Uddrag fra Bank of Americas Harnett/ Zerohedge

Meanwhile, the investor zeitgeist is stay risk-on until:

- 2nd wave inflation causes Fed hikes,

- US growth surprises down (via say fiscal tightening/payrolls <50k/credit event).

Being the perpetual contrarian, Hartnett says no to the conventional zeitgeist, and instead lays out the BIG Trade, saying to go long “BIG” in ’25, expecting contrarian outperformance of Bonds, International stocks, Gold.

On Bonds:

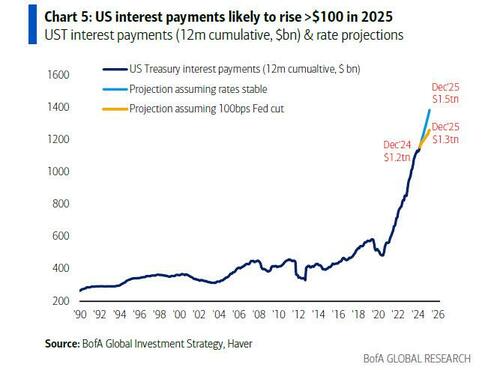

Make Treasuries Great Again: Hartnett expects US Treasury yields to fall below 4%; as background, the BofA analyst writes that the $37tn of government debt & budget deficit of 9% GDP in the past 5 years is a huge catalyst for the 50% jump in US nominal GDP since 2020; as Hartnett noted previously, the $7tn US government is now 3rd largest economy in world, and – perhaps the most important point of Hartnett’s latest note – is that Trump/Musk need a US government recession to arrest US debt spiral (that’s because interest payments are set to rise $100-300bn next 12 months)..

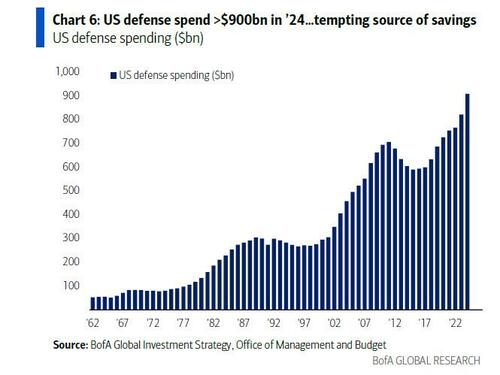

… and persuade the GOP deficit-hawkish Freedom Caucus to back Trump tax cuts (via budget reconciliation); meanwhile, Musk’s DOGE (Department of Government Efficiency) targets $1tn of public sector savings; BofA Global Research Economics base case is $150-300bn in savings, but could rise to $500bn (1.5% of GDP) if administration successful on spending impoundment & layoff-related litigation; Hartnett sees the US defense budget, which is set to surpass $900bn in ’24 vs $630bn in ’19…

… as a tempting source of savings as the “forever wars” end. Finally, a US government recession is bond positive.

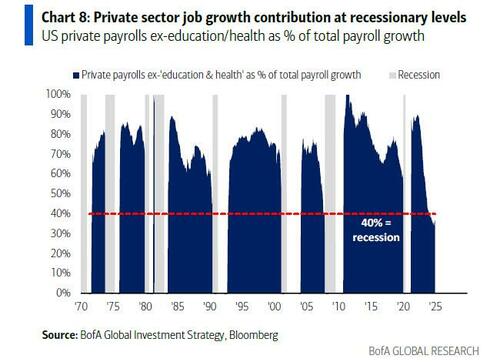

Big government to small government is also bond-positive via labor market; consider that the US public sector (government/education/health) accounts for 1/3 of US payrolls, and has created 1 of every 4 new jobs this decade, public sector payrolls currently growing 3% YoY vs. <1% YoY in private sector.

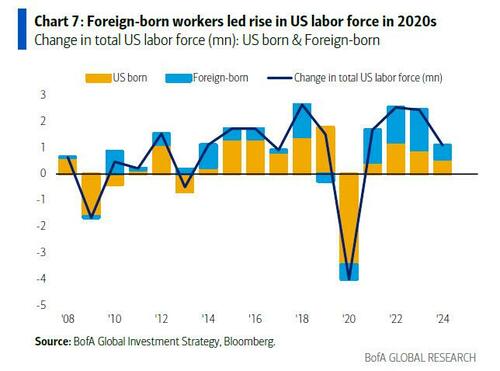

But if Trump/Musk get their wish of a smaller government = public sector jobs down = US payrolls peak in H1’25; in addition new immigration policy = bond bullish. Sure enough, US-Mexico border encounters falling sharply (800k in Q4’23, 300k in Q4’24, likely fall toward zero in Q1’25); Here Hartnett points out the chart we first created over a year ago, showing that the 3.9 million jump in number of foreign-born workers since Jan 2020 accounted for >90% of increase in US labor supply, an increase that boosted profit margins & consumer spending; but these bond-negative catalysts are set to reverse as supply of foreign workers falls in ‘25/’26.

Finally, Hartnett notes that :all great bull markets begin with a bear market rally”; and unloved Treasuries in a bear market rally in 2025, remain the best allocation hedge for a “top” in asset prices, and bond risk-reward improving; Hartnett calculates that a ‘low risk’ bond portfolio (20% T-bills, 20% 30-year US Treasury, 20% IG, 20% HY, 20% EM) generates 9-10% if US Treasury yields fall back toward 4%, and the BofA strategist expect US Treasury yields to fall below 4% in ’25.

On International:

Global stocks are simply a “cheap with catalysts” play in ‘25: China stocks trading on 10x, UK & Emerging Markets on 12x, Europe on 14x vs US forward PE of 22x; bad geopolitics is great for tech/defense-heavy, energy-independent US, and less good for mercantilist, oil-dependent Asia & Europe…but Hartnett believes that geopolitics in 2025 is shifting from bad to good (not so sure about that); and while manufacturing recessions are good for US growth stocks, the US manufacturing recession ending (global PMIs up from 45-50 two-year contraction range to 50-55 expansion range), which is positive for global value stocks; furthermore, China/Europe are easing fiscal policy in ’25 (contrast to US in ’25), and funding reconstruction in Ukraine & Middle East, more Europe & Japan defense spending, stimulating China consumer; Hartnett is therefore:

- long China on no escalation of US-China trade/tech war,

- won’t go long Japan until Nikkei can prove it can rally with stronger yen,

- long Europe but expect profit-taking on Feb 23rd German election and Feb/March Russia/Ukraine peace talks;

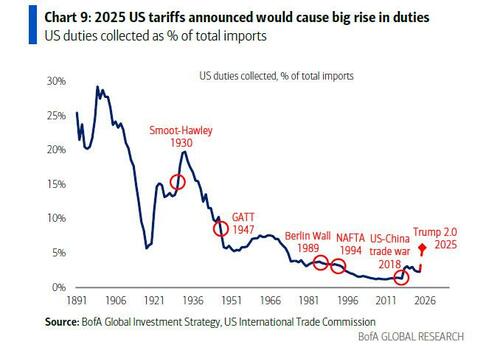

Trade war won’t end ’25 bid for International; The BofA analyst concedes that implementation of US tariffs (now delayed) on $1.4tn of China/Mexico/Canada imports would have caused spike from 2% to 6% in US duties as % of imports…

… and yes, the backdrop is more vulnerable to big trade war in 2025 than in 2018 (when US taxes had just been cut, global manufacturing was booming with all PMIs 55-60)…

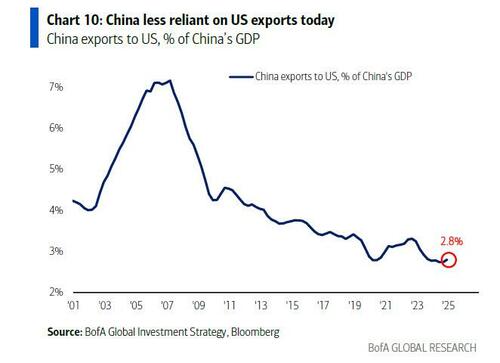

… and inflation no threat (CPI had averaged 1.5% since GFC), tech less dominant (Magnificent 7 = 15% of S&P 500 vs. 33% today); but Hartnett observes that the 2025 reality is there are 2 trade wars: the real strategic one with China, and tactical ones with everyone else; the latter is to remain transactional; and too much for US & China to lose with big escalation of US-China trade war. To this point, Hartnett cautions that it would be a big political misstep for Trump to allow 2nd wave of inflation, and meanwhile China is less reliant on exports to the US, which are down to just 2.8% of China GDP today vs. 7.2% in ’07…

… and neither side is likely to pursue “MAD” tech war because while US and allies control >90% of global semiconductor manufacturing, China extracts 60% and processes 85% of world’s rare earth minerals.