Uddrag fra Goldman/ Zerohedge:

Friday was the worst day of the year in US equities — a cocktail of serious reversion in the momentum factor, a high U-M inflation print and stories of “pandemic potential.”

So, if a big question coming into the week was whether S&P could convincingly breakout from a 3-month trading range, the answer was a decided NO.

Looking forward, the foundation of the US market is still one of durable growth, fairly easy financial conditions and a remarkable acceleration of innovation.

1. flow-of-funds / positioning.

The long gamma position held by option market makers again provided ballast to the tape (in an otherwise very noisy trading environment). looking forward, I’m going with the same framework from last week: flows are supportive now, but that sponsorship is set to wane as February becomes March. part of this is the customary slowdown of start-of-year retail demand, part is the stock buyback seasonal, part is a trading community that’s already pretty full of risk (I’d put length currently held at +7), part is some diminution of that gamma position post-February expiry, and part is the flipping of momentum triggers in the systematic crowd.

2. US tech.

As we head into NVDA earnings, the basic story is this: the Magnificent Seven has come off the boil (with huge intra-cohort skews), while the broad tech complex has performed well (AI software +14%, cyber security +13%, internet +10%, analog semis +8%). here’s another way to frame it: equal weight NDX is up 6% YTD — equivalent to last year’s entire return. with appreciation for the stock specific risk that’s ahead of us — and the opportunity set that suddenly popped up in foreign markets — I would still argue that US tech stocks continue to collectively deliver. I’d also point out that MSFT’s comments on quantum computing add to the 2025 theme of an acceleration in the pace of realized innovation – even if, as Pete Callahan reminded me “this one feels more abstract than some of the headlines we’ve seen this year (and, this doesn’t necessarily mean ‘linear’ stock performance as innovation is a cousin of change and disruption)”.

3. US growth.

As well-narrated by our US Economics department, we have entered a softer patch, with Q1 GDP tracking around 2.0%. should one be concerned? while there are lots of plates spinning at the moment — and plenty for business owners to think about — given the underlying health of the domestic labor market and household balance sheets, I don’t want to go too far on growth concerns just yet. said another way: slower, but not slow.

4. Europe.

A great start to the year had patch of turbulence, with the DAX printing its softest week of the year. here’s where it gets interesting: this market has been recently bought. this is clear to me in GS PB data and broader flow-of-funds data. so, amidst the ongoing volleys on tariffs and Ukraine, as we come out of the German election on Sunday, one big question is whether this inflection in the flow of capital will persist or not.

5. China.

I’ll lead with a similar observation: this market is being bought. from a very low starting point, hedge funds have reengaged. in addition, volumes have been huge, with a clear pattern of domestic sponsorship. I’ll ask a similar question: will global real money commit to this market and underwrite a structural capital allocation cycle? said another way: as we saw in Q4’24, fast money will come and go, so the onus will soon be on real money to carry the baton.

6. Humble pie.

Pulling the prior two paragraphs together, I suspect the core issues that have plagued European equities for years — a lack of growth, a lack of innovation, and thus a lack of competitiveness — are ongoing secular challenges. I also suspect the core issues that have plagued Chinese equities for years — a meaningful downshift in growth, poor shareholder treatment and a growing fissure in global trade — are ongoing secular challenges. with all that said, I have been dead wrong and missed these trading rallies. so, while I remain a structural skeptic here relative to the US, I concede there has been a window to make some great tactical trades, and I’ve missed it.

7. Japan.

In the prior two years, this equity market captivated the attention of many, and delivered a nice dose of upside convexity (+28% in 2023, +19% in 2024). as we sit here today, NKY has been mired in a 38-40k range trade for several months. in turn, it has fallen down the interest list — a function of underperformance vs other non-dollar markets (particularly China), as well as some lasting scar tissue from the August 5th vol shock. while I understand all of that, I’d also argue the fundamental story is still on track: corporates are delivering on both earnings growth and shareholder reform.

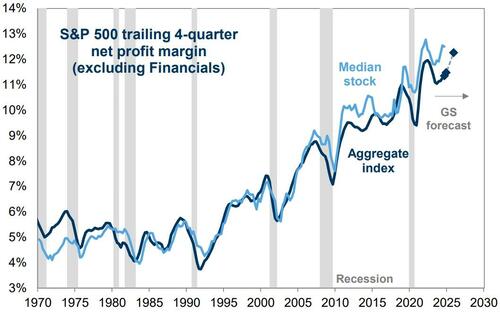

8. Some big picture charts

The 1990s brought in a wave of tech innovation that clearly hasn’t stopped. along that path, note the secular improvement in S&P profit margins. I’m not smart enough to know where AI will lead us, but I’m inclined to think that it only supports a trend that’s been well in train:

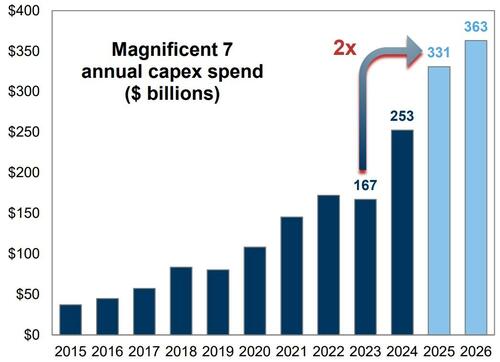

As mentioned on the back of Q4 earnings, US mega cap tech companies show no sign of backing down from their immense capex plans (nor does BABA, as we learned this week). specific to the Magnificent Seven, this contextualizes the growth in annual spend over the past decade:

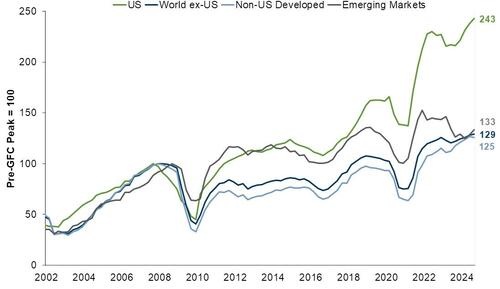

This plots trailing earnings growth of the US vs various cuts of ROW (in local FX). I think this clearly demonstrates why US equities have outperformed so much in the COVID era. now the debate turns on whether that immense gap is set to converge or not — that’s the nature of the bet for folks who have been sliding their capital away from the US of late (thanks Brett Nelson):

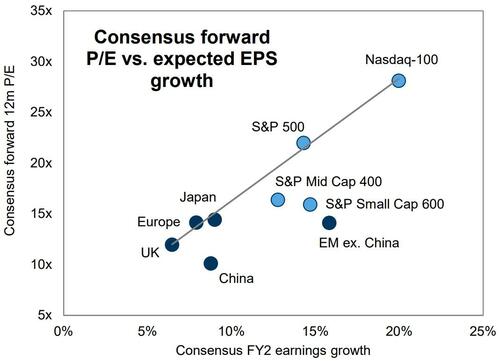

I think this also nicely frames another element of the US vs ROW debate that’s playing out in real-time. based on the relationship between P/E and expected earnings growth, market behavior has largely been very rational. if you want to argue that China and EM have been undervalued, I concede that this would agree with you, but again I don’t think that’s more important than the relative earnings question:

9. Some more local charts

January 27th — also known as “DeepSeek Monday” — will likely be remembered for a long time. flashing forward to today, I find it a little interesting that our AI leaders-vs-laggards pair, which saw a multi standard deviation break that day, has filled in the gap … next week will of course hold major sway here:

In the context of inflation, this is the agricultural component of our GSCI index. this could be a significant variable in the lived experience of US households and therefore bears watching:

This is a key chart to watch in the context of Chinese equities. while there are too many indices to keep track of — more on that in a minute — note the post-BABA breakout in HSCEI vs the highs of the prior trading rally:

10. To end with a bang.

As someone put it this week, “Europe is being shocked into action” as it relates to defense spending. here’s an update to one that you’ve seen before, our basket of European defense contractors:

11. one liners for the road:

i. the most interesting line I saw this week: “Musk: SpaceX to send Grok and robots to Mars next year.”

ii. I’m not sure what to do with this today, but I’m starting to hear more anecdotes that suggest AI disruption to the jobs market could be more severe (and more near) than initially thought.

iii. tariffs: who really knows, but as pointed out by a client, it’s not crazy to think about the interplay between still-tricky inflation and the sequence/magnitude of tariffs.

iv. the Fed: while arguably hawkish, there isn’t that much to say about this week’s commentary — in fact, not enough to warrant a full paragraph above, which is something of a statement unto itself.

v. “how are Chinese stocks trading this year?” I suppose it depends on how you want to look at it: SH300 +1% … SHCOMP +1% … MSCI-China +13% … H-shares +20%… HSTECH +23% … BABA +70%.

vi. “active US large cap mutual funds carry a 790 bps underweight in the Magnificent Seven” (hence YTD outperformance).

With all that said, Pasquariello warns that the tactical setup is set to get trickier: inflows will likely slow, the local seasonal is lousy and large allocators of capital are hunting other fields.

Therefore, I’m sticking with this basic stance: long of US equities — on a conviction level that’s middle of the dial — married with high quality portfolio hedges (for example, in the VIX index, selling puts to fund call spreads sets up well; specific implementations available).