Uddrag fra Authers:

Friday dawned with a sense that something was about to be decided. It wasn’t. Non-farm payrolls data for August showed employment growing, but more slowly and by a bit less than had been expected, while the separately measured unemployment rate ticked down slightly. Two questions dominating market discussions — Will there be a recession? And will the Federal Reserve cut by 50 or just 25 basis points when it meets later this month? — were left unresolved. If anything, the answers seem a little further away.

Lindsay Rosner of Goldman Sachs Asset Management captured feelings neatly:

Labor market continues to show signs of deceleration. That is real. This report doesn’t clearly state 25 or 50 bps for the first cut, which was the answer the market was hoping to get. What is clear is the Fed is cutting and upcoming Fedspeak will help shed some light on the internal debate around September.

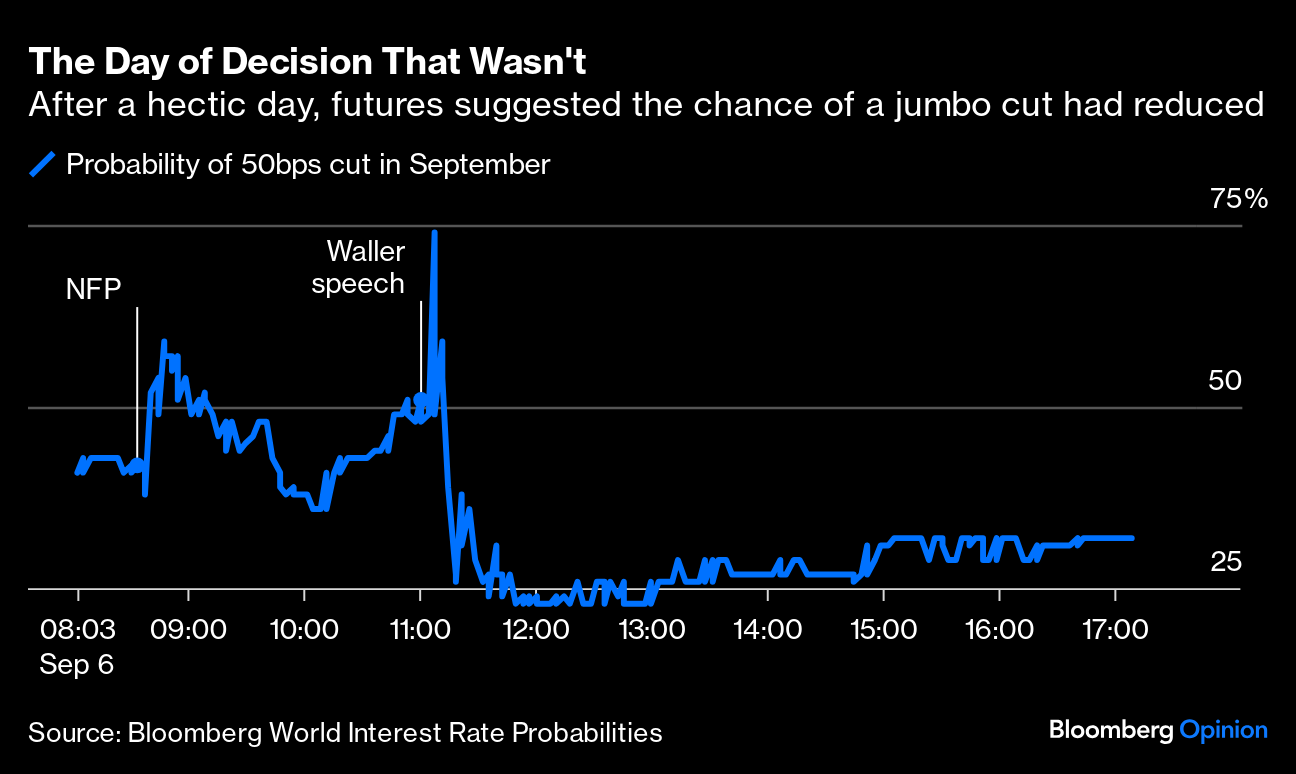

That proved prescient, as a mid-morning speech by Fed Governor Christopher Waller moved the market far more than the data. This is how the odds of a 50 basis-point cut (25 basis points already seems a total certainty) moved as Friday trading unfolded:

Waller’s speech is worth reading. He said the latest data reinforced the Fed’s view of “continued moderation in the labor market,” that “the balance of risks has shifted toward the employment side of our dual mandate,” and that monetary policy “needs to adjust accordingly.” Most strikingly, he said that the latest batch of data “no longer requires patience, it requires action.” That sounds like strong stuff from a governor generally regarded as a hawk. The immediate market reaction wasn’t surprising. But his final summing up merits closer reading:

As of today, I believe it is important to start the rate cutting process at our next meeting. If subsequent data show a significant deterioration in the labor market, the FOMC can act quickly and forcefully to adjust monetary policy. I am open-minded about the size and pace of cuts, which will be based on what the data tell us about the evolution of the economy… If the data supports cuts at consecutive meetings, then I believe it will be appropriate to cut at consecutive meetings. If the data suggests the need for larger cuts, then I will support that as well.