Uddrag fra Goldman Sachs:

We are entering the fourth week of President Trump’s term. The tariff threat has so far been used for fentanyl and immigration, but this week it shited to supply chain security (over the weekend announced 25% tariffs on aluminum and steel imports from all countries) and trade imbalances (pre-announced news conference on trade reciprocity).

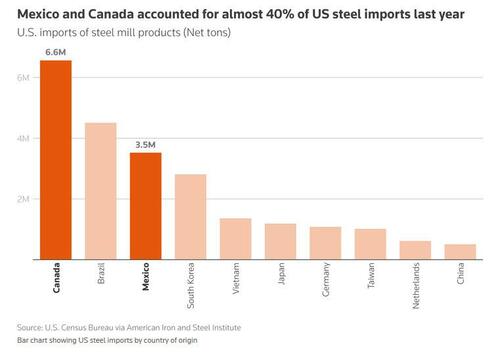

That threat was implemented just after 5pm on Monday, when Trump ordered a 25% tariff on steel and aluminum imports, escalating efforts to protect politically important US industries with levies hitting some of the country’s closest allies, most notably Canada (see below), which is the source of most steel…

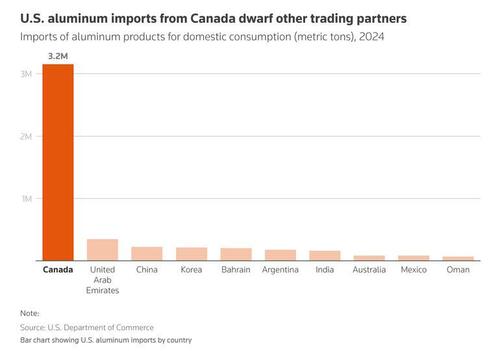

… and virtually all aluminum imports (source).

Some context: roughly a quarter of all steel used in the United States is imported, the bulk of it from Mexico and Canada or countries Asia and Europe like Japan, South Korea and Germany.

While China is the world’s largest steel producer and exporter, very little is sent to the United States. Tariffs of 25% imposed in 2018 shut most Chinese steel out of the market. China exported only 508,000 net tons of steel to the U.S. last year or 1.8% of total American steel imports.

In the case of aluminum, the U.S. is more heavily reliant on imports. Roughly half all aluminum used in the U.S. is imported, The vast majority comes from Canada. At 3.2 million tons last year, Canadian imports were twice the next nine countries combined.

Trump’s move comes on top of new 10% tariffs on goods from China; 25% levies on Canada and Mexico that are currently paused; and the president’s plan to slap reciprocal duties on other nations. It is also the broadest-reaching action yet by Trump to confront US trade deficits and harness international commerce as a source of revenue.

Trump authorized the new tariffs under Section 232 of the Trade Expansion Act, which gives the president broad authority to impose trade restrictions on domestic security grounds. It is the same power that Trump used to levy steel and aluminum tariffs in 2018, during his first term in office. With his proclamations Monday, Trump is effectively reviving and expanding those tariffs.

A senior administration official said the action was necessary because steel and aluminum exporters abused exceptions under the previous policy, which hurt US producers. The official detailed the moves on a call with reporters earlier Monday on condition of anonymity.

According to Bloomberg, Trump’s decision to include downstream finished products is a significant move that will have broad-reaching price impacts on a massive swath of US consumers. Whereas Trump’s 2018 tariffs focused mostly on raw steelmaking and primary aluminum production, these new tariffs will include things like extrusions and slabs that are turned into value-added products needed in everything from automobiles to window frames and skyscrapers. The move would fulfill what the most extreme trade protectionists have sought for years.

Trump will also direct US Customs and Border Protection to step up oversight to prevent foreign countries from misclassifying steel products to evade tariffs.

The effort reprises a strategy Trump adopted during his first term, when he imposed tariffs of 25% on steel and 10% on aluminum that prompted a decline in US imports of the metals. The levies sparked retaliation from US trading partners, including the European Union, which imposed tariffs on iconic American goods, from Harley-Davidson Inc. motorcycles to Levi Strauss & Co. jeans.

Trump ended up granting duty-free status to several major exporters, including Canada, Mexico and Brazil. Former President Joe Biden expanded those exemptions during his term in office.

Who is most impacted?

For one answer we go to Goldman commodities trader Adam Gillard, who shares the following perspectives on the proposed tariffs:

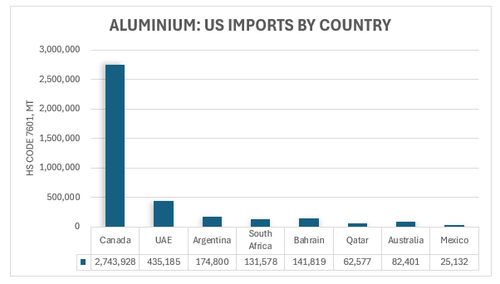

- What is the current US import requirement: Primary imports (HS code 7601) are ~4 million MT per year (vs ~0.7mn production), of which ~68% comes from Canada.

- What are current tariffs on US aluminium imports: During Trump’s first term he implemented 10% tariffs, but granted exemptions for Canada, Argentina and Australia, meaning that in practice no tariffs were applied to US imports given Canadian units are the marginal supply.

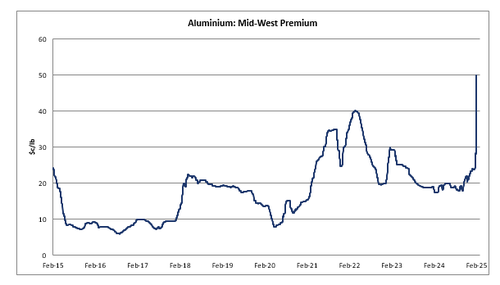

- How does the market incentive US imports: Imports are (broadly) incentivized by the difference between US and European physical premia (Mid-West Premium, “MWP”, and European Duty paid, “EDP”, respectively). Pre-election MWP traded at ~$0.19/lb ($420/mt) vs EDP at ~$340/mt in order to incentivise imports of marginal Canadian units, assuming $0.05/lb logistical costs

- What probability of tariffs were priced on Friday: ~20% chance of a 25% tariff.

- Where should US premiums trade to incentive imports with 25% tariffs: Assuming unchanged European premiums, spot MWP should rally to $0.5/lb to incentive imports

- Does any of this matter for the LME price (ex-US): No. We think MWP rallies in order to continue incentivising US imports from Canada, post 25% tariff application, not the LME price.

Separately, in a note published overnight, DB’s head of FX George Saravelos made several observations on what appears to be Trump’s most likely next step, namely reciprocal tariffs, and concludes that the impact varies widely depending on how reciprocity is defined. Moreover, whether any announcements this week are presented as the opening or closing salvo of a global tariff approach will be of material importance.

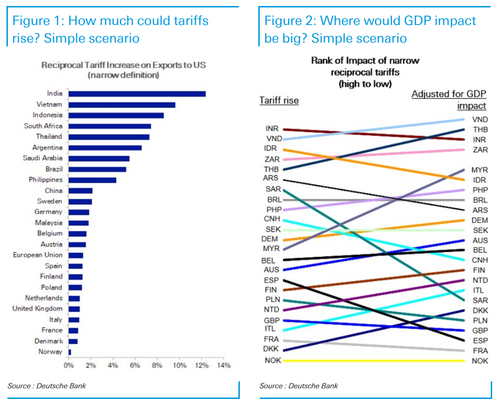

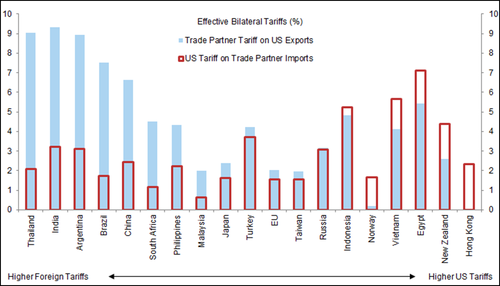

- “Narrow” reciprocity would have a very small impact. Taken as a literal interpretation of the US replicating other countries’ tariffs on its own imports, DB calculates (using 10,000 tariff lines) that the average weighted increase in the US rate would be only 2%. The reason is simple: the starting point of global tariffs is already very low; even if the US matches the rest of the world, the impact would be minimal. Still, some countries would be impacted more than others. The charts below show where tariffs would go up the most, but the numbers also need to be adjusted by the relative importance of US trade in that country’s GDP. Vietnam, Thailand and India show up as the most vulnerable.

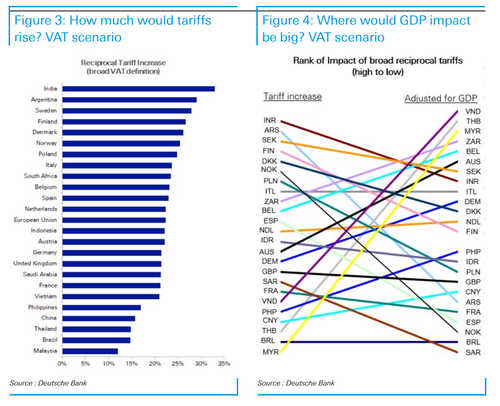

- A broad interpretation could be much more damaging. But are reciprocal tariffs more broadly defined? In an interview last week, NEC Chair Kevin Hassett emphasized the high burden of European taxation on US companies, with President Trump making frequent references to European VAT as well as non-tariff barriers. If reciprocal tariffs are applied on a VAT basis (note that a US importer does have to pay VAT at the point of entry), European countries would be much higher on the list of impacted countries given high consumption taxes. The overall US tariff rate would increase by more than 10% (figures below).

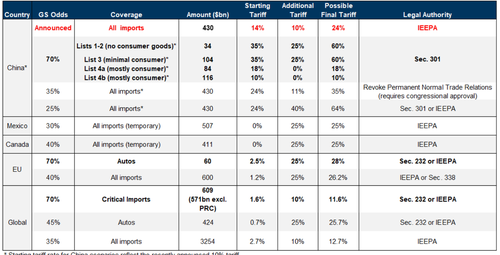

- Timeline unlikely to be immediate. Steel and aluminium tariffs will likely be based on Section 232 national security grounds, which place little restriction on executive authority and can be implemented immediately. They will affect only six countries (Canada and Mexico being the most impacted) given the US already applies such tariffs to the rest of the world. Broad-based reciprocal tariffs are most likely under a Section 301 investigation or Section 338 authority. Both routes were explicitly mentioned in the tariff memo issued on the first day of the administration. Given the preparatory work required, it would be surprising if immediate implementation is announced – and it would be a negative surprise if this were the case.

Next, we go back to the Goldman trading desk where several other traders and strategists share their opinions; below we excerpt several comments and charts below from the bank’s immediate reaction, plus a collection of key quotes from thought leaders at bottom on broader tariff direction.

Mike Cahill (FX Strategy) with some more context:

These announcement shows that last week’s delay of Canada & Mexico tariffs should not be taken as a sign of lower terminal tariff risks, but rather that these “negotiating tariffs” are distinct from the protectionist tariffs Trump has long favored.

Steel & aluminium tariffs have been an important focus for Trump throughout even though they affect a little less than $50bn of imports. They were the first real shot in the 2018 trade war and ultimately proved to be a microcosm of US trade policy under Trump–bigger than expected, frequently delayed and adjusted to exempt some of the larger impacts. But ultimately implemented eventually.

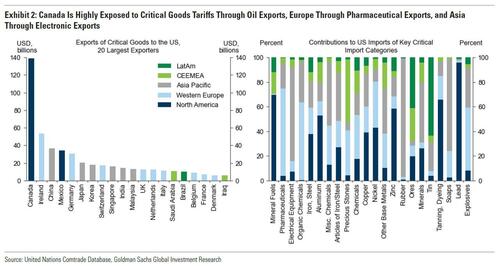

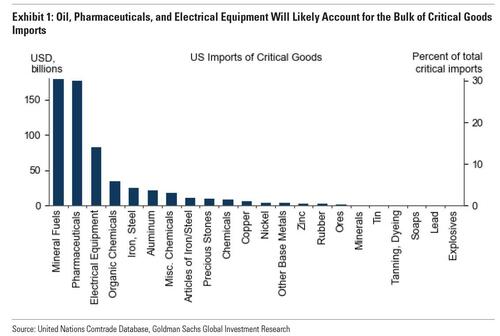

Steel/aluminium only small part of broader critical imports category: Alec Phillips baseline trade outlook now also incorporates a 10% increase in tariff rates on $609bn of US critical imports from all trade partners (70% probability).

Based on recent comments from President Trump, Goldman anticipates that oil, pharmaceuticals, and semiconductors and other electrical equipment will account for the bulk of these critical goods (

Countries impacted: Critical goods tariffs would have a broad global impact under our assumed product list. They would likely affect $139bn of US imports from Canada (mostly oil), $142bn from the Euro Area (mostly pharmaceuticals), and $141bn from Asia (mostly semiconductors and other electrical equipment).

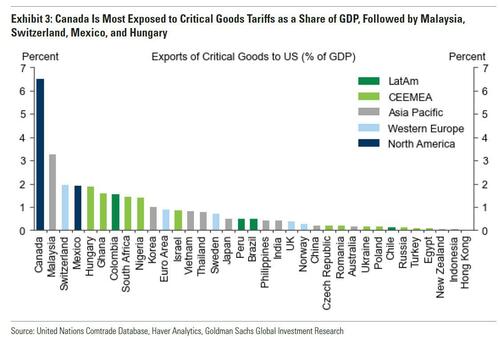

Canada is again most exposed as a share of GDP (6.5%), although Malaysia (3.2%), Switzerland (2.0%), Mexico (1.9%), and Hungary (1.9%) would also face export headwinds from these tariffs.

On Reciprocal Tariffs – Who’s at Risk?

See below for helpful chart published back in 2018 by Goldman. It shows that EMs are more exposed to reciprocal tariff risk (given the broad trend to lower tariffs in DM). Thailand, India and Brazil are most at risk given the effective tariff spread against the US. However, Trump has also flagged on several occasions the wedge between European and US auto tariffs (10% and 2.5% respectively).

Karen Fishman (FX Strategy):

To assess this risk, we gather data on tariff rates for major US trade partners which are not members in a US free-trade agreement (FTA).The underlying data are so-called “most favored nation” rates—the rates charged to WTO members other than FTA partners—on over 5,000 individual products.[2] We then collect bilateral US exports and imports on these same products. Finally, we calculate effective bilateral tariff rates on US exports—trading partner tariff rates weighted by US export volumes to those markets—and US imports—US tariff rates weighted by US import volumes from those markets. Chart below shows our results with full note here.

Goldman economists have previously flagged that a systematic attempt to fully align tariff rates would require congressional approval. However, there is always chance decides to use a framework of ‘unequal’ tariffs to unilaterally raise tariffs on certain countries under IEEPA.

Finally, here are some key quotes from Goldman thought leaders on Adam Crook’s Weekend Email (here), with many

highlighting the potential shift towards EU.

Alec Phillips (Chief US Political Economist):

Trump has as pretty clearly signaled that he is focused on the EU…. And I think if you had to pick one country or trading bloc that is next in line, you would point to the EU as that one….. We have been assuming auto tariffs on the EU in our base case but obviously, if the President is saying that something is definitely going to happen with regard to the EU, auto tariffs are probably the minimum…. and it’s certainly possible that we end up seeing an EU focused tariff across the board… similar to what they’ve done with Canada and Mexico…. It’s also possible that we end up seeing that critical imports tariff… if you look at the source of those imports outside of Canada, Mexico and China, most of it is coming from the EU…. One way or another, it looks like the EU is going to be a focus… at a minimum auto tariffs… but obviously the risks are increasing around some of those other things…

Brad W. Setser (Senior Fellow Council on Foreign Relations (CFR):

I think probably the next move is some kind of action against Europe, largely because Trump has talked about it and he believes in it…. I think there’s an open debate about whether it’s going to be sectoral, which would imply a Section 232 National Security investigation, probably on pharmaceuticals as well as autos, given what the President has been saying, and that sets up a negotiating period… There does seem to be a set of people in the Administration who want tariffs: Let’s start with a 10% tariff and start big rather than start small… Unclear what legal authority he would use other than IEEPA to do that against Europe… But that’s where the rhetoric has been. ..

I hope that the Administration is reverting back to what I viewed as the expected playbook on Canada, Mexico tariffs… there will be another round of concessions and then it’ll go into a renegotiation of USMCA, which would play out over a six-month period … and then we would be in a world of threats against Europe, perhaps action against Europe and direct negotiation with the Chinese…. But there’s a real probability that we do end up back in a USMCA trade war, which would be one of the most destructive ways to start…. But the next move, I think, is towards Europe…

Geoff Oamoto (GS Office of Government Affairs) paraphrased from GS Weekend Macro Call:

On what China + EU: The auto sector is going to remain in focus, the timing is a little unclear. I think the more interesting question to think through is how much of this will be about electric vehicles and how much of this will be about Chinese supply chains and interests in Mexico vs Europe. President Trump also mentioned interest in copper and sectors like pharmaceuticals….

On the latest reciprocal tariff headlines: They would match the exact tariff level that the US faces with other countries… and they would mirror that tariff back to the country for their exports coming to the US. Again, that is the latest announcement… It is unclear when the timing of that would be if that would be immediate or if that would be delayed…. Certainly, this would mean a variation in country-by-country so in my view if they do pursue this and this reporting is accurate, the reciprocal tariffs are somewhere in the middle of a universal tariff and one for negotiating leverage, because it will be quite broad in terms of its application, but it will still be different country-by-country….