Uddrag fra Deutsche Bank/ Bank of America/ Zerohedge

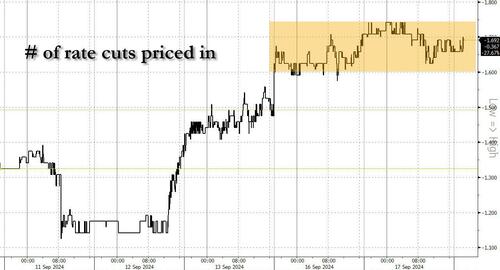

First, recall that with less than 24 hours to go until the Fed announcement, the rates market has currently priced in approximately 70% odds of a 50bps rate cut, a number that soared from just 15% after last Thursday’s hot CPI print, as a result of a barrage of media reports and news articles (including two from Nikileaks) that strongly hinted, if not urged, for a 50bps rate cut.

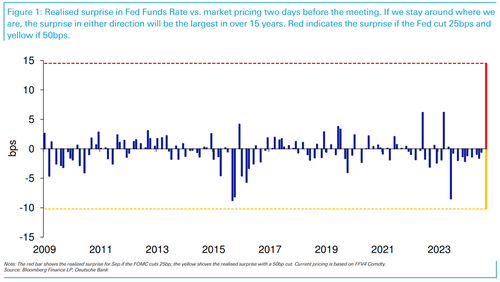

And yet, as DB’s Matt Raskin pointed out on Monday, the surprise component of the Fed’s rate move two days was the largest in over 15 years, regardless of whether the central bank goes 25 or 50. That’s because usually the day before the FOMC decision, the market has gotten enough signals from the Fed to “know” with near certainty what to expect: in other words, the rate-implied odds ahead of the FOMC decision are either ~0% or ~100%. However, this time the constant chatter by various media outlets has been assumed by the market to be tantamount to trial balloons, and despite the recent hawkish Fed rhetoric, the market has taken the side of the media leaks, all of which are uniformly “jumbo” dovish (for more on this, see “Nifty, Shifty, Grifty, Swift-y Fifty-50“.)

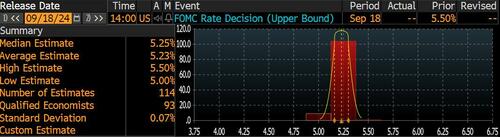

But wait, there’s more: while the market surprise will be the greatest since at least 2009 no matter which way the Fed goes, the surprise to economists, should the Fed cut 50bps, will be even greater. That’s because of the 114 economists polled by Bloomberg, only 9 expect a 50bps rate cut, the vast majority, or 105, see the Fed cutting “only” 25bps.

To summarize: not only is the market set up for a record surprise, based on its own forecast that is split between between expectations for a 25bps and a 50bps cut, but never before has the chasm between the prevailing market consensus (70% odds of a 50bps cut) and economists (92% see 25bps), been this great.

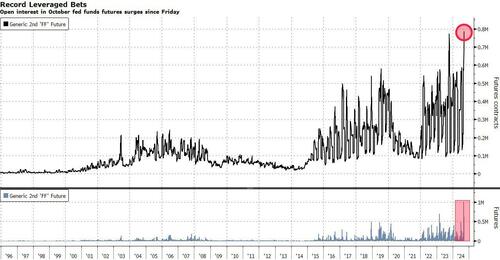

And here comes the punchline: despite this never-before-seen uncertainty, earlier today Bloomberg’s Ed Bolingbroke reported that activity in October fed funds futures – which investors are using to bet on this week’s policy meeting – has surged since the end of last week to the most extreme level of any such contract since the derivative’s inception in 1988, and what’s more alarming, is that the bulk of these new bets are targeting an outsized half-point cut, including a surge of positions put in place this week alone, the data show.

The soaring volumes in the October fed funds contract have also left open interest, or the amount of leverage held by traders, just short of 800,000 contracts. The bulk of the recent activity has targeted a half-point cut, with almost a third of new positions coming over the past two sessions. Record uncertainty, perhaps. But traders are also acting as if they have never been more confident of a 50bps rate cute!

And, as Bolingbroke adds, in the futures market linked to the Secured Overnight Financing Rate, Monday’s session also saw a huge new trade on a similar theme that stands to benefit from a half-point rate cut.

In other words, traders – perhaps emboldened by the duo of dovish WSJ articles by Timiraos/Greg Ip and/or the Bill “Never Trump” Dudley Bloomberg op-ed which the Fed failed to react to (and how could it, since it is in a blackout period, and the media now appears to have taken a political mind of its own) are now locked into record wagers tied to the Fed’s “consensus” 50bps rate cut, and are risking staggering losses if officials opt for a standard-sized reduction… as 92% of economists expect will happen, losses which will cascade across all asset classes as Fed Funds are forced to reprice violently if the Fed surprises.

In short, the Fed is now trapped:

- cut 25bps (as the Fed had broadly suggested it would do ahead of the blackout period), and it will be viewed a “hawkish” and send a risk shockwave across markets.

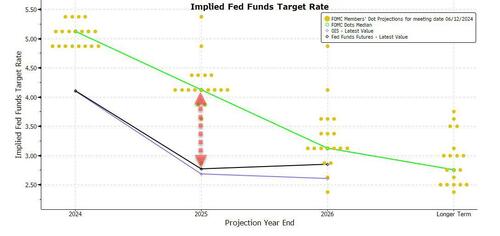

- cut 50bps, and the “jumbo” cut will spark just as jumbo expectations for November, December, and so on, and unless the Fed also drastically revises its dot plot to catch down to the market, where the chasm for the end of 2025 is even bigger at 1.25% (red arrow below), then the result will also be a risk shockwave across markets.

Finally, in case that all wasn’t enough, yesterday three Democratic senators, led by Elizabeth Warren of course, openly called for the Fed to go 75bps, confirming that all the posturing and narrative creation in the past weeks has been entirely political… not to mention that these are the same people outraged at the idea that Trump should have a say in setting interest rates. As Rabobank’s Michael Every wondered out loud, “Is that a framing device to make a 50bp move look measured, or is that just a conspiratorial thinking? It’s not like there isn’t a swirl of such thinking around right now, and for very good reasons, even if, again, it risks getting one’s hand broken even typing it.”

In any case, while some such as JPM’s Andrew Tyler are complacent and confident that there won’t be a selloff in either case, writing that “I recognize that there are some investors who view 50 bps as a more panicked move due to growth fears. I do not share that concern,” others disagree and are certain that the Fed has now left the market vulnerable to selling pressure if the Fed starts smaller and Powell telegraphs a gradual approach. Among them is Subadra Rajappa, head of US rates strategy at Societe Generale, who said that “the market reaction will be much stronger if the Fed cuts by 25 basis points instead of 50 basis points,” adding that “the positioning, the optimism, the easier financial conditions, that sort of narrative could be tested.”

Short-term US Treasuries, which are more sensitive to Fed policy, may be hit the most by any reaction, especially given that they are “already pretty aggressively priced,” said Kathy Jones, chief fixed income strategist at Charles Schwab. “You could back up 10 basis points, 15 basis points pretty easily if it’s 25 basis points, as an initial reaction.” Such a move would also send the dollar surging, and crash the yen some 200 pips if not more, as markets will once again focus on the staggering yield differentials between the US and Japan.

Elsewhere, broader market sentiment in the the cash market for US Treasuries remains positive, although Tuesday’s JPMorgan Treasury client survey showed a reduction in long positions consistent with risk reduction ahead of the Wednesday risk event. A separate survey from Bank of America also showed investors leaning bullish.

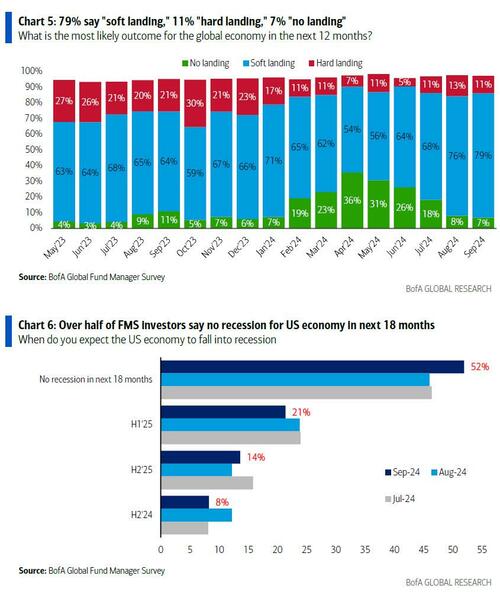

“The global rates rally is driving a perception that long rates is the most crowded trade, exceeding long equities for the first time,” Bank of America strategists wrote in a note, pointing out that a record 79% of survey respondents to the latest Fund Manager Survey expect a “soft landing” while for the first time, a majority expects no recession in the next 18 months! Well, maybe someone should inform these “professional investors” that a panicked 50bps rate cut by the Fed would confirm that the coming landing would be anything but soft (more in the full Fund Manager Survey note available to professional subs).

Needless to say, everyone knows what happens to “most crowded trades” when suddenly the entire foundation of said trade collapses, in this case, should the Fed cut “only” 25