Uddrag fra finanshuse

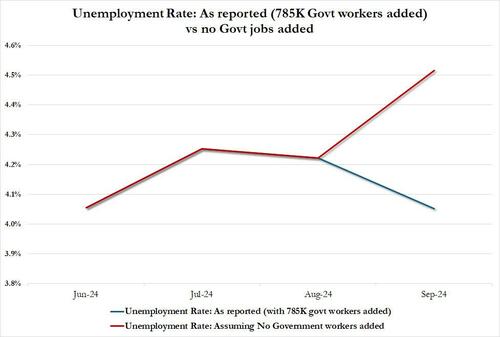

Up until last week’s jobs report, virtually nobody expected tomorrow’s CPI print to be even remotely interesting or market-moving: after all, the Fed has made it very clear that in their mind at least, inflation has been defeated when the Fed will launched the latest easing cycle with a jumbo cut last month, one which it expects to follow with at least two more regular cuts by year end. But then something unexpected happened: the jobs print came in beyond red hot – and well above the highest economist estimate – with the unemployment rate unexpectedly sliding to 4.1% (although as we showed, the unemp rate would have been 4.5% had the BLS not “calculated” that a record 785K government workers were added to payrolls in September).

The cherry on top was that both hourly and weekly wages came in hotter than expected, suggesting that far from beaten, wage inflation had been at best dormant and was about to make a second run for it.

As a result, attention suddenly shifted with many wondering if the Fed had not eased too much already – with financial conditions already the easiest they have been in over two years it’s almost as if the Fed had not hiked rates at all since 2023 – and whether inflation wasn’t about to make a triumphant return, as it did in the 1970s when the Burns Fed made the biggest policy error in US central bank history.

This is how Goldman strategist Dominic Wilson summarized the dynamic:

The strength in the jobs report last week changes the context for the CPI release quite a bit. A couple of weeks ago, I think the market would have been fairly tolerant of a somewhat higher print and excited about the prospect of accelerated easing on a lower than expected one. Now, the threshold for relief from a soft print is higher than it was and the risk is that a high-side print fuels the recent narrative shift that the Fed could do a lot less than previously thought…the reaction towards a high print is likely to be larger than to a lower one, so there may be some downside skew to equities for the number. I’m less confident about that than I would have been a week ago because a) the rates market has repriced quite a lot in the last week – with mid-2025 pricing up by nearly 50bp already and b) there seems to be a reasonable amount of fear going into the number, so the “true” consensus may be higher than it looks and getting through it unscathed may be more of a relief than before. But I still think the market is now in a mood to take out Fed cuts more quickly than it will put them back in.

So what does Wall Street expect from tomorrow’s Sept CPI print

- The consensus looks for headline CPI to rise +0.1% M/M in September, down from +0.2%

- The core rate is seen cooling to +0.2% M/M, also down from +0.3% previously.

- On an annual basis, headline CPI is also seen dropping, to 2.3% YoY, from 2.5% YoY.

- Core CPI is expected to remain unchanged for the third month in a row at 3.2% YoY, with attention once again turning to supercore inflation which has come in unexpectedly hot in recent months.

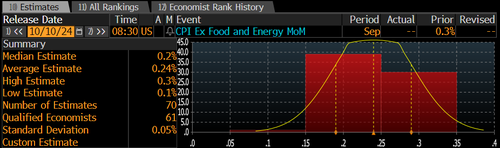

The expected distribution for Sept Core CPI (MoM) shows a roughly equal number of analysts expecting a 0.2% increase as a 0.3%, with just one economist (Jason Schenker from Prestige expects 0.1%).

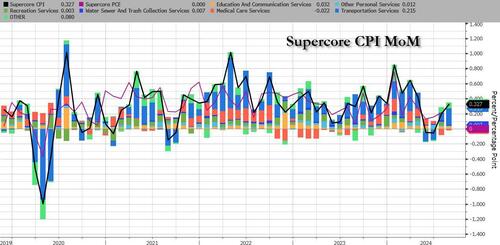

Supercore CPI has been hot in recent months, on the back of surging auto insurance prices. If trends persists, expect even more Supercore heat.

From a top-down perspective, Fed Chair Powell spoke earlier this week and expressed growing confidence in inflation’s return to the 2% target, and said that the 50bps cut in September reflects this confidence. He noted that low inflation in new leases will eventually affect headline inflation and observes a flattening of housing services inflation, albeit slowly. Powell suggested that housing services inflation will decline if the growth rate of rents for new tenants remains low. He believes that further cooling in the labour market was unnecessary to achieve its 2% inflation goal, highlighting a balanced risk in reaching both employment and inflation objectives. Powell said that the upcoming November confab will consider additional employment and inflation reports, but emphasized that the recalibration of policy can help to maintain labor market strength while supporting the move towards the inflation goal.

Turning to the sellside, in its commentary on tomorrow’s report, Wells Fargo said a strike among East and Gulf Coast dockworkers poses a near-term upside risk for goods inflation; however, improved retail inventories and soft demand should limit consumer goods price impacts (especially since the strike was resolved just a few days in). Services inflation is expected to decline further, with the core CPI monthly rate growth downshifting.

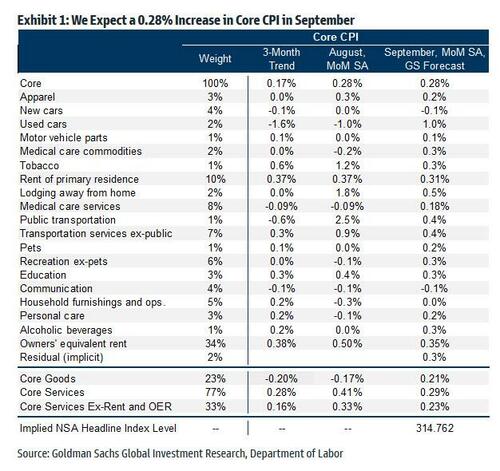

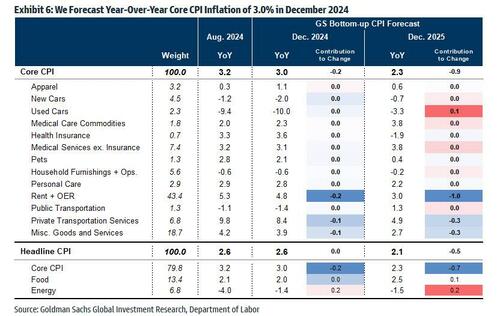

Goldman (full CPI preview here) expects a 0.28% increase in September core CPI (higher than the 0.2% consensus), corresponding to a year-over-year rate of 3.16% (in line with the 3.2% consensus). The bank also expects a 0.10% increase in September headline CPI in line with consensus, and a year-over-year rate of 2.27% vs. 2.3% consensus. The forecast is consistent with a 0.23% increase in CPI core services excluding rent and owners’ equivalent rent. Exhibit 1 provides a component-level summary of the forecast.

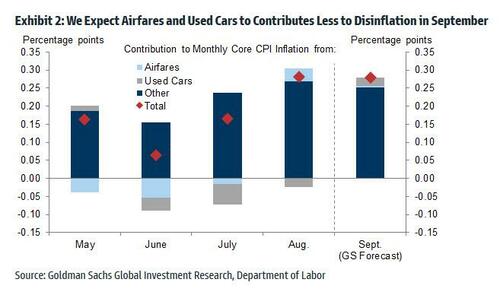

The bank’s core CPI forecast for September is in line with the August pace but above the +0.13% average pace of the three months before that. The chart below shows the softer readings were aided by large declines in the airfares component—which declined 3.4% on average—and the used cars component—which declined 1.1% on average. In September, similar to August, Goldman expects less disinflationary pressure from those two components. Used car prices should increase 1.0%, as used car auction prices have rebounded in recent months, while airfares are set to rise 0.5%, reflecting a modest boost from residual seasonality.

Goldman highlights two other key component-level trends the bank expects to see in this month’s report:

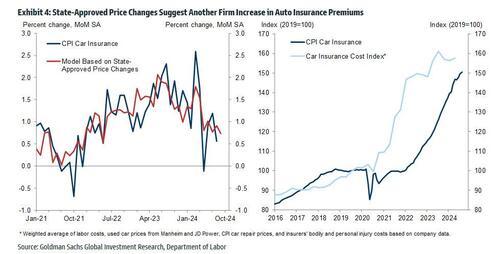

- 1. Car insurance. Expect another firm increase of 0.7% in car insurance prices in September, reflecting continued, albeit decelerating increases in premiums. This compares to a 1.1% average monthly pace so far in 2024. Higher car prices, repair costs, and medical and litigation costs have all put pressure on insurance companies to raise prices, but premiums have been passed onto consumers with a long lag in part because insurers have to negotiate price increases with state regulators. Most of the gap between insurance premiums and costs has now closed. As a result, Goldman expects increase in CPI car insurance to return to the pre-pandemic pace next year. Car insurance has a much smaller weight and is measured using different source data in the PCE index, so it is unlikely for these changes to have meaningful effects on PCE inflation.

- 2. Shelter. After outsized increases in July and August, shelter inflation is expected to moderate, with owners’ equivalent rent increasing 0.35% and primary rents increasing 0.31%. Going forward, stronger rent growth for single-family homes will likely lead OER to outpace rent in the CPI. Overall shelter inflation is forecast to be running at a monthly pace of around 0.3% by December 2024.

Going forward, Goldman expects monthly core CPI inflation of around 0.20-0.25% for the rest of the year, with further disinflation in the pipeline in 2024 from rebalancing in the auto, housing rental, and labor markets, though offsets will emerge from catch-up inflation in healthcare and car insurance. Goldman forecasts year-over-year core CPI inflation of 3.0% and core PCE inflation of 2.6% in December 2024.

From Goldman’s econ research team we turn to Goldman S&T desk, which proposes the following reaction function, which sees the highest market upside the lower the CPI print comes in, and the worst outcome is if core CPI rises above 0.34%.

Going down the list, here is what some other Goldman traders expect tomorrow:

Dom Wilson (Senior Markets Advisor)

The strength in the jobs report last week changes the context for the CPI release quite a bit. A couple of weeks ago, I think the market would have been fairly tolerant of a somewhat higher print and excited about the prospect of accelerated easing on a lower than expected one. Now, the threshold for relief from a soft print is higher than it was and the risk is that a high-side print fuels the recent narrative shift that the Fed could do a lot less than previously thought. Our own core forecast of 28bp (so a rounded 0.3%) is above the published consensus. I think that kind of number or higher would open up the prospect that the market keeps dialing back its expectations for the Fed easing cycle, though as always it matters that the composition isn’t (like it was last month) one that’s clearly more PCE-friendly. An inflation-driven rate shift is generally harder for equities to absorb than one (like last week) that’s coming from a better growth picture.

Given this backdrop, I think it’s probably true that the reaction towards a high print is likely to be larger than to a lower one, so there may be some downside skew to equities for the number. I’m less confident about that than I would have been a week ago because a) the rates market has repriced quite a lot in the last week – with mid-2025 pricing up by nearly 50bp already and b) there seems to be a reasonable amount of fear going into the number, so the “true” consensus may be higher than it looks and getting through it unscathed may be more of a relief than before. But I still think the market is now in a mood to take out Fed cuts more quickly than it will put them back in. This means that short-dated protection around the number likely makes sense here though given quite high skew, it may be easier to structure convexity through OTM calls. Our core equity stance is still positive though, and I think the set-up for megacap tech into earnings is a lot more balanced than a quarter ago, so we would expect a sell-off (except on a very large surprise) to be something that creates an opportunity to add length back in. For pure protection, cross-asset trades can be riskier, but very short-dated EUR/$ vol stands out as low versus the other very liquid macro assets and is another potential way to set up for an upside surprise.

Shawn Tuteja (ETF/Basket Vol Trading)

Equities have been comfortable to ignore this last move higher in yields across the curve in rates, with the view being the Fed put remains and higher yields just means better growth. What’s been missing for months is any worry over inflation, which could start to change should we get a high inflation print. I think this print feels asymmetric, especially with equities at the all-time highs and into the election. Duration sensitive pockets of the market have heavily skewed risk/return into the print – Defensives have ample room to correct should we keep going higher in yield, but the cleanest expression of a high CPI and higher yields tailwind is buying puts on GSXUNPTC, our nonprofitable tech basket. At the sector level, we’ve seen financials and energy trade strong in the past few sessions, as geopolitics and increasing Republican odds have given a bid to these less-loved pockets of the market. We continue to think there is value in these sectors and expect them to act more defensively on risk corrections in the short-term.

Lou Miller (Macro Thematic Structuring)

The market is more focused on growth than inflation and good is good and bad is bad, but the S&P 500 is approaching 22x fwd P/E (within 1x of 2021 levels) and gross is likely higher than normal going into a binary election event so the continued progress of inflation is important to risk, alongside continued earnings delivery by corporate America. The 10yr yield is 45bps off the lows, and if inflation proves to be a bit stickier (oil, China off the lows as well) that could help slowly change the narrative from the current goldilocks backdrop where the fed is cutting into decent US growth and improving earnings trends. Our proxy for cyclicals/defensives ex commodities is near the highs alongside AI bellwethers, and the backtest for 6m post a non-recessionary rate cut is good for stocks, and good for the styles that our clients traffic in (hi growth, hi margin, long momentum, big size, etc). We are biased constructive risk, but would be shorting lower quality long duration stocks here to hedge inflation risk if CPI comes in hot, as a resilient economy might put pressure on 10s anyways and seasonal dynamics (mutual fund tax loss selling) and election uncertainty will likely keep higher risk business models under pressure anyways.

Joe Clyne (Index Vol Trading)

As the SPX has broken to all-time highs, we are seeing increasing signs of positive spot/vol correlation that we think can continue coming out of CPI. The desk like trades that sell skew and that own vol on the topside, particularly in post-election tenors. The straddle for CPI is priced at around 80 bps which seems fair to us, though certainly has a smaller premium to base vol than we’ve seen during extremely low vol periods. We think a lighter CPI will be a relief to the market, particularly given the selloff in backend yields over the course of the last few weeks.

Our favorite trades here are either NDX Nov vol which has normalized dramatically as a spread to SPX, or the SPX Jan 6100 calls. The Jan 6100 calls cost roughly 1% and are a 12.4v for the 25 delta call. We think it’s difficult for these to move much lower in advance of the election and should have a spot up vol up beta on any rallies close to what the straddle has as a baseline move.

Indicatively, the straddle-implied move for the S&P thru tomrrow’s close is for a 0.80% move.

Bottom line: the CPI print once again matters, and whereas a hotter print would have been supportive of risk assets as recently as last Thursday, after last week’s jobs report, the reaction function has been flipped on its head, and the weaker than core number tomorrow, the better for stocks, with a hot CPI likely to spark a big selloff in stocks

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her