Uddrag fra Goldman/ Zerohedge/

Summary

After the remarkable December flip-flop, when – just three months after the September jumbo rate cut – the Fed announced the most hawkish rate cut in its history, expectations for the Fed have been rather choppy as a hot December jobs report saw markets price in just one 25bps rate cut for the year with several banks revising their rate cut projections, with some even expecting no more rate cuts.

However, as Newsquawk reminds us, a soft CPI and PPI report thereafter saw pricing reverse the post-NFP hawkishness, with markets back to pricing in about 40bps of easing this year, which fully prices one cut with a 60% probably of a second by year-end.

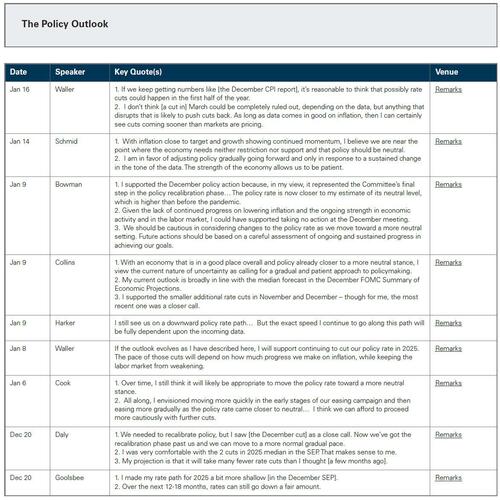

The Fed speak highlight was arguably Governor Waller, who leant dovish, noting a cut in March cannot be ruled out (markets pricing just 6bps of easing (24% probability). However, he was very data-dependent, noting that data could disrupt that view. He also noted that cuts could start several months from now if current inflation expectations are met, adding that three or four cuts this year are possible if data cooperates.

He also noted that he may be a little more optimistic about inflation than his colleagues. Nonetheless, there is still a wide range of views on the Fed with Governor Bowman acknowledging she voted for a December cut on the basis it was the “final step”.

It is almost a certainty that January will see rates left unchanged, therefore focus lies further out the curve to assess when the Fed may start to lower rates again, with expectations largely to be shaped by incoming data. We will see the January and February jobs and CPI reports before the March 19th FOMC, which will help shape expectations. Note, that the February jobs report will also see the annual revisions be released, which ING highlights are widely expected to see some significant downward revisions.

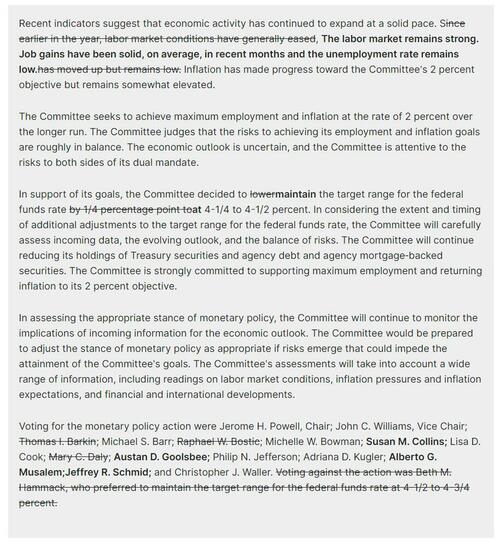

In its FOMC preview, Goldman writes that the January meeting is “unlikely to provide any major surprises or offer much new information.” The first paragraph of the FOMC’s post-meeting statement might upgrade the description of labor market conditions to “have stabilized” (rather than “generally eased” over the course of last year) in light of the strong December employment report, but we do not expect more significant changes.

But neither the statement nor the press conference is likely to provide strong guidance about the March meeting or the timeline for further cuts. After all, participants will have two more rounds of inflation data and possibly more information about tariffs by the time they meet next, so there is no reason to pre-commit.

Overall, aside from the dovish and hawkish ends of the spectrum, the Fed largely highlights how they can afford to be patient with rate cuts but that further rate cuts are still likely needed to get to neutral, but there is a lot of uncertainty around the neutral rate. The arguments also highlight how risks to the labor market have diminished, which allows the Fed to be more patient, while they are still confident that inflation will return to the 2% target.

On the new Trump admin, there has been a range of views, highlighted by Chair Powell at the post-Dec FOMC press conference noting some people did take a very preliminary step and incorporated conditional effects of coming policies in their projections. Post-meeting, Daly (2027 voter) said her projections are always about the data, and Goolsbee (2025 voter) said their job is to think through scenarios, and they do not know what new administration will propose it is difficult to forecast. Waller does not expect tariffs to produce persistent inflation and thus are not likely to influence views on appropriate monetary policy, while Bowman stated they should refrain from prejudging incoming admin’s future policies.

Prior Meeting

The Federal Reserve cut rates by 25bps, as expected, to 4.25-4.5% in an 11-1 split, with Hammack voting to leave rates unchanged. The statement was little changed from the November meeting but added in considering the “extent and timing” of additional rate adjustments (prev. In considering additional adjustments), Fed will assess incoming data, evolving outlook and balance of risks, signalling a slowing of easing ahead.

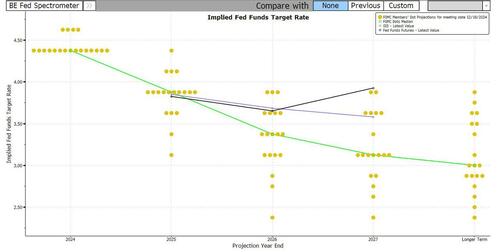

The further hawkish skew came in the updated SEPs whereby the median dot plot for 2025 and 2026 FFR forecasts were lifted above expectations. Recapping, the median 2025 and 2026 dot rose to 3.9% (prev. 3.4%, exp. 3.6%) and 3.4% (exp. 3.1%, prev. 2.9%), respectively, while 2027 and longer run median dot plots rose to 3.1% (prev. 2.9%) and 3.0% (prev. 2.9%), as expected. As such, the 2025 median dot plot looks for just two cuts in 2025, but the FOMC were more aligned this time round – four members see rates above the median, and five see rates below, but ten were in line with the median. Elsewhere, Core PCE inflation is now seen at 2.5% for 2025 (exp. 2.3%, prev. 2.2%) and 2.2% for 2026 (exp. 2.0%, prev. 2.0%). Forecasts for the unemployment rate were largely as expected, with all horizons, ex-longer run, seen at 4.3%, although 2027 was expected.

In Chair Powell’s pre-prepared remarks, following the rate decision, he stated the Fed is squarely focused on two goals, and that the economy is strong, the labour market remains solid, and inflation is much closer to the 2% goal. The Chair added that the policy stance is now significantly less restrictive, and going forward they can be more cautious, something which was indicated from the updated SEPs and statement tweak. In the Q&A, Powell said that today’s decision was a “closer call”, but the “right call”, suggesting there was a discussion surrounding holding rates at this meeting. Powell added risks are twosided, and trying to steer between those two risks.

On the statement change, Powell stated that “extent and timing language” shows the Fed is at or near the point of slowing rate cuts, and the slower pace of cuts reflects that expectation. Powell said that cuts they make in 2025 will be in response to data and as long as the labour market and economy are solid, they can be cautious as they consider further cuts. In addition, looking to US President Trump’s term, Powell said some people did take a very preliminary step and incorporated conditional effects of coming policies in their projections.

Continuing to look ahead, Powell said the Fed will be looking for further progress in inflation to make those cuts, and added that from here is a new phase, and the Fed is going to be cautious about further cuts. After the meeting, Goldman Sachs said despite the hawkish message from the dots, they kept their more dovish baseline forecast of three more cuts in March, June, and September 2025 unchanged, though added a bit more probability weight in their Fed scenario analysis to an outcome with a higher terminal rate.

Minutes Recap

The FOMC’s December meeting minutes noted that participants believed the Fed was nearing a point where it would be appropriate to slow the pace of easing. If data met expectations, they agreed it would be suitable to gradually move towards a more neutral policy stance. The majority of participants favoured a 25bps reduction at the December meeting, although some suggested keeping rates unchanged due to concerns about persistently high inflation.

The minutes also revealed that several participants had incorporated ‘placeholder assumptions’ on potential trade and immigration policy changes into their projections. Fed staff, in turn, adjusted their economic forecasts, projecting slightly lower GDP growth and a modest increase in the unemployment rate, incorporating recent data and assumptions of potential policy shifts from the incoming administration.

Capital Economics writes that the Fed has seemingly expressed concern about the potential economic impact of Trump’s trade and immigration policies, incorporating uncertainties into their projections, and despite recent stronger inflation, the decision to cut rates by 25bps was seen as “finely balanced”.

Tariff Uncertainty:

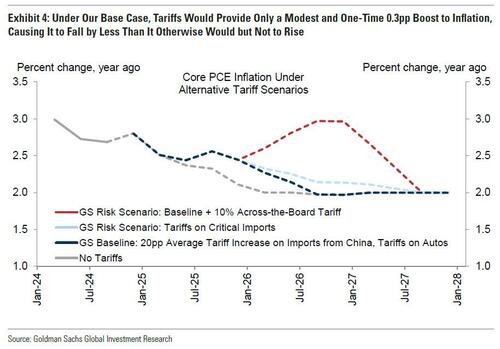

Because the economic data would not make the decision to cut obvious one way or the other, the FOMC’s decisions will likely hinge in large part on how the Committee chooses to handle tariffs. The tariffs on autos and imports from China in many banks’ baseline forecast would provide only a modest and one-time 0.3pp boost to inflation, causing it to fall by less than it otherwise would in 2025—to 2.4% instead of 2.1%—but not to rise.

The Fed staff and other forecasters should also be able to estimate the size of the boost, which would make it clear that the underlying trend had fallen more impressively. For these reasons, Goldman thinks the tariffs in its baseline would leave the door open to further rate cuts this year. That said, some FOMC participants might be reluctant to cut either because of uncertainty about what is coming or out of concern that their rate cuts might be blamed for any inflation boost from tariffs.

To shed light on how the FOMC might handle potential tariffs, we look back at the recently released transcripts and staff analysis from the meetings in 2018 and 2019 during the first trade war. We see three lessons.

- First, Fed officials took a relaxed view of the impact of tariffs on inflation. The Fed staff compared the evolution of consumer prices of tariffed and non-tariffed goods and ultimately concluded that tariffs would have only a limited one-time effect on inflation peaking at 30bp. President Harker compared tariffs to a VAT or consumption tax increase that central banks would usually look through, the staff estimated that tariffs on capital goods would actually lower consumer price inflation because the offset from dollar appreciation would outweigh any indirect impact of those tariffs on consumer goods, and Fed officials noted that inflation would most likely end up lower after the tariff effects dropped out of the year-on-year calculation because the economy would have weakened.

- Second, the staff’s estimate of the GDP hit from the larger tariff proposals was severe and larger than Wall Street’s. While the staff and participants generally saw the tariffs actually implemented as having moderate effects, they estimated that a proposed 15% universal tariff would lower GDP by 4% over two years, a large enough estimate to make a downturn a real concern. By mid-2019, both the staff and participants had become more concerned about the impact of trade policy uncertainty.

- Third, while the FOMC ultimately chose to cut, some participants were skeptical that the effects of tariffs really merited a monetary policy response. Then-Presidents George and Rosengren dissented against all three cuts. Among non-voters, President Harker said “I simply do not think the economic fundamentals warrant such a decision,” President Barkin said that the uncertainty rationale was “challenged by the data” and President Bostic agreed, and then-President Mester opposed a cut and worried about a “hall of mirrors” in which the FOMC chases bond market pricing and in doing so encourages it to go even further.

In short, tariffs were not seen as a reason to hike but rather as a reason to cut, though a debatable one.

Separately, in a note earlier this week, Goldman noted (and Nikileaks Timiraos over at the WSJ cribbed this morning) that a common argument for why this time might be different is that FOMC participants might worry more about the risk of tariffs unanchoring inflation expectations in the aftermath of the recent inflation surge. Goldman’s analysis suggested that the pure inflation effect of the tariffs in a baseline or even of a universal tariff should not be enough to unanchor inflation expectations, but that tariffs could have a much larger effect if tariff-driven price increases prove to be as salient as gas price increases, say because they receive media attention far out of proportion to their size. Even in that scenario, the FOMC would likely judge a rise in survey-based inflation expectations driven by tariff headlines considerably less threatening than one driven by actual experience of high and broad-based inflation—a reason to forego cuts, perhaps, but not to hike. And if tariff-driven price increases did begin to dominate headlines and receive widespread attention, the White House might worry about their political cost and hold back on further increases.

Press Conference:

In the press conference, Goldman’s economists will listen for any hints about three key questions. First, would the further decline in inflation we expect in coming months be enough to reassure the more hawkish participants, who were likely concerned about the lack of progress on year-on-year core PCE inflation in 2024H2, and open the door to rate cuts? Second, how strongly does the leadership feel that the current level of the funds rate is still “meaningfully restrictive”—Powell said this four times in December—and not an appropriate stopping point? And third, how does the FOMC intend to navigate uncertainty about potential tariff increases now and their impact on prices, GDP, and financial markets later?

FOMC Policy Statement:

Morgan Stanley expects the following changes to the December FOMC statement that will appear in January. Strikethrough text is language that will be removed from the December statement, and boldface text represents new additions that will appear in January.

The Fed’s Path Forward:

While the market consensus is for just over 1 rate cut for the rest of 2025, Goldman’s baseline forecast calls for two 25bp rate cuts this year in June and December and one more in 2026 because the bank remains confident that inflation is headed back toward the Fed’s 2% goal and—following the historical precedent outlined above—do not expect tariffs to restrain the FOMC from cutting indefinitely. But the bank admits that it is hard to have great confidence in the exact timing of cuts, both because its economic forecast—lower inflation and a healthy labor market—would not make the decision to cut obvious, and because even after a look back at the 2018-2019 experience it is still hard to know how the FOMC will choose to navigate possible tariffs this time.

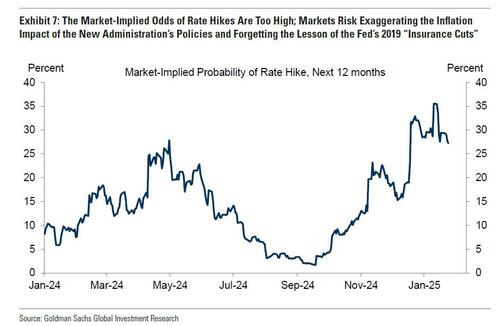

Goldman is, however, far more confident that market pricing as a probabilistic statement about possible Fed paths in coming years is too hawkish. The bank sees the 4% funds rate that the market is pricing over the next few years as the very top of the range of where the FOMC might plausibly see neutral and be willing to leave policy on hold indefinitely. Because there is always some chance of large rate cuts in a potential recession, for 4% to make sense as an average outcome, one must also see a meaningful chance of hikes. Here Goldman says that the market 35% implied probability of a rate hike over the next year is too high, and speculates that market pricing presumably reflects the widespread view that the combination of higher tariffs, fewer low-wage immigrant workers, and tax cuts will be inflationary and therefore hawkish. Directionally this makes some sense, but Goldman thinks the impact is much smaller and the risks are more two-sided than thought. Additionally, Goldman does not expect further declines in immigration flows

In fact, only tariffs could move the needle significantly on inflation. While they could restrain the FOMC from cutting, Fed officials would set a very high bar to hike from a starting point they already see as meaningfully above neutral in response to a one-time price level increase. And more importantly, any tariffs that raised inflation enough to even open a discussion about hiking would quite likely also unsettle the equity market, which in itself would be deflationary and spark rate cut discussions. As noted above, when fairly modest tariffs rattled the equity market in 2019, the Fed ultimately delivered three “insurance cuts.” We worry that lesson is not being sufficiently heeded today.to moderately below the pre-pandemic rate or modest additional tax cuts to boost inflation appreciably.

Trader Takes:

In a note from Goldman’s Cross Asset Sales, the bank’s traders write that they are looking for a less eventful FOMC meeting tomorrow and not expecting significant new insights or surprises. Powell’s press conference will offer more room for variance, and we will be watching in particular how he responds to inevitable questions on:

- How the Committee will navigate the risks posed by tariffs, and in particular how they intend on framing the inflation discussion in response to a one-time price shock

- Central bank independence under the Trump administration and

- The restrictiveness of policy rates, and how opinions on this front are divided within the committee.

The desk views risks over the meeting as skewed to a dovish reaction, and remain biased to long expressions targeted on 2025 year-end rates.

Goldman Trading/Strategy takes by sector:

Rates:

1. Meeting Risk Skewed to Dovish Reaction: Following fireworks at last month’s meeting, we are looking for a far less eventful spectacle tomorrow. The mkt is assigning just .25bp premia for a cut, largely reflecting intermeeting cut tail risk rather than any actual probability of easing, and we don’t expect any updates to forward guidance in the statement or tweaks to the path of QT. Powell’s press conference will offer more room for variance, and we will be watching in particular how he responds to inevitable questions on: 1) How the Committee will navigate the risks posed by tariffs, and in particular how they intend on framing the inflation discussion in response to a one-time price shock 2) Central bank independence under the Trump administration and 3) The restrictiveness of policy rates, and how opinions on this front are divided within the committee. We view risks over the meeting as skewed to a dovish reaction, and remain biased to long expressions targeted on 2025 year-end rates. While mid-2025 meeting gaps like Jul/Sep have flattened modestly off of post-NFP highs, the preponderance of this rally has been driven by a shrinking of hike probabilities within the distribution as opposed to a real push for cuts this year, which could quickly reprice SEP gaps to the -12 to -15 range. We also have sympathy for z5z6 steepeners, which trades as a long vol proxy and expect to steepen in either a substantial rally or selloff. Any hawkish risk is most likely to come via Powell’s response to central bank independence, where a reasonable degree of push-back to Trump’s recent interest rate rhetoric feels like a base case scenario. Positioning in the front end remains somewhat long, but fwd steepeners are fairly concentrated and most at risk to hawkish rhetoric, particularly in the scenario where z5z6 steepens at the expense of 5s30s on push back against cuts in the first half of the year. (Brian Bingham & Cemre Ertas – STIR Macro Trading)

1. Curve Steepeners & Long Swap Spreads: In contrast to December, I think this will be a quite uneventful meeting with only small tweaks in statement and wording tweaks in the first paragraph around the labour market given the strong December employment. The message from the Chair will be to watch and wait which they have the luxury to do given the strong economy. They want to see further progress down towards 2%, very much a FED in wait-and-see mode. With conviction, if the labour market was to weaken or multiple weak payroll reports, that would completely change their tune – absent this, they will watch the data and watch the policies of the new administration unfold before moving again. In terms of R*, I felt that it moved into a higher range for a while, it feels like the Fed has generally been acknowledging this – that being said, the Chair mentioned multiple times in December that the policy was restrictive. If the economy continues to perform well, you would continue to see a rise in the long run dot.

Around favorite trades, I continue to have a strong conviction that the US yield curve will steepen over time. I think the term premia priced in late December and early January came from an exceptionally low starting point, the next move from the Fed will be an ease, and the market will look forward to the prospect of a new FED Chair. Combined with the general high deficits and high level of supply the market needs to digest, the term premium could increase. I like to be long swap spreads, that is something that I have been opposite for many years with deficits and a general need to digest a greater amount of bond supply – I think a good amount of that is in the price, I think there is good carry and roll down, and the prospect of longer-term deficit-cutting measures is underappreciated. (Josh Schiffrin – Chief Strategy Officer and Head of Financial Risk for GBM)

1. Rate Vol Update: The start of the year has been eventful across a series of data prints, inauguration anticipation, and setup for the Fed. As the market traded heavy out of year end and into NFP, the desk saw material demand for intermediate expiry vol, both on the left side and right side of the surface, as well as demand for upper left receivers as cuts continued to be priced out of whites and reds. After the strong print, the sizable bear flattening induced a further bid to vols leading into CPI. The in line/weaker side CPI print allowed the market to breathe a strong sigh of relief, as we backed off of 5% in the bond and the belly richened into the ~15bp retrace in belly yields. Just as vols went up a good deal into the selloff, this rally back into the middle/richer side of the local range caused a pretty material collapse in implieds, and in particular a steepening of the surface as shorter dated expiries felt the brunt of the move. However, short dated implieds were very well bid on the Friday before inauguration, even as the rate market itself failed to deliver, on anticipation of Trump’s remarks at his inauguration address. In particular, the franchise came in to sell upper left (3m-1y expiry), particularly in 2y tails, to take out some of the risk premium for tariff-induced policy uncertainty. With delivered vol collapsing through the end of last week, implied vols took a further leg lower and we reached local lows in outright vols, the richness of left vs right, and the steepness of the surface. At one point last Friday, 1d10y straddles traded at 3.35bp breakeven for this Monday. With benefit of hindsight, that was very good value. Deepseek euphoria induced a negative move in risk assets and an associated bid for Treasuries, sending implied vols bid, particularly on TY whose spreads massively outperformed. Though we saw some demand for gamma first thing in the morning, as equities bounced off of the lows, flows quickly turned to selling the pop and duration eased off of the highs. Now, the market is looking towards the FOMC, which is supposed to be a non-event from an incremental information perspective, though vols and delta will be levered to any indication of a change in the Fed’s reaction function by Powell. (Mitch Cornell – USD Rate Vol Trading)

FX:

2. Further Downside Risks; But Don’t Expect USD Downturn: I think the biggest question for this meeting is whether the FOMC still feels that rates are “meaningfully restrictive,” which will dictate how quickly the Fed would be willing to respond to an unexpected loosening in the labor market, or tightening in financial conditions from the equity market selloff.

This matters to us in FX because the extra support the Dollar was receiving from tariff expectations has fallen away for now. We still think rate differentials supported EUR/USD’s decline from 1.12 to around 1.05, but overly-aggressive tariff expectations were responsible for much of the remainder over the last month. We think about two-thirds of that tariff premium has now unwound, which is in line with a positioning reset but too far relative to the shift in fundamentals. With those expectations now pushed back, there is some further downside risk if the Fed also convinces the market that some of the policy rate repricing was similarly aggressive.

This leads to the Dollar question of the day, which is whether the Dollar can fall together with US equities. While this can happen occasionally, I think what made the moves around SVB in 2023 so clear is we swapped monetary tightening for credit tightening, which has the opposite effect for the currency. Initially, the Dollar decline was concentrated in JPY, CHF and EUR, but morphed into higher beta currencies when the market priced an easier path for the Fed. Today’s move looks different. Even though strong asset returns have been an important support of the strong Dollar, we have to look at that in relative terms, and I wouldn’t expect this to turn into a broader Dollar downturn unless there is a clear tightening that the Fed needs to respond to. (Michael Cahill – FX Research)

3. Fed Likely On Hold; Recent Moves Are Tariff Driven: The FED is likely on hold for at least two quarters and recent moves in FX have been, and is likely to continue being, driven by tariff developments (or lack thereof). The apparently dovish stance from most Trump narratives last week with respective to tariff imposition has even prompted some to suggest that we may have seen the cycle highs in the USD. I find this prognosis to be somewhat premature. Clearly the consensus (and I include myself) has been wrong footed on the timing of tariff delivery. Unfortunately, the fact that DT himself referenced February 1st as a potentially significant milestone means that the market will likely view it as such and over-price tariff delivery into the date and overreact to non-delivery immediately afterwards. Reality is that the new Administration does appear to be taking a much more considered approach to tariffs more broadly. My read is that means they are coming later (likely case: Q2), but they are still coming. I also sense an over-reaction to the “would rather not tariff China comment”, although like most moves this week, that likely just reflected a surfeit of wrong-footed positioning that could not bear one more challenging soundbite. However, I was surprised at the aggregate tone regarding tariffs this week which to me at least, plays up the near term risks to Mexico and Canada, plays down the near term risks to Europe and China, and for all gives me the impression that the “negotiation impact” of tariffs should be given precedence over their actual likelihood of imposition.

Last week we flagged 1.07/08 in EURUSD and 7.20/25 in USDCNH in the event of tariff disappointment. We have achieved the latter but are struggling to achieve the former although we may still, but positioning is rapidly turning more neutral. Both levels look worthy re-entry points for core USD strength. In the aftermath of an admittedly surprisingly dovish and conciliatory DT this week, a more broadly tactical approach is required, as I suspect the real catalysts for a re-test of the cycle highs in the USD may not come until Q2, but I still believe they will come. Given the risk to Canada and Mexico being high and early on the list, I would look to position for USD topside in both, on a 3m horizon, but with the caveat that Feb 1 is now a bigger event than it should be… And whilst we are fans of JPY this year, we find the price action in USD/JPY this week as confirming our concerns that this has become consensus with USDJPY barely changed despite the BOJ hiking and the DXY selling off 150bp: we can be patient for a return to 158+ before engaging on USD shorts there.” (Alan Stewart – Head of EMEA EM Trading)

Equities:

1. Policy News & Tech Earnings to Dominate: Our forecasts are for the Fed to hold the policy rate unchanged at this meeting and to cut 50 more basis points later this year. Our Econ team believes that the meeting is unlikely to offer a lot of new information. The market is fully pricing a hold this week, and beyond that is pricing ~50bps of cuts remaining in the Fed’s cutting cycle. With the labor market seemingly healthy, the focus this time around is likely to be on any hints as to how the Fed is thinking about the restrictiveness of the funds rate at current levels, and about both the uncertainty around and potential impact of tariffs. But they may not offer much new until they have more information about both the inflation trajectory and the path of broader policies. The market priced a hawkish policy shock after the last FOMC and through payrolls, but has unwound some of that since the friendlier CPI release and in the absence of early tariff actions. The market is already pricing strong growth but seems more worried about inflation risks again—our broad view is that the market is overpricing the risks of rate hikes this year and underpricing the probability-weighted path, so we have viewed receivers on front-end rates as potential hedges against any growth worry. We also think relaxation about inflation-driven Fed risks should ultimately be helpful for risk assets and think it makes sense to take advantage of optionality when the market offers it cheaply. Any softening in the tone from December would likely continue the recent relaxation about Fed hawkishness. But policy news from the new Administration and tech earnings are likely to dominate over the coming days and weeks and it is the run-up to the March FOMC that is likely to be more significant for markets. (Dom Wilson & Vickie Chang).

2. Like Owning Options Into The Fed: Equities had a rough start to the week as news of DeepSeek’s AI model sent US tech stocks tumbling. SPX finished the day -1.4% and NDX finished -2.9%. Interestingly, we didn’t see an outsized vol reaction to the large realized moves. Vol and skew both were bid, but not as much as one would expect on a day where spot moved over 3 standard deviations. We think this is indicative of the saturated positioning in vol – dealers are net long options from systematic sellers and do not need to buy convexity off the back of large market moves. With this setup, the desk likes owning options heading into Wednesday’s Fed as we think they will continue to carry well. Wednesday’s straddle in SPX is currently 1.05%. (Alexis Slattery – Index Deriv Trading)

Credit:

1. At The Tights But Still Constructive: Into January’s FOMC meeting, credit is back near historical tights, with CDX IG inside 49bps and CDX HY above a $108 price. These are tight valuations amidst an uncertain macro environment, but at an ok fundamental point and constructive technical backdrop. Before the DeepSeek headlines impacted broader markets going into this FOMC week, the desk saw hedges being added in the one delta product. Tails remain very cheap in credit, and look attractive as entry points for hedging agendas. Market participants are less focused on small to moderate sell offs where credit’s beta to equities remains decayed, as the synthetic credit market has its eyes, and its hedges, instead set on more ‘taily’ structures, playing for downside in the case of beta ramping up in larger scale sell offs.

Looking at the broader picture, to see a sustained large move wider, the technical picture in credit needs to deteriorate – a catalyst, change in US inflation, slowdown of the inflows below net supply, etc. Going into the meeting, the expectation is that there will not be much new information provided; moreso, a reiteration of a stabilizing labor market without strong guidance about March or the timeline for further cuts. The US economic landscape still looks promising with strong growth, inflation seemingly coming down, low unemployment, and a supportive government administration – even amidst some macro volatility in headlines and policy. Given this landscape, we continue to think compression will play out. (Thank You Lex Groark – Macro Credit Index Trading)

Commodities:

1. Jan Meeting Unlikely to Offer New Insights: Gold’s focus still lies between a renewed buying pressure from central banks, Trumps’s statements and some physical intricacies that have kept the market busy since early December. The easing cycle remains a tailwind for Gold but investors are more focused on international trade policies and local physical developments. Barring an unexpected statement or shift in language, we believe the Jan meeting is unlikely to offer new insights into the path forward. (Ben Binet Laisne – Metals Trading)