Uddrag fra Goldman Sachs/ Zerohedge

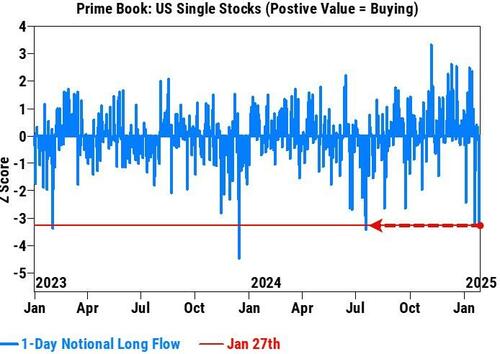

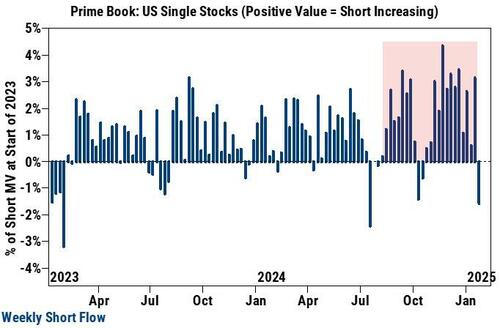

US single stocks on the Prime book on Monday saw the largest net selling since Sep ’24 (-2.4 SDs), driven almost entirely by long liquidations.

Source: Goldman Sachs

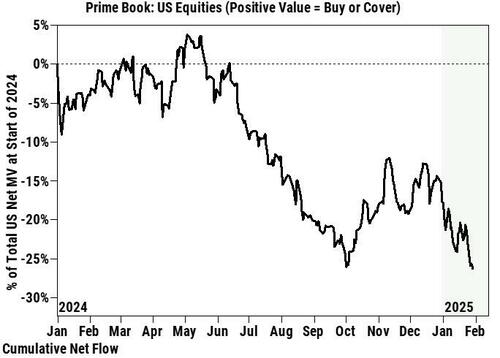

So far in January in cumulative notional terms, short sales in US equities have outpaced long buys by roughly 10 to 1.

Source: Goldman Sachs

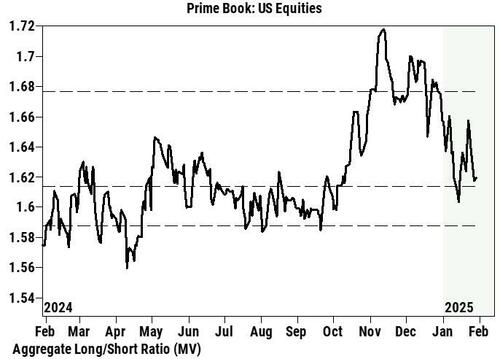

Aggregate US Long/Short ratio (MV) has fallen sharply in the past month and is now roughly in-line with one-year averages in the 57th percentile.

Source: Goldman Sachs

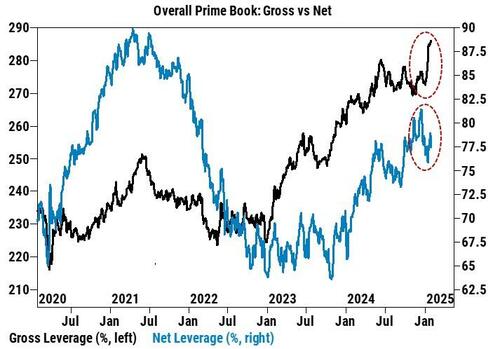

Overall Gross leverage has increased sharply by ~13 pts in January MTD, while Net leverage is roughly flat.

Source: Goldman Sachs

Since the start of the year, aggregate short market value in the US has risen by +5.3%, outpacing the +2.9% increase in long market value.

Source: Goldman Sachs

Coming into this week, US single stock shorts on the Prime book have increased in 22 of the last 25 weeks.

Source: Goldman Sachs

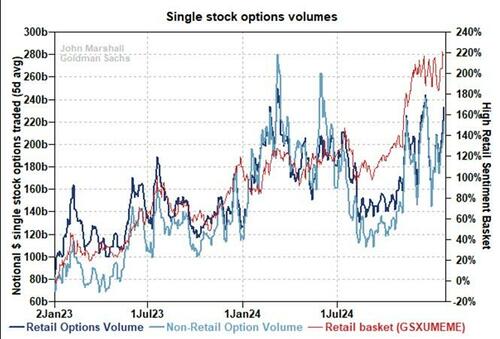

John Marshall in GIR noted a recent surge of option volumes in single stocks…

Source: Goldman Sachs

…which together with strong market seasonality thru mid-February as well as signs of rising animal spirits from retail traders ( h/t Scott Rubner) increase the risk of a short unwind in the near term, in our view.