Authored by Simon White, Bloomberg macro strategist,

Optimism is growing that a Trump put will eventually put a floor under stock-market declines.

It was another messy day for stocks on Tuesday, the fourth day in row the S&P 500 was down on an intraday basis, a fairly unusual occurrence.

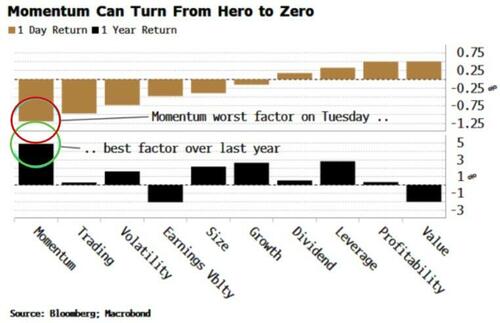

The momentum factor was the worst performing of all the key factor types on Tuesday. The mainstays of momentum strategies, such as Nvidia, Tesla and Meta, were among the stocks down the most on the day. The factor has been the principal driver of the market’s rise over the last year.

Momentum, though, has a knack of turning from the market’s biggest support into its greatest foe as strategies are reversed.

All eyes are on Nvidia’s after-market earnings announcement today to arrest the decline in prices.

Yet there is another hope that is gaining traction: the Trump put.

The US president’s focus on the stock market is well known. He has used it as a scorecard for the success of his presidency, with a widely held belief that he will not allow the market to fall too far.

Michael Hartnett, chief investment strategist at Bank of America, in an interview on Bloomberg TV on Tuesday, even went as far as to speculate that the strike price of the put is around 5,600-5,700 on the S&P, about 4%-5% lower from here.

We will see.

Trump has discussed taking some upfront pain if it is necessary to achieve his administration’s long-term goals.

Perhaps, then, there is some tolerance for stock-market weakness while he has the political capital to wear it.

Either way, we are in an unusual situation where central bank and president are both likely de facto targeting the stock market.

We’ll soon find out whose put has the higher strike price.