Uddrag fra Zerohedge:

Back in October when stocks were on the verge of hitting an all time high, we reported that corporate insiders (and especially those who worked for NVDA) were sniffing out the looming market top, and were selling their own shares at the fastest pace in years.

Fast forward 6 months when the market has flipped 180 degrees, and with most stocks now in a bear market, insiders seemingly can’t buy fast enough.

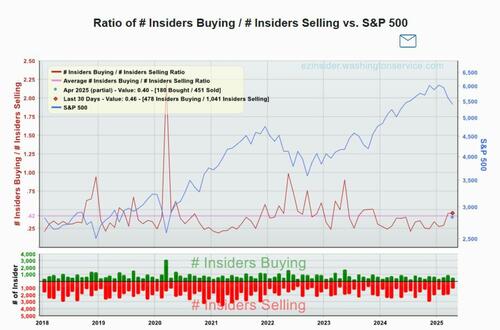

As Bloomberg’s Jessica Menton reports, hurting stock bulls have gotten an encouraging sign from the people who know their companies best. As shown in the chart below, corporate insiders scooped up shares of their own companies at the fastest pace in 16 months as the S&P 500 sank in March, and they kept buying at an elevated clip as the rout accelerated this month in the wake of President Donald Trump’s global tariff rollout.

No less than 180 corporate insiders purchased their own stock in the first two weeks of the month, data compiled by the Washington Service show. This tipped the buy/sell ratio to 0.40, keeping it near the highest level since late 2023. While corporate executives often buy stock for reasons unrelated to market performance, the uptick in purchases suggests a confidence in their companies that’s reassuring to investors who’ve been battered by the weeks-long selloff.

“This is a positive sign,” said Matt Lloyd, chief investment strategist at Advisors Asset Management. “Investors are still mired in a negative feedback loop, given trade and economic uncertainty. So it’s pivotal for this trend to continue as the stock market attempts to get its sea legs.”

Growing optimism from corporate executives stands in sharp contrast to the broader dire mood.

Investor sentiment regarding economic prospects is the most negative in three decades. Meanwhile, according to the latest Bank of America Global Fund Managers survey, most Wall Street professionals have rarely been gloomier, with 82% of respondents expecting the global economy to weaken. A record number of them intend to reduce exposure to US equities, according to the poll. Then again, this is the same poll that has become the best contrarian indicator around, as it is literally always wrong, and the same respondents were record bullish in February, just before the market crashed.