Uddrag fra finanshuse:

AI darling NVIDIA will report its quarterly earnings on Wednesday, February 26th, at 4:20pm ET. Here is what consensus expects the company will report:

- Q4 EPS is expected to be $0.84

- Revenue forecast at $38,2bln, just below the top end of the company’s guidance range ($36.75BN-$38.25BN) with the following breakdown:

- Data Center revenue at $34.06BN

- Gaming $3.02BN

- Professional Visualisation $507MM

- Automotive $459MM

- Gross profit margin expected at 73.5%

- Operating expenses $3.4BN.

Looking ahead, for Q1, Wall Street expects revenue of $42.3BN and EPS at $0.92.

And in tabular format.

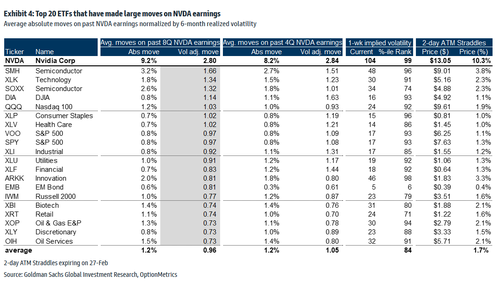

Looking at the technicals and positioning, Goldman’s John Marshall writes that NVDA’s earnings report has been a key driver of volatility for the S&P 500 and other major ETFs over the past two years. Option pricing suggests that investors expect this NVDA earnings day to be very significant: the NVDA 27-Feb straddles imply a +/- 10.3% move over the next two days, while NVDA has averaged a move of +/-9.2% on its past 8 earnings days.

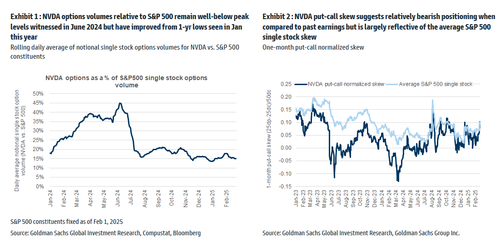

NVDA positioning ahead of tonight’s earnings event: NVDA options have been very active accounting for 15% of all single stock options volumes over the past month; while this is below 2024 levels (when it hit a staggering 45%), it remains one of the top stocks by dollar options volume. Put-call skew levels suggest investors are bearishly positioned relative to recent NVDA earnings events, but we also note that put-call skew for the average S&P 500 stock has turned bearish over the past week.

Some more details on positioning:

- Options positioning: NVDA 1-month normalized put-call skew suggests investors are bearishly positioning heading into earnings relative to its past earnings events, but here Goldman notes that positioning is also bearish for the average S&P 500 stock.

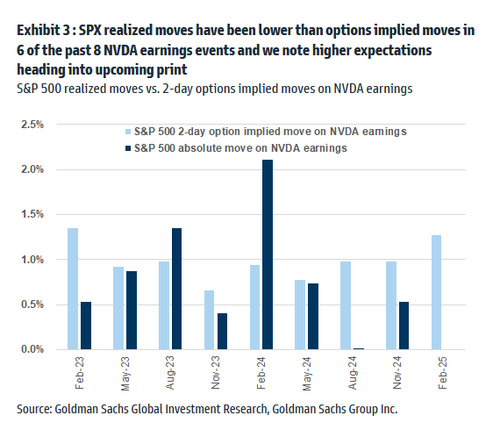

- SPX moves: SPX straddles imply a move of +/-1.3% for SPX over the next two days which include NVDA’s earnings report. This is higher than the +/- 0.8% move the SPX has made on the past 8 NVDA earnings reports.

- ETF moves: Below Marshall highlights the top 20 ETFs that have historically made large moves on NVDA earnings. Semiconductors/Tech ETFs top the list and are generally pricing an above average move than on past NVDA earnings days. Among the top movers, SMH, QQQ and SPY options are pricing a bigger implied move than normal.

Ahead of the release, KeyBanc believes that any strong results out of Nvidia should ease concerns that DeepSeek could hinder near-term AI capital expenditure. Despite previous worries over constraints related to the ramp-up of GB200 NVL servers, KeyBanc anticipates NVIDIA will exceed expectations and offer guidance for Q1 that is conservatively and moderately higher than consensus. Separately, Susquehanna expects a beat/raise, though more in line with recent reports due to near-term concerns regarding GB200 delays and pushbacks.

JPMorgan trader Josh Meyers writes (full note here) that client views remain mixed heading into earnings, but sentiment has improved – nudged along by Asia datapoints and improving sell-side narratives. To the first point, JPM’s Albert Hung in Taiwan has underscored improving B200 sales supported by growing HGX shipments and increasing ODM success standing up NVL72 racks. To the second, last week’s note from TD Cowen helped catalyze a backlash against the AI ASIC > GP-GPU narrative. It sounds like B200 shipments accelerated modestly in the back half of F4Q25, potentially giving Jensen room to share a more optimistic outlook (offsetting a hedge fund narrative linking weakness in FN optical shipments to a bearish drop in H100 shipments). There’s also growing optimism that a more modular approach for servers starting with B300 may make it easier to stand up servers as shipments start in 2H (though JPM’s Asia team remains skeptical).

Meanwhile, Meyer’s buyside survey reveals an expectation that we will return roughly to a 2+2 quarter; and investors increasingly sound curious about what we’ll hear at GTC and Computex, and as we get more visibility on ‘26 CSP capex – which is what’s needed to get the stock to take its next big leg up.

Finally, Goldman’s Matthew Kaplan underscores that the options-implied move through Friday is 10%, and notes that positioning is 7 out of 10, or notably lower than prior quarters. He notes that the stock has been range-bound for ~8 months now as complexity has picked up (ASICs vs Merchant, DeepSeek, Blackwell timing, GMs contracting q/q, etc).

The Goldman trader also says that near-term market expectations feel relatively in check with feedback suggesting investors are braced for a more modest beat/raise cadence than the ‘normal’ (~$1-2bn beat + a q/q guide up of +$2bn q/q) given the hand-off from Hopper to Blackwell products (for context, cons = Jan revs ~$38.1bn + April revs ~$42.2bn). He concludes by suggesting that there will be more focus on commentary into the July quarter (timing of Blackwell? China demand?) and broader comments to help settle 2026+ debates.

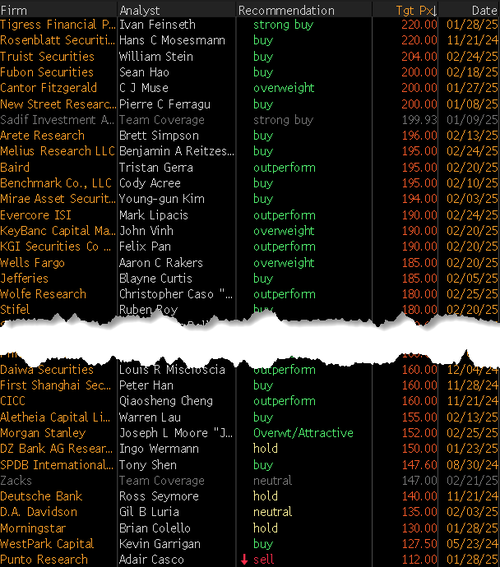

One final point: while most Wall Street analysts are if not wildly bullish then certainly moderately so, Deutsche Bank is a rare Wall Street bank that’s staying on the sidelines in failing to recommend the chipmaker. Last Thursday, Deutsche reiterated its hold rating on Nvidia which puts it in a small minority on Wall Street, where 68 out of 76 analysts covering the stock rate it a buy or a strong buy, and just one analyst has a Sell rating, according to Bloomberg. The consensus price target is $174.9, or about 26% higher than where the stock is trading now.

Deutsche Bank is far less optimistic, sticking to a price target of $140 per share, close to where Nvidia finished Thursday. While analyst Ross Seymore sees string results from Nvidia, he also believes the company’s guidance for the current quarter ending in April will only match the Street’s estimates, leaving the stock with little room to climb.

“We see limited upside in the [April-quarter] guidance given the ongoing complexities of the Blackwell ramp, with the buyside expecting ~flattish q/q guidance (off a higher [January-quarter] base),” Seymore wrote, adding that “despite the DeepSeek-related concerns on AI capital efficiency which arose in January, it appears that the large CSP/hyperscaler/AI co’s remain committed to their expansive capital budgets, with many reiterating tens of $ billion in capex in 2025 alone.”

Investors will question whether the high level of demand for Nvidia processors can be sustained in 2026 and future years, the analyst noted, which could challenge the stock’s upward trajectory.