Uddrag fra Goldman, JP Morgan og en stribe andre finanshuse:

Analytikernes forventninger: Senest Forventning

| Feb 12, 14:30 | 5h 3min | USD | Inflation Rate MoM (Jan) | High | 0.4% | 0.3% | |||

| Feb 12, 14:30 | 5h 3min | USD | Core Inflation Rate MoM (Jan) | High | 0.2% | 0.3% | |||

| Feb 12, 14:30 | 5h 3min | USD | CPI s.a (Jan) | High | 317.685 | 318.2 | |||

| Feb 12, 14:30 | 5h 3min | USD | Inflation Rate YoY (Jan) | High | 2.9% | 2.9% | |||

| Feb 12, 14:30 | 5h 3min | USD | Core Inflation Rate YoY (Jan) | High | 3.2% | 3.1% | |||

| Feb 12, 14:30 | 5h 3min | USD | CPI (Jan) | High | 315.61 | 317.46 |

After the market yoyoed like a volatile, drunken sailor for much of 2022 and 2023 after every monthly CPI print, focus gradually shifted away from the inflation number and to unemployment because the Fed, conventional wisdom claimed, had inflation under control and so the only gating factor for Fed policy was slack or tightness in the labor market. But now that the labor market has slowed down substantially and appears to have stabilized in the low-100K range even as inflation refuses to make the trek from 3% to 2%, and in fact is started to pick up again, attention is once again shifting to the CPI number, so much so that according to JPM, S&P option straddles are pricing in a whopping 1.3% swing in the S&P on Wednesday, one of the largest implied move ahead of a CPI print since the regional bank turmoil of 2023.

In other words, the CPI matters a lot, again.

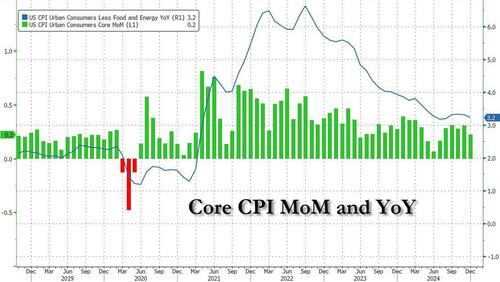

The good news, for Trump, is that last month’s CPI report came in cooler than expected, with Core CPI missing expectations both sequentially and YoY (while headline CPI rose at a 2.9% annual pace, the highest since July, if in line with estimates)

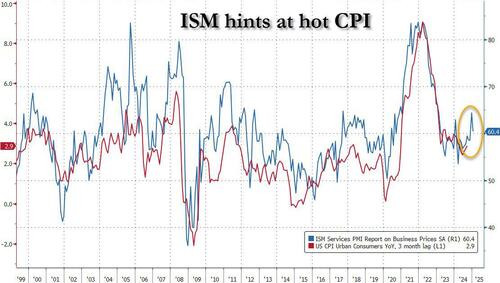

Unfortunately, it appears unlikely that headline CPI will come in cool for two months in a row, especially with energy prices starting to pick up once again not to mention the recent spike in several key food items such as eggs, while core inflation remains as sticky as ever; meanwhile the recent jump in the stock market is only boosting the wealth effect, which is never deflationary. Furthermore, as we first pointed out last month, the highly correlated CPI and ISM Service Prices Paid index suggest that inflation is due for a sizable move higher.

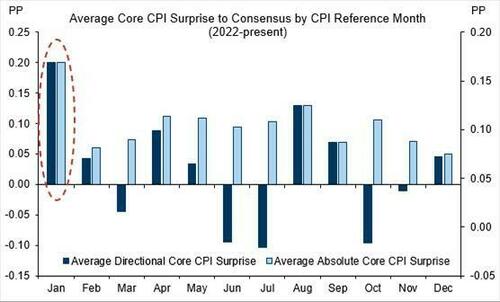

Separately, in recent years January has regularly seen the CPI surprise to the topside (see chart below). On the other hand, Goldman sees less scope for a January surge in sequential inflation from outsized start of the year price increases this year (i.e., what we’ve dubbed the “January effect”), because price pressures have moderated over the last year and also because the bar for a seasonally adjusted January jump has risen as the seasonal factors have come to expect larger January increases.

In short, the risk is for another upside CPI surprise, something which any remaining deep state operatives at the BLS will be more than happy to “goalseek” for Trump’s first official inflation report as it means even less probability of a Fed rate cut during Trump’s first year, and thus more market pain, more disenchantment with a Trump admin that would be “more of the same”, and at least something for the panicked and demoralized Democrats to look forward to.

With that said, here is a quick preview of what consensus expects tomorrow:

- Headline CPI is expected to rise by 0.3% in January, down from the previous month’s 0.4% pace; Analyst expectations currently range from 0.2-0.4%.

- Annual CPI is also expected to remain unchanged at 2.9% and a five month high, with forecasts in a rather wide range between 2.5-3.1%.

- Core CPI is expected to rise 0.3% M/M, up from 0.2% in December; that translates into a 3.1% Y/Y increase, below the previous month’s 3.2% print.

- For the monthly print forecasts range between 0.2-0.4% ; this translates into a year-over-year print range from 2.9-3.3%.

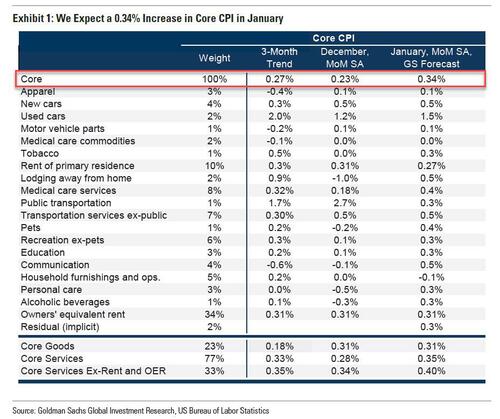

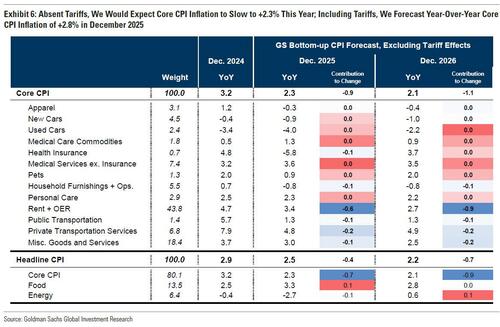

Confirming the risk to a hot print tomorrow, Goldman is slightly ahead of consensus, and expects a 0.34% increase in January core CPI (vs. 0.3% consensus), a number which is just a fraction away from rounding up to 0.4%, and which corresponds to a year-over-year rate of 3.19% (vs. 3.1% consensus). The bank also expects a 0.36% increase in January headline CPI (vs. 0.3% consensus), reflecting 0.4% higher food prices and 0.6% higher energy prices. The bank’s forecast is consistent with a 0.40% increase in CPI core services excluding rent and owners’ equivalent rent and with a 0.32% increase in core PCE in December.

Some more details: Goldman highlights three key component-level trends expected in this month’s report:

1. Car prices. After rising 1.2% in December, the bank expects used car prices to accelerate to a 1.5% increase in January, reflecting an increase in used-car auction prices. New car prices should rise 0.5%, as promotional dealer incentives declined 12% on a sequential basis in January.

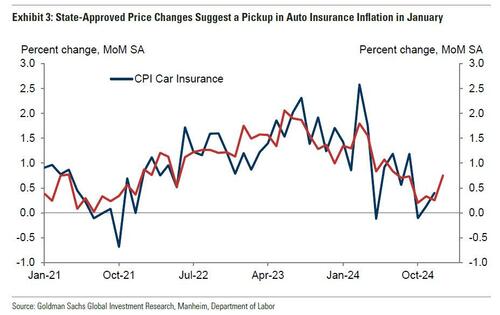

2. Car Insurance. Goldman expects an acceleration in car insurance prices (+0.75%) in January (vs. +0.40% in December), reflecting increases in premiums indicated by the bank’s online dataset. Higher car prices, repair costs, and medical and litigation costs have all put pressure on insurance companies to raise prices, but premiums have been passed onto consumers with a long lag in part because insurers have to negotiate price increases with state regulators. Most of the gap between insurance premiums and costs has now closed. As a result, while increases in CPI car insurance will return to the pre-pandemic pace this year, an early read on February suggests a slightly larger increase than in January.

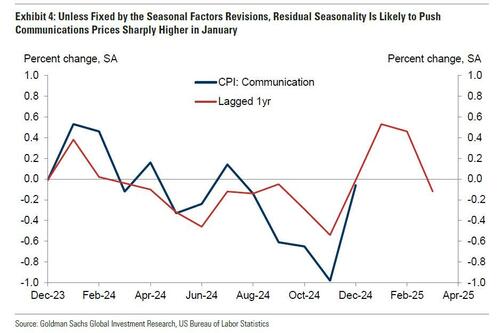

3. Communications. Goldman expects seasonal distortions and a postage price increase to boost the communications category relative to its typically deflationary trend (GS forecast +0.5% for January vs. flat in December and -1.0% in November). However, the seasonal distortions present in this category could be tempered by the annual revisions to the seasonal factors released with this week’s report (discussed in more detail below).

Elsewhere in the report, the bank expects softer airfares inflation this month because seasonal distortions should provide only a modest boost and the bank’s online dataset suggests that underlying pricing trends were sequentially softer. Shelter categories are expected to moderate slightly, reflecting a 0.31% increase in owners’ equivalent rent (vs. +0.33% in December) and a 0.27% increase in rent (vs. +0.33% in December).

The January report will also incorporate two annual updates to the CPI:

First, the seasonal factors will be updated to reflect the price movements of 2024, which could reduce the impact of seasonal distortions that explained some of the pattern of core inflation last year. The revisions tend to cause monthly inflation readings to be revised toward the annual average. In other words, higher inflation readings for the year tend to be revised lower and lower readings tend to be revised higher. On average over the last decade, about 20% of the relative strength of a month’s initial core inflation vintage has been revised away in its first annual revision. Last year, monthly core CPI inflation was particularly elevated in Q1 (10bp above the 2024 average) and particularly low in May-July (14bp below).

The seasonal factor revision could also lead to the resumption of seasonal adjustment for some components. The pandemic disrupted some seasonal patterns and introduced new ones, causing some components that were once adjusted to begin failing seasonality tests. Indeed, the BLS stopped seasonally adjusting CPI categories amounting to roughly 16% of the basket at the beginning of 2021 and has not yet resumed adjustment for many of those categories. Seasonal patterns appear to have reemerged for some of these components, such a consumer electronics, which were seasonally adjusted prior to the pandemic but had not tested positive for seasonality thereafter. Resumption of seasonal adjustment for some of these components would likely have a larger impact on PCE prices than the CPI because many of these components have a larger weight in the PCE price index than in the CPI. Because only the prior two months of data are revised with a given PCE release, the full impact on PCE prices likely will not be fully realized until the NIPA annual revisions in September.

Second, the weights will be updated to reflect spending shares from the latest Consumer Expenditure Survey, which corresponds to spending in 2023. With the largest shifts in consumption patterns having occurred by 2022, this revision is not expect to result in meaningful changes in the component weights with this update.

Going forward, Goldman expects monthly CPI inflation of around 0.25% over the next few months; the bank sees further disinflation in the pipeline from rebalancing in the auto, housing rental, and labor markets, though Goldman expects offsets from catch-up inflation in healthcare and a boost from an escalation in tariff policy. Year-over-year core CPI inflation is expected to print around +2.8% and core PCE inflation of +2.6% in December 2025.

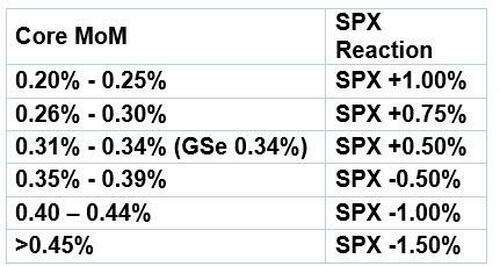

In terms of the market’s reaction function, Goldman’s Lee Coppersmith expects the following based on what core MoM CPI prints:

Going around the Goldman trading desk, here are some other expectations

Dom Wilson (Senior Markets Advisor)

Our official forecast for the CPI is a bit of a mixed bag – a touch above consensus at 0.4% on headline and a 34bp core CPI reading (which is on the high side, but rounds to, the 0.3% consensus). With January effects still a potential issue, and new seasonal factors, there’s probably a bit more variance than usual around that. If we print around the consensus, there could be some mild relief, given that yoy readings will move lower, but the market may need to see February/March readings to conclude that Q1 overall is tracking meaningfully better than last year’s bump. As with a lot of macro data, the larger issue is that it’s the policy backdrop that is the bigger swing factor for inflation and the Fed.

We do think the underlying inflation pressures ex-tariffs are likely to prove more benign than the market expects, but tariffs are likely to offset that in the near-term and we’ve raised our inflation forecasts recently. Markets have priced some of that risk already – front-end inflation has climbed to new local highs recently – and we have less than 1.5 Fed cuts priced for 2025, with little beyond that. So over the medium term, the risks skew towards friendlier inflation and more easing than the market now expects, particularly beyond the next couple of quarters. But given that trade policy is a key issue here, tomorrow’s CPI release likely won’t really shift views here unless it’s a big surprise. We still think should move higher along our baseline, but favor diversifying that exposure to include non-US markets, and pairing that with long USD exposure.

Ryan Hammond (US Equity Portfolio Strategy)

Despite near-term uncertainty, a solid fundamental outlook remains key to our view that the S&P 500 will ultimately rise 7% to 6500 by year-end. As we wrote on Friday, 4Q earnings season generally validated our baseline view. Aggregate EPS grew 12% year/year, beating the consensus expectation of 8% growth at the beginning of reporting season. The median stock grew earnings by 7%. Bottom-up consensus 2025 earnings estimates had remarkably resilient last year thanks to continued improvements in Magnificent 7 earnings expectations. Consensus 2025 EPS estimates have recently inflected lower, but this dynamic consistent with the historical pattern of negative EPS revisions. Our 2025 S&P 500 EPS forecast of $268 (+11% year/year growth) is roughly 1% below the top-down and bottom-up consensus estimates. Tariffs represent a potential downside risk: We estimate that every 5 pp increase in the US tariff rate would reduce S&P 500 EPS by roughly 1-2%, holding all else equal.

Joe Clyne (Index Vol Trading)

Heading into tomorrow’s CPI, we continue to think that the street is long gamma and prefer owning forward vol to owning spot starting vol. The straddle for tomorrow looks like it will go out around 80 bps. That is broadly in line with recent realized even with the event tomorrow, but the desk thinks that speaks to the fact that gamma is well-owned street wide. On the other hand, we think that the 3m 25 delta call, particularly in SPX, looks like a good own on close to an 11v. In fact, looking broadly across the curve, we think longer-dated upside looks like a better own than gamma. NDX and RUT vols look more fair to us, but if we had to pick a gamma to own, we’d pick RUT even after it’s recent difficult spell of carry. All in all, we like being long forward vol, especially on the upside.

As has become a monthly tradition, JPMorgan’s market intel desk is also out with its reaction matrix, which is based on the core CPI MoM print and is as follows:

- 0.40% or higher. This first tail outcome would likely be driven by a spike in Shelter as well as seeing some parts of Core Goods flipping from deflationary to inflationary (HH, Medical, and Alcohol). Expect the bond market to react violently as it shifts its view to Fed Funds not being restrictive and the most likely next action of the Fed to be a hike rather than a cut. The move in bond yields would pull the USD higher, further pressuring stocks. Look for NDX to outperform SPX and RTY to underperform. Odds 5.0%; SPX loses 1.5% – 2%.

- Between 0.33% – 0.39%. This outcome is likely driven more by hotter goods than services with a more muted reaction in the bond market but similar reaction on stocks. This print is unlikely to fully eliminate all cut expectations for FY25, but likely pushed implied probabilities to be a coin flip as to whether we get one cut in FY25. As of Friday, 37.5bps worth of cuts are being priced into the bond market. Odds 25.0%; SPX loses 75bps – 1.5%.

- Between 0.27% – 0.33%. The base scenario which shows a mild increase MoM but is aligned with the trend seen since September which is an inflection higher in inflation that is trending higher with improved growth/hiring, albeit at a potentially softer rate. Look for bond yields to remain range-bound and for a positive outcome for stocks. The upper range is not quite Goldilocks but given the resilience of the market YTD stocks likely push higher led by RTY. Odds, 40.0%; SPX loses 25bps to gains 1%.

- Between 0.21% – 0.27%. This is Goldilocks especially if we combine this with a stronger Retail Sales number. Look for the market to fully price in 2x cuts this year and for Equities to respond favorably led by SMid-caps. Odds 25.0%;

- SPX gains 1% – 1.5%.

- 0.20% or lower. The other tail outcome, potentially achieved by a stepdown in Shelter as Core Goods flips back to being net deflationary. Bond yields bull steepen in this scenario leading to material outperformance by RTY versus SPX. USD likely has a negative reaction aiding EM Equities which likely outperform RTY. Odds 5.0%; SPX gains 1.25% – 1.75%.

The Market Intel team underscores what we said above: unlike just a few months ago, when straddles priced in at most a 0.3%-0.4% market move on CPI days, the market is suddenly on edge about tomorrow’s print and the result is that the implied SPX move through tomorrow’s close based on option straddles is a whopping 1.3%, not only well above the 2024 average but also above last month’s 1.1%, which was the highest in over a year.

Commenting on what to expect, Andrew Tyler, head of JPM’s Market Intel desk, says that the Market overreacted to the Univ of Michigan data, in his view. “That puts an over-emphasis on the CPI print. Our view on the economy remains one of above-trend GDP, positive EPS, and a neutral Fed with a dovish tilt. Even a slightly hotter print here does refute that hypothesis but does increase the risk to US inflation from a potential China reboot, particularly if that reboot is catalyzed with larger than expected fiscal stimulus.”

Finally, in terms of how to monetize the print, JPMorgan likes elements of Tech/Growth (Mag7, Datacenters, Semis, ARKK and NDX) and Value/Cyclicals (JPM’s Cyclicals basket, Large-Cap Financials, Regional Banks, Consumer Discretionary like Retailers, Transports, and small-caps), plus EM Equities (Brazil, China, and Mexico) but prefer to use options given the uncertainty surrounding tariff policy. Tyler removed some of the Discretionary plays from the menu, specifically Airlines and Autos/Suppliers. For those looking for shorts, he says that Energy, Materials, and Staples make the most sense.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her