially relevant in a context of dry summer liquidity and seasonality headwinds

Volatility spiked but is starting to normalize and GCSMSPY7 trades at a vol discount to SPX, offering cheaper protection.

Meanwhile, AI capex risks feel well understood here, leaving room for upside risk if earnings deliver. Hedging market beta with GSCMSPY7 makes more sense than SPX in this backdrop.

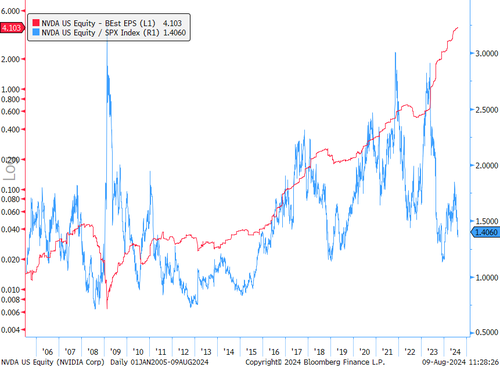

The below charts shows NVDA valuation premium to SPX,. It looks balanced vs history. NVDA 24m PE has reset back to 25x, down from 305x in July and close to 5y lows c.20x… and its weight in SPX is close to 5%, levels at which mutual funds demands kicks in.

More in the full note available to pro subs in the usual place.