Uddrag fra Goldman/ Zerohedge:

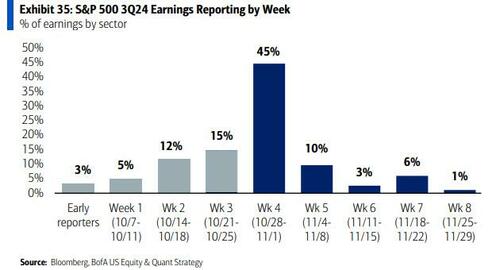

in the coming days when a whopping 45% of the S&P by market cap is set to report.

GOOGL reports tomorrow post close, META and MSFT report Wednesday post close, and AAPL and AMZN report Thursday post close (see below for this week’s full event schedule).

In its latest positioning reports, Goldman has been highlighting that positioning across the Megacaps does appear to be cleaner into Q3 prints relative to the last several quarters, at least from a HF perspective, although these dynamics can be fluid, particularly with the Nasdaq up 8 of the past 9 sessions and up 7 weeks in a row, its best run since Nov’23, however, perhaps more telling of the action out there, the Nasdaq Equalweight / NDXE has traded lower on 3 of 4 weeks.

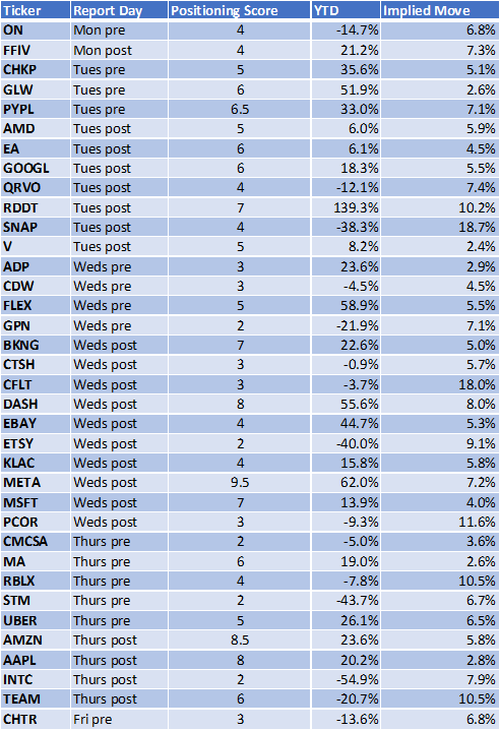

Here is a snapshot of how Goldman views desk “Positioning Scores” into the big week of earnings:

Additionally, while the day-to-day action has been focused on earnings, Goldman’s Peter Callahan writes that it is hard to ignore the juxtaposition of earnings vs the Nov 5th U.S. Election (throw in 11/1 NFPs and 11/7 FOMC) given potential impacts on risk appetite/skews around earnings (e.g. feels like it could be easier to sell bad news than chase good news?) as well as policy driven rotations (at this point, reasonable debate on how much has been ‘pre-traded’ re: sector tilts and policy outcomes).

Here are 10 main themes and storylines according to Callahan, as we enter the busiest week for tech earnings:

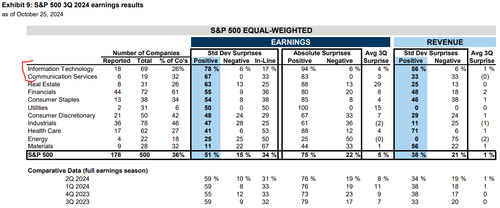

- 1. So far, so good for TMT: thus far, TMT stocks are pacing the index higher re: 3Q earnings beats with ~78% of Info Tech earnings beating on EPS (1std) and ~67% of Comm Srvcs names beating.

- 2. Subsector check-ins: Internet set-ups feel tougher (above street expectations, nuanced 4Q linearity, stocks at highs), software conviction remains low (feels like a ‘wait and see’ re: 4Q guides supporting 2025 outlooks, not to mention the move in Rates), Mag5 this week (while positioning is lighter, it feels like investors are struggling to pick a print to lean into on the long side esp with the Election 4-5 days after most reports), Payments (investors appear relatively ‘relaxed’ here – at least relative to recent EPS cycles), Hardware (an unusually high positioning bar into earnings with 2025 potentially a robust year – think: PC cycle, iPhone cycle, non-AI DC recovery, etc) and CME (debate if the Cable / Tower stories catch any rate-of-change optimism into 2025)…

- 3. Sentiment check: here is Goldman’s desk view on investor sentiment into earnings this week: Most loved: RDDT, MA, BKNG, DASH, META, AAPL, AMZN vs. Most debated: ON, FFIV, EA, Visa, EBAY, MSFT, RBLX, UBER, TEAM vs. Most out of favor: AMD, GOOGL, SNAP, GPN, CFLT, ETSY, PCOR, STMicro, INTC.

- 4. Analog / Cyclical semis: following a no worse than expected “seasonal” 4Q revenue guide from TXN last week (albeit below cons and down ~7% q/q) with TXN citing momentum in China autos / EVs (and, elsewhere Tesla guided 2025 units +20-30% y/y) – TBD if market remains in ‘buy cuts’ / ‘weakness’ mode next week across Analog/MCU semis: ON (cons 4Q revs +1% q/q), ALGM (cons +8% q/q), STMicro (cons 4Q revs +4% q/q), MPWR (cons 4Q revs +1% q/q) … then the following week(s): NXPI (4Q cons +4% q/q) and MCHP (4Q cons revs +3% q/q)..

- 5. Starting to see some stalling out in more ‘defensive’ / low-vol stocks, which, beyond earnings reactions, feels partially informed by the back up in Rates (10yr >4.2%) as well as the ‘tension’ around cyclical exposure – this coming week, a handful of ‘value’ / ‘defensive’ TMT stocks entering earnings near the highs: FFIV, CHKP, MSCI, ZBRA, ADP, EBAY, GDDY.

- 6. AI Infra names: one of the bigger (best?) themes into 2025 is the markets’ interest in playing the broadening out of the Datacenter trade across the “infra” level (e.g. recovery in ‘core’ DC spending + AI tailwinds – e.g. going from GPUs to switching, optical, CPUs, etc) – with big runs in stocks like GLW, BDC, FLEX, ETN, feels like the tactical set-ups are a bit more demanding (even if the 2025 theses likely remain intact) – think VRT last week.

- 7. Memory / capex: fair bit of confusion around what the Memory vs. Semicap story is into 2025 (think: ASML’s cut, TER noting the HBM Test TAM could be flat or slightly decline in 2025 in 2025 & BE Semi guiding 4Q below the street vs. LRCX upbeat commentary on 2025 WFE growth). This coming week, watch: Samsung (color on HBM / Memory vs Foundry / Logic ambitions), KLAC (more ASML or LRCX like in tone?), UCTT (supplier for SPE players) and ASM International .. my sense has been that investors’ bias is to “wait” on the SPE group (moving parts into 2025), but we’ll see if the charts accommodate that!

- 8. Ads: while there is relatively limited debate on 3Q ad trends (investors largely looking for sold results – GOOGL Search, RDDT, META) there is more debate about 4Q guides (election + later Holidays) and, in turn, the implied launching off points into 2025 (esp as we go from “easy comps” in 2024 to “tough(er) comps” in 2025, ramping ad inventory in CTV and more of an “AI pull” – both product and capex)

- 9. Software: while we had a good start thus far, this week (and next) will be a bigger test with a handful of SMID names to report (CFLT, TWLO, GEN, PCOR, PAYC, PCTY, TEAM) with investors looking for signs of stability on 4Q guides to help underwrite confidence in 2025 outlooks / estimates (e.g. moving parts on tough 4Q comps, Election linearity, lapping 3yr renewals from 2021, etc).

- 10. Mag 7: positioning is cleaner here (at least among HFs), which is a good thinh; the challenge is, it is hard to find a print that investors feel ‘great’ about leaning into right now – META (elevated topline expects + ’25 capex/expenses), AMZN (4Q OI guide debate), GOOG (YT decel + regulatory overhang), MSFT (lack of Azure visibility + limited EPS revisions as of late), AAPL (C4Q guide unknowns).

Here are the key earnings and events this week:

Tues 10/29:

- Earnings:

- Pre: AMT, CHKP, CVLT, CTS, GLW, Hellofresh, HUBB, IPGP, LDOS, MSCI, PYPL, SOFI, SSTK, XRX, ZBRA

- Post: AMD, ASM Int’l, EA, FSLR, GOOGL, LBTYA, QRVO, RDDT, SNAP, UDMY, VRNS, Visa;

- INTU hosting Intuit Connect

- Payments: Money20/20 Conference

- TechCrunch Disrupt 10/28-10/30

- GamesBeat NEXT

- Quantum+AI Summit in NYC (link)

Weds 10/30:

- Earnings:

- Pre: ADP, Advantest, AVT, BLKB, Capgem, CDW, CRTO, DAY, EXTR, FVRR, FLEX, GPN, GRMN, IMAX, MediaTek, TEL, TTMI, WBTN;

- Post: Accelink, AEIS, ALKT, ALTR, Anritsu, BKNG, BHE, CVNA, COMP, CMPR, CGNX, COIN, CTSH, CFLT, DASH, EBAY, ETSY, GEN, GDDY, HOOD, INFA, KLAC, META, MSFT, MSTR, MPWR, NTGR, NXT, OLED, PAYC, PCTY, PCOR, ROKU, Samsung, SIMO, TENB, TWLO, Ubisoft;

- INTU hosting Intuit Connect

- Payments: Money20/20 Conference

- TechCrunch Disrupt 10/28-10/30

- Quantum+AI Summit in NYC

- OpenAI’s DevDay in London

- Cantor European TMT Conference

- ThinkEquity Conference

Thurs 10/31:

- Earnings:

- Pre: Aixtron, ALGM, ARW, BDC, CNK, CMCSA, DNB, ETN, GCI, Hyatt, MA, MBLY, NCLH, PTON, RDWR, Renesas, RBLX, SIRI, SWI, STMicro, Stellantis, TREE, UBER; //

- Post: Advantech, AMZN, AAPL, HOYA, INTC, JNPR, ONTO, TEAM, UMG, VIAV, VRRM;

- Cantor European TMT Conference

Fri 11/2: NFPs (cons +110k) + Auto Sales + ISM Manufacturing

- Earnings: Pre: CHTR, DBRG, FUBO, Murata, NVT, Wayfair;

Finally, three charts from the Goldman trader:

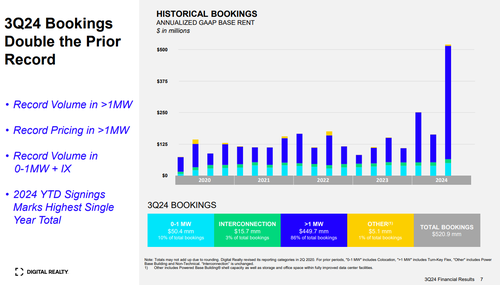

Historically, I haven’t been as focused on REITs, but the print from DLR last week caught my eye (Goldman research called it “dramatic upside in new bookings activity”) including the below slide from their investor deck re: 3Q bookings inflecting (50% of new bookings from GenAI).

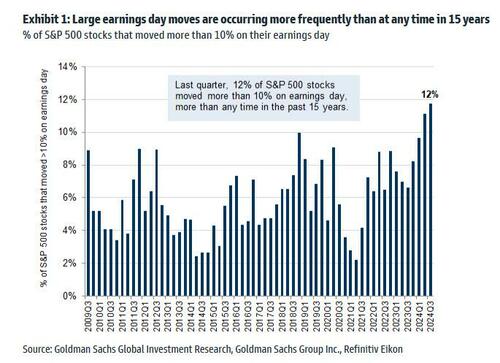

If it feels volatile out there.. that’s because it is – Big earnings-day moves are happening more frequently than any time in the past 15 years.

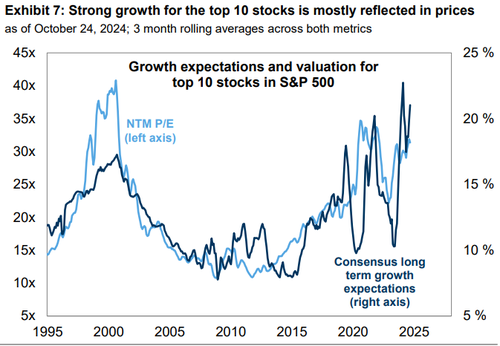

Consensus long-term growth expectations for the 10 largest stocks in the S&P 500 are currently in the 99th percentile relative to the past two decades. It remains to be seen whether these companies will meet these optimistic estimates. However, the P/E valuation of these top 10 stocks sits in the 93rd percentile, reflecting a low risk premium relative to history.