Uddrag fra Bank of America/ Zerohedge:

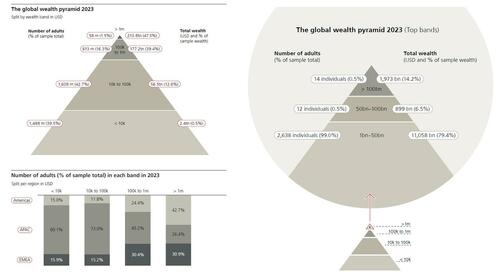

… the reality is that while the lower and middle classes are both facing their Wile E Coyote moment, the ultra rich have never had it better, as the following snapshot of the latest global wealthy pyramid from UBS shows: less than 30 people now account for $3 trillion in wealth, more than the $2.4 trillion in wealth divided by the bottom 1.5 billion adults.

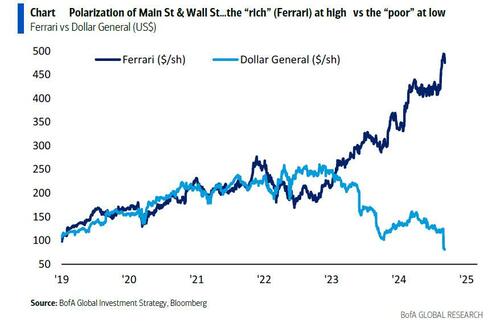

This record chasm between the rich and poor was also one of the core topics in Michael Hartnett’s latest Flow Show, with the BofA strategist naturally tying it to the recent performance market, and by extension, the Federal Reserve, that single biggest creator of inequality and social discontent in world history. As Hartnett shows in the chart below, the “rich” e.g. Ferrari at all time high vs the “poor” e.g. Dollar General at 6 year low, with the record polarization emerging several years into Biden’s regime…

… a “polarization” between Main Street & Wall Street, thanks to the $15 trillion market cap of monopolistic “Magnificent 7” vs the $18 trillion market cap of some 4846 companies in the MSCI Developed Markets small & mid cap indices. This record “polarization” is also the primary reason why social cohesion is fraying – any time you have a record number of “poors” and a record small number of rich controlling most of the wealth in history, the result is inevitably a revolution – and why “market fragility” and NVDA trading increasingly like a penny stock, is all the rage.

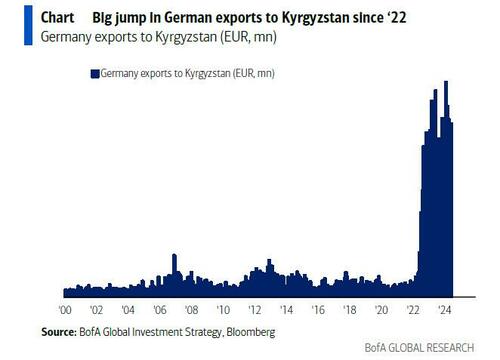

And yes, the Fed is behind this: according to Hartnett, FX markets are screaming “here comes 50bps cut”, a cut which will come with home, food and stock prices at all time highs and rising fast (see “Powell Vows To Cut Rates With Stocks, Home Prices, Rents And Food At All Time Highs“). Case in point, just a few weeks after the implosion of the Japanese currency seemed unstoppable, Yen longs are now at 3½ year highs, and Euro longs at month highs… this despite BoJ policy rate at 0.25%, political dysfunction France/Germany; German GDP unchanged since 2018 as exporters desperate – yes, they keep plowing goods into Russia, only through Kyrgyzstan this time…

… Volkswagen closing factories in Germany time since 1938. Amid this background, the only reason all want to short US$ is the certainty the Fed is about to start slashing rates… and slash them so much, it may soon start smelling of QE and NIRP, not to mention another bigger and badder burst of inflation.

While it is no secret that over the long-run the rich will get richer, the poor will get poorer, inflation will keep rising along with the price of anything not nailed down (things that are nailed down will appreciate even more quickly), confusion has emerged over what will happen in the short-to medium term, and here Hartnett has five observations which, naturally, gravitate to his bearish outlook:

- Hard-landing probability underpriced by consensus (13% according to last BofA Global Fund Manager Survey vs 76% probability of soft landing)

- “Sell the 1st rate cut” as risk assets have aggressively front-run Fed/less focused on lower growth.

- Bullish 3Bs of Bonds, Bullion, Breadth (via equity “defensives”): these are the H2 “buy-the-dip” plays;

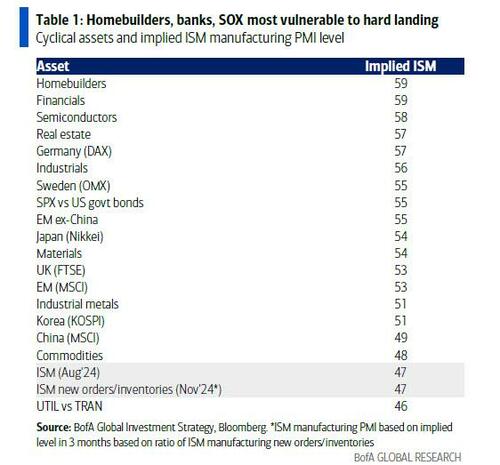

- Cyclical homebuilders, banks, semiconductors most vulnerable to “hard landing”; commodities, EM & China least vulnerable;

- Best global opportunities in real estate/banks in UK, Canada, Australia, NZ, Sweden, all floating mortgage rate markets where transmission mechanism from rates to animal spirits much quicker than in US.

That said, Hartnett admits that it’s not all doom and gloom, even though the data remains challenging for a soft landing, to wit:

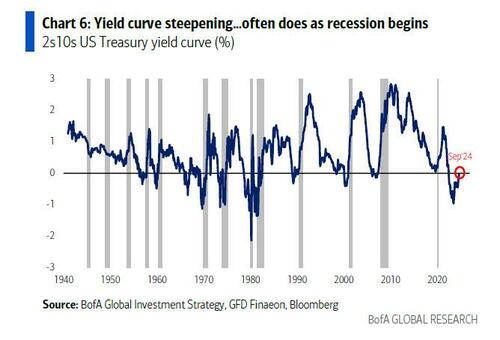

- Yield curve steepening hard: often does before/as a recession begins

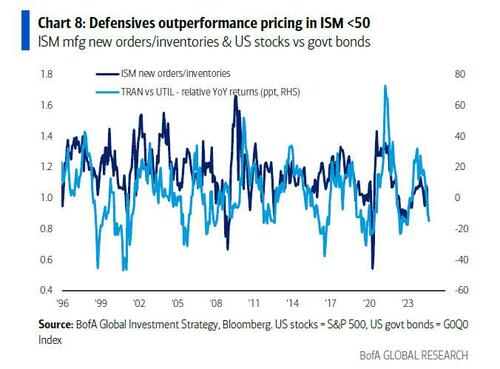

- leading inventory-sales ratio says ISM <50 rest of year, defensives outperformance pricing in ISM <50…

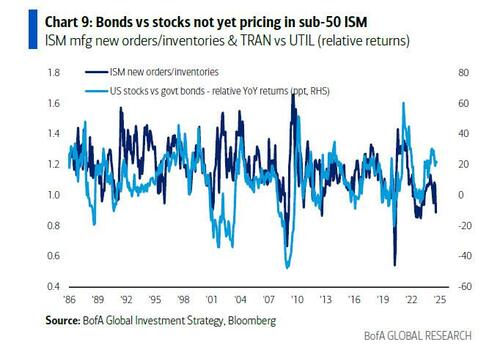

- …. but the bond/stock performance not yet

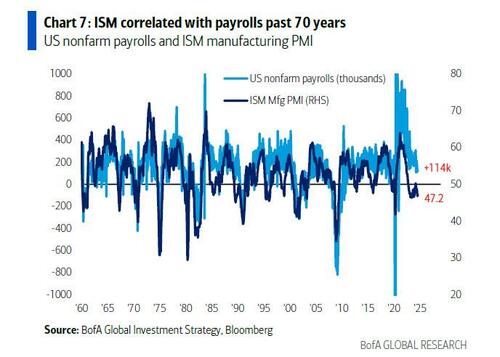

- ISM correlates with payrolls past 70 years, suggesting big jobs drop yet to come…

- … and explains why labor data (JOLTS, ADP, 990k of downward payroll revisions) has been much weaker;

No sign lower rates helping US housing: mortgage apps for purchase pinned to lows…

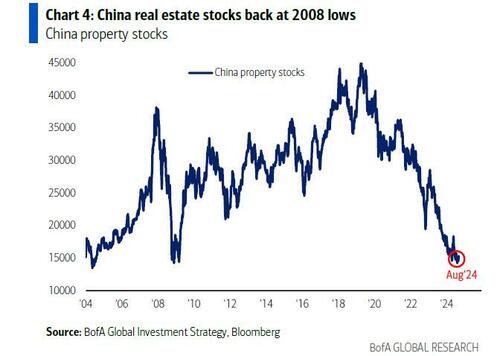

…. And rest-of-world led by China ain’t growing…note China bond yields hitting new all-time lows as China real estate & small cap stocks back at 2008 lows

In light of the above, Hartnett believes that despite a 25bps first cut, the Fed will cut aggressively, and his advice to readers is to “sell the 1st cut”, and wait for better entry to risk assets because…

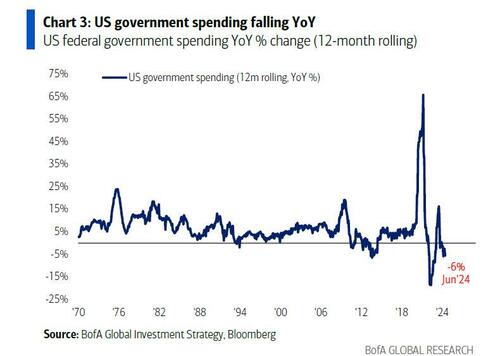

- a. fiscal stimulus reversing: US government spending -6% on 12-month rolling basis;

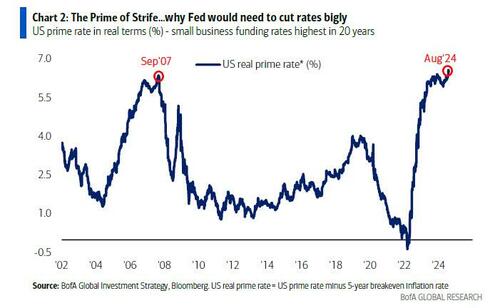

- b. real rates now punishing US small business sector in particular: note US prime rate in real terms = 6.5% = highest this century

One final point: Hartnett would have been even more bearish had jobs come in even lower than they did. This was his preview as of Friday morning:

- Aug payrolls <100k + U-rate >4.4% = hard landing = 50bps Fed cut = sell-the-rip as GT10 heading toward 3%, oil $60/bl, JPY 135, EUR 1.15, SOX 4k;

- In contrast, perfect payroll = 150-175k + tame <0.1% AHE = soft landing = tech & energy lead reversal of recent big defensive outperformance (e.g 15-month high UTIL vs TRAN, 10-month high low vol stocks vs high beta).

We know now that payrolls ended up at +142K, but with unemployment dropping and AHE rising, so while not as bad as Hartnett envisioned, it certainly was bad enough to hammer stocks as the market’s hopes for a 50bps rate cut were promptly dinged.