via Bloomberg,

The ructions in European markets this week toppled decades-old milestones as Germany’s move to abandon its traditional fiscal caution forced traders to rethink positions on stocks, bonds and the euro.

Donald Trump has made it clear Europe can no longer rely on the US for defense, meaning hundreds of billions of euros’ worth of bonds will need to be sold by governments across the continent to foot the bill for increased military spending.

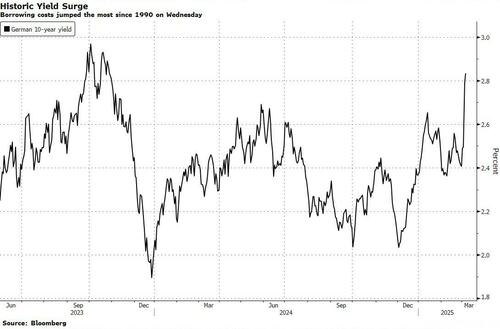

The plans announced by Germany triggered a selloff in bunds that spread to neighboring nations, and rippled out into other markets around the world on Thursday. Speaking after the European Central Bank’s meeting, President Christine Lagarde said the economy can likely expect a boost from the spending and its impact will need to be assessed in due course.

Calling the moves historic might sound tired. But here are eight charts — from stock valuations to steepening bond curves — that show why it’s apt:

Germany’s borrowing costs are rising relative to other nations. The spread between two- and 10-year yields on German bonds has widened much more than for UK and US peers as investors start to take into account the possibility of greater government spending. The gap of 60 basis points is almost 50% wider than its UK equivalent and around double that of the US.

The surge in German yields has lifted borrowing costs closer to equivalent US debt. That shows investors are now seeking a smaller yield premium to hold US bonds rather than bunds since the German spending plans were unveiled.

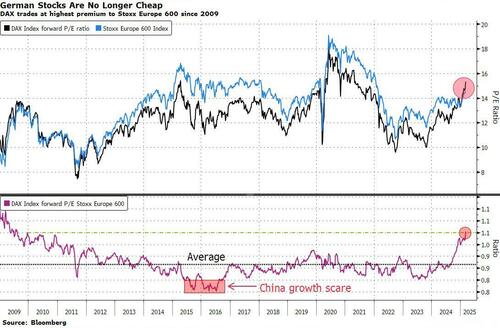

After a searing rally, Germany’s DAX stock index is no longer cheaper than the broader European market, and now trades at its highest premium to the Stoxx 600 in 16 years. The expectation is that this will feed into results, and the gap could reverse once analysts factor in the potential earnings boost for German stocks from Berlin’s big spending plans.

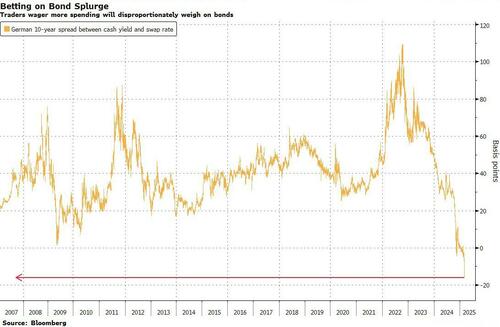

The drop in German 10-year bonds propelled its yield 16 basis points above the rate on comparable swaps. That’s the most in data going back to 2007. The inversion is important as a yardstick of future issuance: bonds tend to weaken relative to swaps as the market anticipates more debt sales.

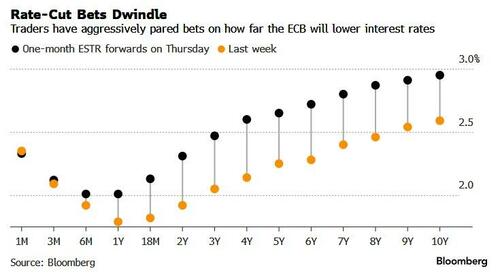

The so-called Euro Short Term Rate and its forward projections are a useful proxy for where money markets see interest rates at the ECB. Traders have pared their wagers sharply this week for further monetary-policy easing and no longer expect the deposit rate to fall below 2%. The ECB cut rates a quarter point at its meeting on Thursday, as predicted.

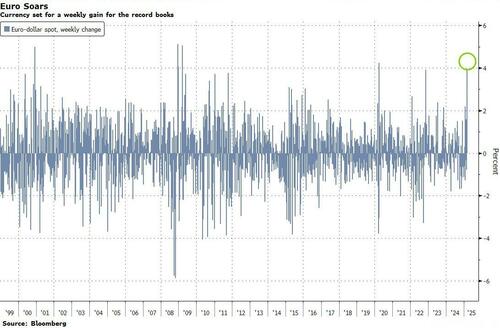

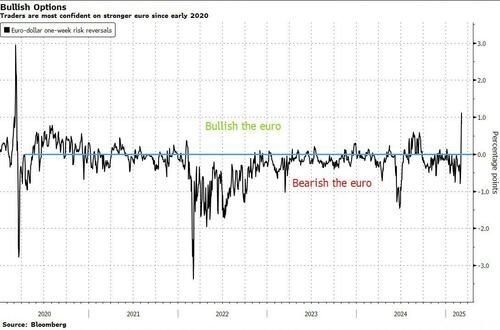

Massive amounts of government spending that potentially stokes inflation — requiring higher interest rates as a result — is good news for the euro. The common currency rose to a four-month high versus the dollar and is on course for one of its best weekly performances since its creation.

The gains in the euro were met with one of the sharpest bullish repricings in the options space. So-called risk reversals, which depict the difference in demand between bullish and bearish euro trades, rose to levels last seen half a decade ago, pointing to further gains for the common currency. Options volumes hit a record for the euro-dollar pair on Wednesday, according to data from the Depository Trust & Clearing Corporation.

The last time German borrowing costs surged this much was in the wake of an event that marked the end of the Cold War. On Wednesday, the 10-year bund yield spiked 30 basis points, the most since the months that followed the fall of the Berlin Wall in November 1989.