Uddrag fra Zerohedge:

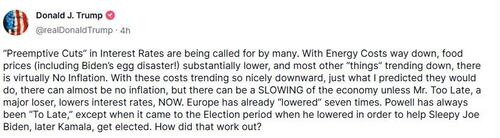

That certainly did not help the market, which is growing increasingly uncomfortable with the current dynamic between The White House and the “loser” Fed.

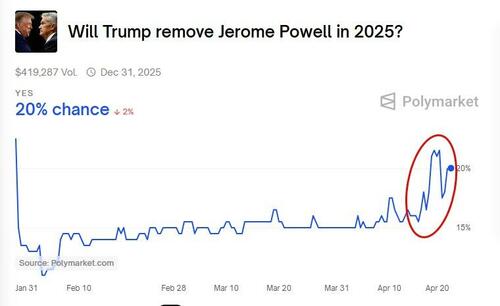

The prediction markets lifted the odds of Trump trying to kick Powell out to 20%…

Interestingly, the market is moving towards Trump’s position, now pricing in 4 rate-cuts this year…

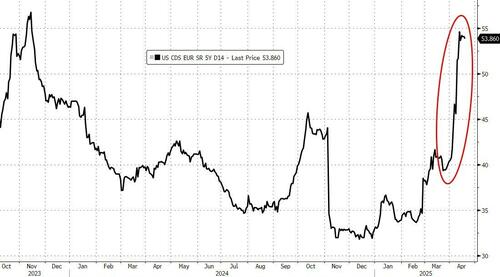

Quite a day for the world:

- Pope died,

- WEF’s Klaus Schwab resigned,

- Kanye admits sucking his cousin’s cock,

- and the dollar crashed pushing USA Sovereign Risk to 18-month highs…

Today’s only US macro data certainly added fuel to the fire for the need for rate-cuts as LEI plunged to 9 year lows…

Stocks drifted lower overnight following Trump’s comments (which he added to during the day session) and as soon as the cash market opened, all the US majors puked. The last hour saw some buying (profit-taking from 0-DTEs) lift stocks off the lows…

This is the 4th straight down day for the Dow, S&P, and Nasdaq…

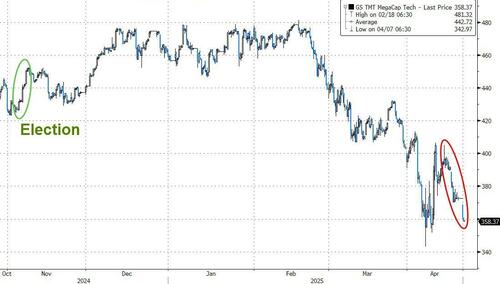

Mega-Cap Tech tumbled back towards YTD lows (and is once again down 25% from the highs in mid-Feb)…

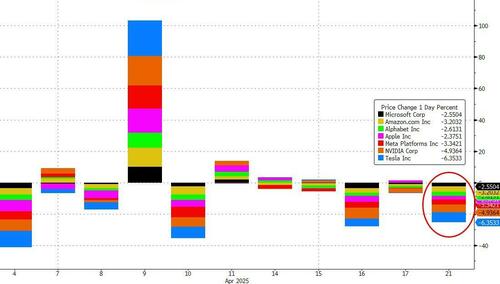

All of the MAG7 stocks were lower today, led by TSLA and NVDA

Both equity and bond vol jumped back higher today after a few days of relief…

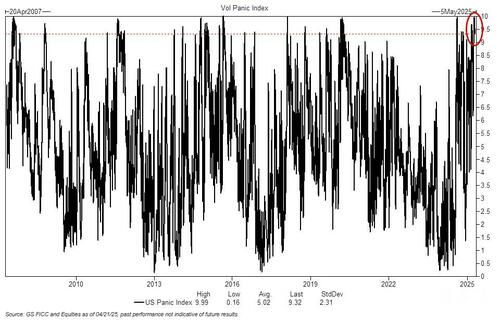

…and Goldman’s ‘Vol Panic’ Index is back near record highs…

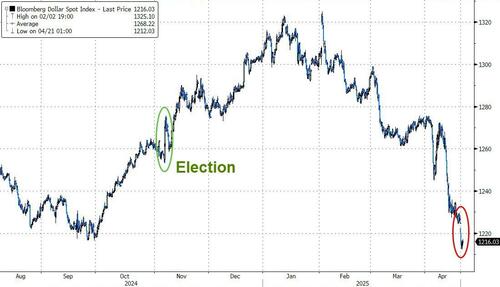

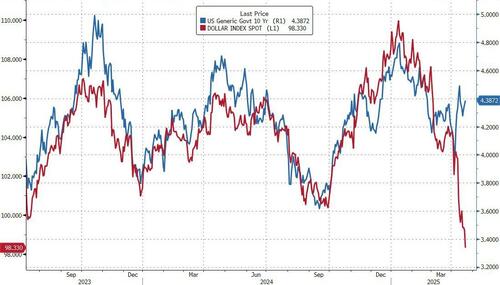

The dollar was clubbed like a baby seal today, breaking below the October 2024 lows and down a stunning 8.5% from February highs…

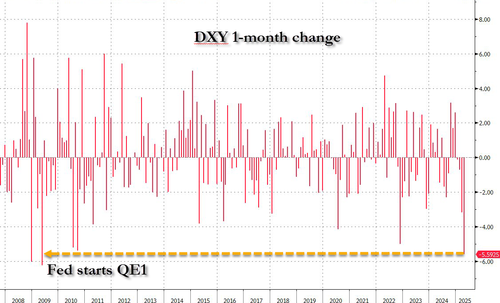

With just over a week left in the month, The Dollar Index looks set for its worst monthly performance since 2009 when The Fed started printing money (QE1)…

And the dollar and bonds remain notably decoupled in this new stagflationary environment…

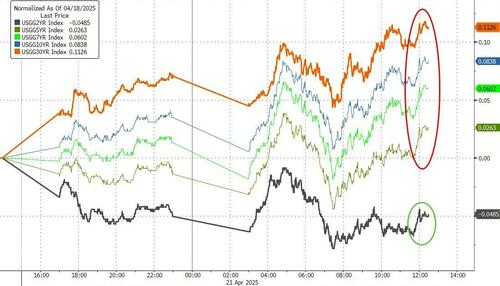

Treasuries were very mixed today with selling at the long-end prompting a dramatic steepening in the curve (2Y -5bps, 30Y +11bps)…

Notably, the ratio between a Bloomberg gauge of US government bonds and that of their global peers has slipped to the lowest since March 2024, underscoring a rapid deterioration in Treasuries’ performance…

The US yield curve (2s10s) soared to +66bps – its steepest since Jan 2022…

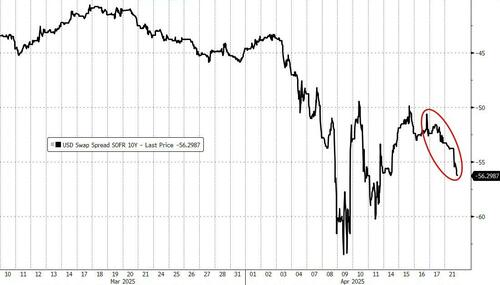

Taking SOFR Swap Spreads as a proxy for pain, the basis trade suffered significantly today…

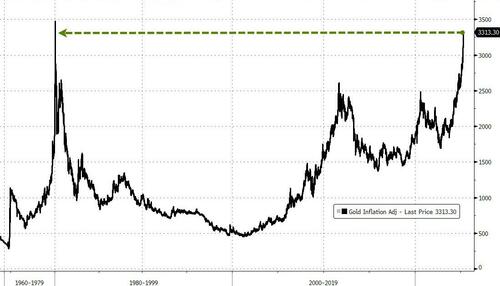

Gold continued to shine, smashing above $3400 to a new record high…

Are we getting a replay of the Great Financial Crisis price changes – Dow dramatically underperforming Gold…

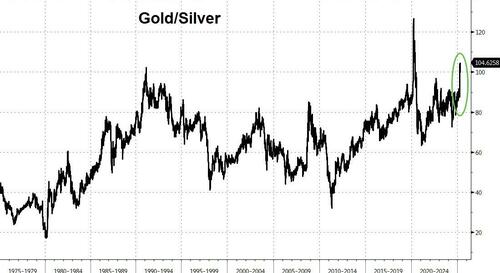

And gold is trading at a stunning 105x the prices of silver – nearing record highs…

Also notably, gold is getting very close to its inflation-adjusted record highs from 1980…

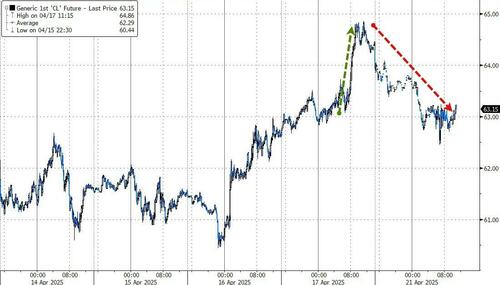

Oil traded lower today, erasing Thursday’s surge…

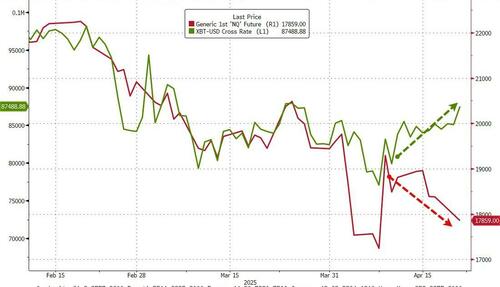

Notably, regimes are shifting as bitcoin rallies…

…decoupling from tech stocks…

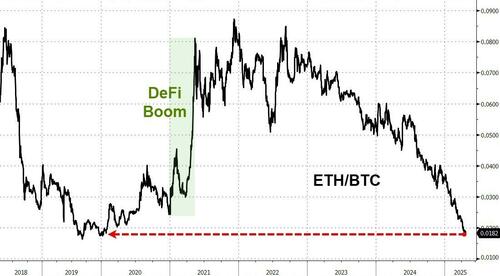

Ethereum tumbled to its weakest relative top bitcoin since January 2020…

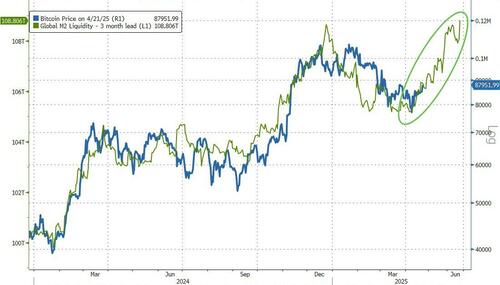

Finally, bitcoin’s breakout today comes right on schedule…

…as the lagged surge in global liquidity is starting to flood the zone ‘away from America’.