Uddrag fra Goldman Sachs:

The headline message from Goldman’s Christian Mueller-Glissman is simple: Remain defensive tactically as markets reprice stagflation risks

Below he highlights the 10 key charts the Portfolio Strategy team are currently watching and discussing most…

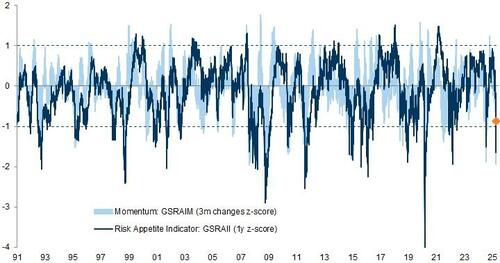

Exhibit 1: Our Risk Appetite Indicator (RAI) has declined sharply, but is currently above levels that historically have given a clear signal for better asymmetry

Source: Goldman Sachs Global Investment Research

Exhibit 2: Positioning and sentiment have turned more bearish, and our aggregate indicator is nearing the bottom quartile

Average percentile of sentiment indicators (data since 2007)

Source: Datastream, Haver Analytics, EPFR, Goldman Sachs Global Investment Research

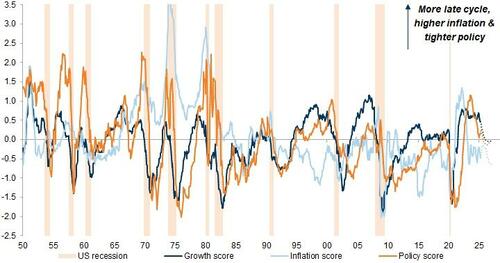

Exhibit 3: Our US macro baseline has become less friendly and points to stagflation

Average expanding z-score of macro and market variables across growth, inflation and policy. Dotted line based on GIR forecasts.

Source: Haver Analytics, Bloomberg, Datastream, Goldman Sachs Global Investment Research

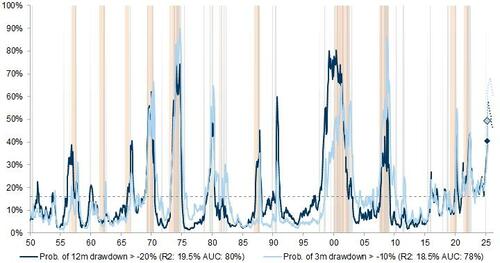

Exhibit 4: Our equity drawdown risk framework points to downside risk, with the drawdown probability peaking in the summer in our economists’ baseline

Implied probability of S&P 500 drawdown based on multi-variate logit model (Orange/light grey shading = S&P 500 subsequent drawdown >20%/>10%. Dashed line = unconditional probability). Dotted line based on GIR macro forecasts.

Source: Haver Analytics, Datastream, Goldman Sachs Global Investment Research

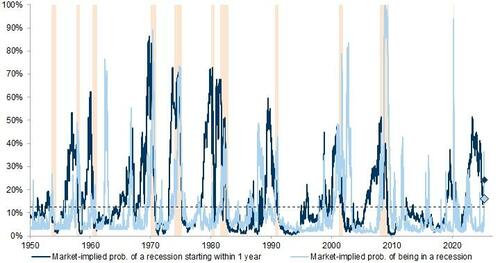

Exhibit 5: Market pricing of recession risk in risky assets has picked up

Orange shading: US recession. Dotted line: unconditional probability

Source: Datastream, Haver Analytics, Worldscope, Goldman Sachs Global Investment Research

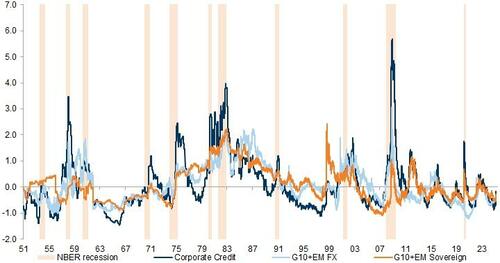

Exhibit 6: Carry risk premia have picked up from low levels, although they are still below historical recessionary levels

Average of back-expanding z-scores

Corporate credit (avg.): BBB vs. AAA, IG Credit, HY Credit. G10 + EM FX is the average between: the carry of top vs. bottom 3 G10 carry strategy and Top 5 EMFX strategy. G10 sovereign is the average carry of Italy, Spain, France, Greece and Portugal versus the Euro area benchmark. EM sovereign carry is calculated on the EM sovereign spread in USD. History extended based on BBB vs. AAA spreads.

Source: Robert Shiller, Haver Analytics, Goldman Sachs Global Investment Research

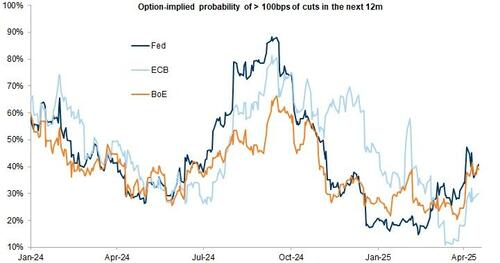

Exhibit 7: There should be some additional buffer from the Fed in case of a recession

Based on the price of 1Y1M swaptions vs. O/N rate

Source: Goldman Sachs FICC and Equities, Haver Analytics, Goldman Sachs Global Investment Research

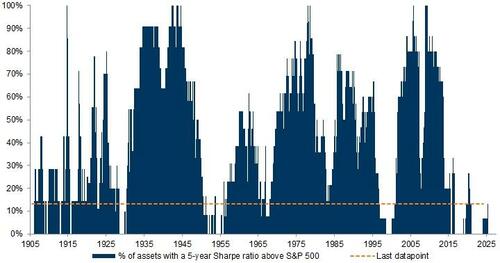

Exhibit 8: US exceptionalism in the last 15 years has been an exception

Assets: S&P 500, SXXP, DAX, FTSE, TOPIX, MSCI EM, US 2Y/10Y/30Y, Germany 10Y, Japan 10Y, UK 10Y, gold, oil, copper, S&P GSCI, DJ Corp, USD IG, USD HY.

Source: Haver Analytics, Datastream, Goldman Sachs Global Investment Research

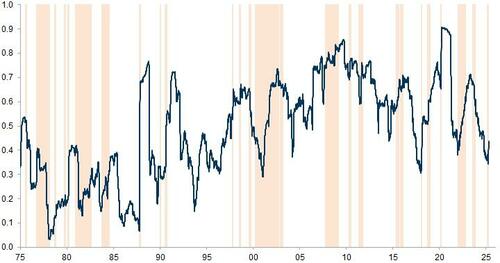

Exhibit 9: More regional diversification opportunities due to cycle divergence

Average pair-wise 1-year rolling correlation of equity markets (monthly returns) – orange shading denotes >10% S&P 500 drawdown

Equity markets included: Australia, Austria, Belgium, Canada, Denmark, France, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Netherlands, Norway, Singapore, South Africa, Sweden, Switzerland, UK, US.

Source: Datastream, Goldman Sachs Global Investment Research

Exhibit 10: Traditional ‘safe havens’ such as the Yen, CHF, and Gold are becoming more important diversifiers, with the Dollar increasingly positively correlated with equities

1-year correlation with the S&P 500 (monthly returns)

Source: Datastream, Goldman Sachs Global Investment Research

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her