Uddrag fra Goldman og Zerohedge

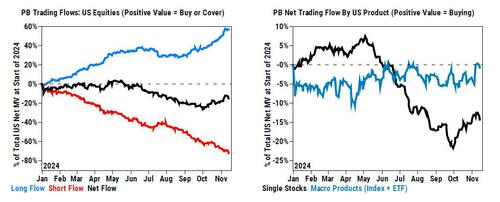

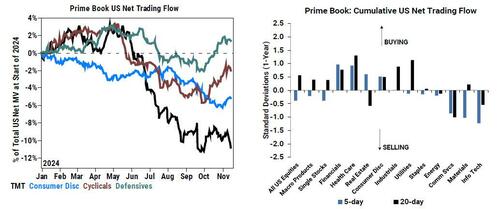

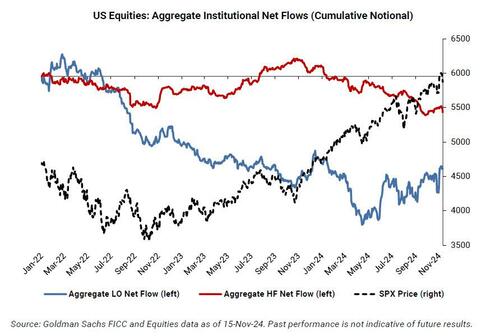

fast-forwarding to today we find that sentiment has reversed substantially, leading to a broad slump in stocks (RTY -4%, NDX -3.4%, SPX -2.1%) as investors continue to assess a new Trump Administration, tighter financial conditions and the potential for a slower pace of rate cuts. As a result, in its latest Weekly Rundown note (available to pro subscribers), Goldman’s PB desk writes that HFs net sold US equities, driven by risk-on flows with short sales outpacing long buys 2 to 1.

Macro Products (Index and ETF combined) made up ~50% of the net selling, driven by short sales and to a much lesser extent long sales (4.2 to 1). A reversal from last week’s covering, US-listed ETF shorts increased by +5.6%, led by shorting in Sector, Credit, and International ETFs.

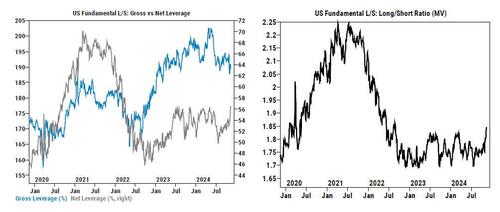

Following last week’s remarkable gross up across the hedge funds space, we find a U-turn there as well with Gross and Net leverage for US Fundamental Long-Short funds both falling on the week.

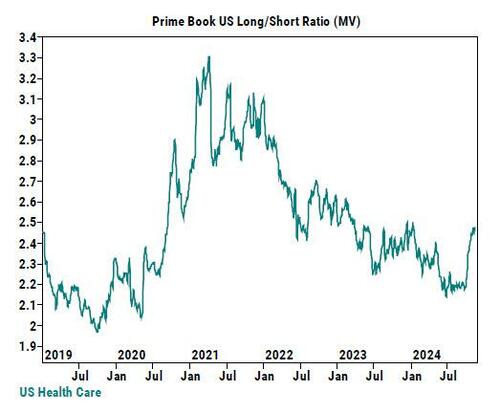

Taking a closer look at sector, we find that Info Tech/Comm Services/Materials were the most notionally net sold sectors, while Health Care/Financials/Consumer Discretionary were the most net bought. In fact, US Healthcare stocks have now been net bought in 7 of the last 8 weeks, and the sector long/short ratio now stands at 2.46, in the 92nd percentile vs. the past year and in the 46th percentile vs. the past five years.

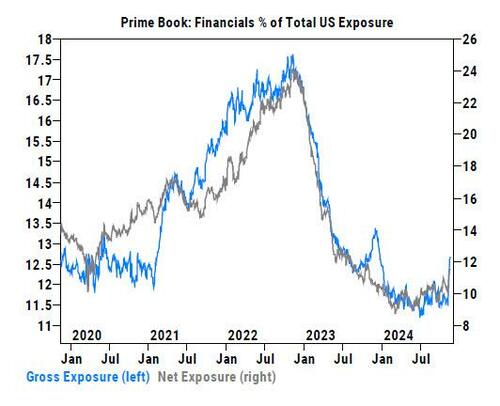

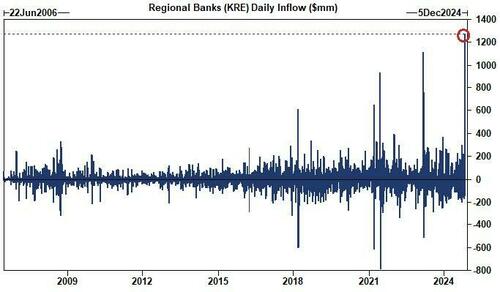

And while Financials was net bought for the 2nd straight week, after last week’s historic buying frenzy…

… the sector saw a notable increase in gross trading activity, driven by both long buys and short sales.

Turning to Goldman’s share sales trading desk, we find more selling as Long-Onlies and Hedge Funds finished the week $500m and -$2.5bn net sellers respectively, as no sector finished materially net to buy.

In Tech, Goldman’s desk noted rotations OUT of semis INTO software (software now outperforming semis > 10% MTD) as better than feared earnings, positioning, and some budding 2025 storylines (“GenAI moving up the stack”) has driven a fair bit of investor attention back into the group.

Elsewhere, the spread between the Healthcare sector (XLV) and the SPY broke through 2011 lows with Large Pharma hit the hardest following RFK Jr appointment.

Supply on Friday started as HF shorts (dedicated Healthcare) but the L/O generalist community later stepped in as sellers too. The epicenter of the supply is Vaccine Exposed (PFE, MRNA, BNTX, NVAX), R&D Uncertainty (IQV, TMO), Food Hormones (ZTS, ELAN) and Pharma Advertising (DOCS). Here are some patallel observations from Goldman’s Health Care specialist Jon Chan:

The S5HLTH setting new 15 year plus lows vs. the S&P 500, as an already difficult to navigate healthcare tape post-election was further exacerbated this week by a complicated confluence of micro and macro – as some of the more negative leaning uncertainties coming out of the 3Q EPS season persisted (i.e. Life Sciences, CROs, etc), a surprise outright clinical failure from ABBV in neurology (driving debates on the risk/reward of executing on earlier stage M&A, also catalyzed a +10.5% bounce in BMY) and CI confirming it is not pursuing a combination with HUM taking one highly watched (but debated) sources of optionality off the table. Overshadowing the micro updates was the late Thursday announcement of Trump nominating RFK Jr. for the HHS head seat. While this was a highly previewed/debated node among healthcare specialists in recent weeks heading into and out of the election, conversations and prediction markets in recent days did not suggest this was the base case outcome for investors – and initial reactions post confirmed headline centered around the vaccine complex (MRNA, PFE, BNTX, NVAX) where RFK Jr. has been publicly critical on for some time. The aperture of the RFK Jr. uncertainty theme widened out into Friday – as debates spread to more nebulous R&D uncertainty (Life Sciences/CRO’s, Biopharma weakness) and other corners of the sector where he’s commented on in the past (i.e. Livestock Vax, Pharma Advertising, etc) – while conversations at the sector level suggested an intermediate term overhang until we get visibility on confirmation likelihood and broader uncertainty that added to the persisting source-of-funds dynamic for the sector.

Finally, and to the delight of our readers, the Goldman desk said that “Hedge Funds short covers were seen in Psychedelics (CMPS, ATAI, MNMD),” the same space which we said one week prior, would see a flurry of buying.